|

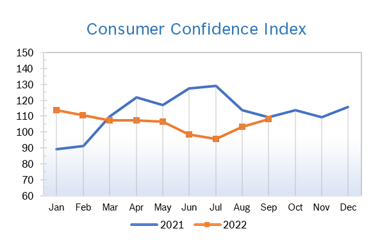

Consumer Spending Rises 0.4% Consumer spending rose 0.4% in August after falling a downwardly revised 0.2% in July. The increase was about twice as much as economists expected. Core consumer spending rose 0.1% in August after rising 0.2% in July. Wages increased 0.3% after surging 0.8% in July. The saving rate was unchanged at 3.5%. July's saving rate was slashed to 3.5% from the previously reported 5.0%. The saving rate was as high as 26.3% in March 2021. It is now near levels seen during the 2007-09 Great Recession. Spending was led by services, where outlays surged 0.8% after edging up 0.1% in July. Spending on goods dropped 0.5%, held down by a decrease in receipts at gasoline service stations and an 11.8% decline in gas prices. Goods spending fell 0.7% in July. There were also declines in spending on recreational goods, another indication consumers were pulling back on discretionary spending. Outlays on furniture and other long-lasting manufactured goods also fell. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose 0.1% in August after being unchanged in July and was up 8.3% year over year after being up 8.5% in July. Core inflation, which excludes the volatile food and energy categories, rose 0.6% in August after rising 0.3% in July and was up 6.5% year over year. The average household is spending $460 more each month to buy the same basket of goods and services as last year, according to Moody’s Analytics. The personal consumption expenditures (PCE) price index gained 0.3% after dipping 0.1% in July and was up 6.2% year over year. Excluding the volatile food and energy components, the PCE price index jumped 0.6% after being unchanged in July. The core PCE price index climbed 4.9% year over year in August. Consumer Confidence Rises to 108

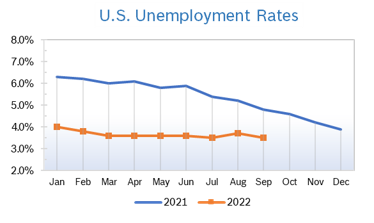

Unemployment Falls to 3.5%

Chicago PMI Falls to 45.7 The Chicago PMI fell sharply to 45.7 in September after falling to 51.2 in August. The decline ended 26 consecutive months of positive readings. A PMI number above 50 signifies expanded activity over the previous month. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Fall 0.1% The Producer Price index (PPI) fell 0.1% in August after falling 0.5% in July and was up 8.7% year over year, down from a 9.8% increase in July and a whopping 11.3% increase in June. Economists surveyed were expecting a monthly jump of 0.3% and a 10.4% yearly increase. Stripping out the volatile categories of food, energy, and trade services, the PPI increased by 0.2% in August, down from July’s increase but higher than expected and was up 5.6% year over year after being up 5.8%year over year in July. Q2 GDP Shrinks 0.6% GDP shrank 0.6% in the second quarter, as the third and final reading was unchanged from the July report, according to the Commerce Department. Over the past four quarters GDP is up 1.7%. Real consumer spending was revised up to show an increase of 1.5% compared to the 1.0% gain first reported. Spending on both durable and non-durable goods fell but spending on services rose sharply. Residential investment, or housing, fell at a 16.2% annual rate in the second quarter compared to a 0.4% annualized increase in the first quarter. The drop in the second quarter subtracted 0.83 percentage points from GDP. Businesses added to inventory at an $83.9 billion annual rate (in real terms) in the second quarter versus accumulation at a $188.5 billion rate in the second quarter. The slower accumulation reduced second-quarter growth by a very sizable 1.83%. The personal-consumption price index (PCE) rose at a 7.1% annualized rate, matching the first quarter. From a year ago, the index is up 6.5%. However, excluding the volatile food and energy categories, the core PCE index rose at a 4.4% versus a 5.2% increase in the first quarter. It was the slowest pace of increase since the first quarter of 2021. From a year ago, the core PCE index is up 4.8%. While back-to-back quarters of negative GDP growth is typically considered a recession, many economists say that while the economy is slowing, strong job growth and consumer spending don’t indicate a wide-spread recession. Most economists expect the economy to return to growth in the third quarter. Fed Raises Rates 0.75% The Fed raised interest rates by another three-quarters of a percent September 21 to a range of 3% to 3.25% as part of their continuing efforts to dampen down inflation without sending the economy into a recession. The increase, which was the fifth since March, was widely expected and there had been some speculation the Fed might raise rates by a full percentage point. Fed Chair Jerome Powell warned people to expect more aggressive hikes ahead and said, “Higher interest rates, slower growth and a softening labor market are all painful for the public that we serve. But they’re not as painful as failing to restore price stability and having to come back and do it down the road again.” Officials forecast that rates would reach 4.4% by the end of this year and 4.6% in 2023, a more aggressive forecast than the previous one of rates leveling out at 3.5%. That implies a fourth consecutive 75 basis point hike could be coming in November, just in time to put a damper on holiday spending. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|