|

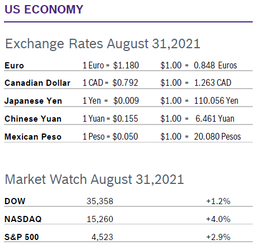

August is typically a quiet month for the markets, but all three indexes hit mid-month highs before falling back slightly. The strong economic recovery, solid corporate earnings and reassurances from the Fed that interest rates would remain low all contributed to gains. There is some concern about the impact of the Delta variant on consumer spending patterns if people begin to restrict travel and activities once again. Consumer Spending Rises 0.3% Consumer spending rose 0.3% in July after rising an upwardly revised 1.1% in June. The increase reflected a 1.0% rise in spending on services and a big drop in spending on durable goods such as autos in addition to a drop in spending on nondurable goods such as clothing. Personal incomes rose 1.1% in July after inching up just 0.1% in June. The personal saving rate rose sharply to 9.6% of after-tax incomes in July. Economists estimate that the excess savings of households now totals around $2.5 trillion, giving consumers plenty of spare cash to fuel future spending. Consumer Prices Rise 0.5% The Consumer Price Index (CPI) rose 0.5% in July after rising 0.9% in June and was up 5.4% year over year. Core inflation, which excludes the volatile food and energy categories, rose 0.3% in July after rising an upwardly revised 0.9% in June and was up 4.3% from July 2020, cooling a bit from June’s 4.5% pace. Many economists now believe that June marked the peak in the annual rate of inflation. However, they also concur that price increases stemming from the reopening of the economy and ongoing supply chain bottlenecks and shortages will keep inflation elevated into 2022. The personal consumption expenditures (PCE) price index excluding the volatile food and energy components rose 0.4% in July for the second consecutive month and was up 4.2% year over year, the largest gain since April 1992. The core PCE price index is the Fed's preferred inflation measure for its 2% target, which is now a flexible average. The Fed believes inflation is transitory and is focused on the employment situation. Consumer Confidence Falls to 113.8

Unemployment Falls to 5.2%

Job Openings Set New Record US job openings soared to yet another record high of 10.1 million jobs in June after inching up to 9.2 million jobs in May and employers filled 700,000 jobs, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). It was the highest number of job openings on record and up substantially from the pandemic low of under 5 million jobs. Economists polled by Reuters had forecast job openings would rise to 9.28 million in June. Vacancies increased in all four regions and the job openings rate rose to 6.5% from 6.1%, as there were just 0.9 workers available for every job opening and employers had trouble filling vacancies. The largest increases in vacancies in June were in professional and business services, retail trade and accommodation and food services. Hiring rose to 6.7 million in June from 6.0 million in May, the second largest increase since the government started tracking the series in 2000. The rise in hiring in June was led by retail trade, with 291,000 more positions filled. The number of people voluntarily leaving their employment in June increased to 3.9 million from 3.6 million in May, well above pre-pandemic levels. The quits rate is usually seen as a barometer of job market confidence, and in June quits were up in all but five of the 21 private industry sectors in the report. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Falls to 66.8 The Chicago Purchasing Managers Index (Chicago PMI) fell to 66.8 in August after jumping to 73.4 in July. It was the lowest reading for the index since June and the 14th consecutive month the index remained in positive territory. Production dropped sharply to 61 and New Orders fell 4.4 points to 67.8, which ISM believed to be due to falling demand. Prices Paid increased 2.3 points to 93.9, hitting the highest level since 1979 as companies continued to grapple with higher costs for materials. The special question for the month asked when respondents believed the pandemic’s impact on the supply chain would peak. A majority (37.8%) believed it would peak in 2022. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 1.0% The Producer Price Index rose 1.0% in July, matching June’s increase. Both increases were above expectations. It was the seventh consecutive monthly increase in wholesale prices, which are up a record 7.8% over the past twelve months. Core inflation, which excludes the volatile food and energy categories, rose 1.0% in July, double the increase in June, and was up 6.2% over the past twelve months. Prices continue to be impacted by pandemic-driven shortages and bottlenecks as the economy got back on its feet much more quickly than expected. Analysts noted that year-over-year inflation numbers will consistently be higher going forward because of the year-over-year comparison to very low numbers caused by the pandemic. Q2 GDP Rises 6.6% GDP grew 6.6% in the second quarter, up slightly from the first reading of 6.5% growth, according to the second reading from the Commerce Department. While robust, the increase was well below economists’ expectations of 9.1% growth. Many economists are now downgrading their estimates for full-year growth from a red-hot 9.0% to a still brisk 6.1%. The big wild card in growth projections is the impact of the rapidly spreading Delta variant, which is difficult to project. The Fed’s GDP forecast for this year was revised up to estimate growth between 6.5% to 7.0% in mid-June. Fed Reassures on Rates Fed Chair Jerome Powell reassured markets that interest rates will not be rising any time soon, although the Fed will probably start dialing back the $120 billion in bond purchases made each month later in the year. Investors have been waiting for concrete information for several weeks. This year’s Jackson Hole Policy Summit was once again a virtual one. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|