|

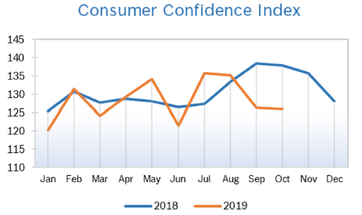

October is traditionally a rough month for the stock market, but the major indexes closed out the month in the black. Despite the Fed’s third rate cut of the year and good news on corporate earnings a lack of resolution and forward progress on trade with China kept the markets from delivering more robust gains. Consumer Spending Rises 0.2% Consumer spending rose 0.2% in September after rising an upwardly revised 0.2% in August, double the 0.1% increase first reported. The increase was in line with economists’ expectations. Much of the increase in spending was driven by big ticket purchases such as automobiles and rising healthcare costs. The Commerce Department data showed personal income rose 0.3% in September, driven by government subsidies to farmers caught in trade war between the US and China. Consumer wages were unchanged in September, causing analysts to question whether or not consumers will drive spending upwards during the holidays. With hiring slowing, wage growth is also stalling, which could significantly curb future consumer spending. Consumer spending slowed to a 2.9% annualized rate during the third quarter after jumping 4.6% in the second quarter; quarterly consumer spending is included in GDP reports. Consumer spending accounts for more than two-thirds of US economic activity. Consumer Confidence Falls to 125.9

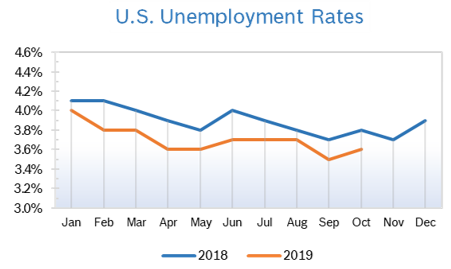

Consumer Prices Flat The Consumer Price Index (CPI) was flat in September after rising a seasonally adjusted 0.1% in August. The year-over-year CPI increase remained at 1.7% in September. Excluding the volatile food and energy categories, core prices rose 0.1% in September after climbing 0.3% in each of the previous three months and were up 2.4% from a year ago. Consumer prices as measured by the personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, were unchanged in September after gaining 0.1% in August. That lowered the annual increase in the core PCE price index to 1.7% in September from 1.8% in August. The core PCE index is the Fed’s preferred inflation measure. It has consistently undershot the U.S. central bank’s 2% target this year. Unemployment Rises to 3.6%

Job Openings Fall to 7.05 Million The number of job openings fell to 7.05 million on the last business day of August after being unchanged at 7.2 million in July, according to the most recent Job Openings and Labor Turnover Survey (JOLTS) from the U.S. Bureau of Labor Statistics. Over the month, hires dropped to 5.8 million after rising to 6.0 million in July and separations increased to 5.8 million. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.4% and 1.2%, respectively. The quits rate is viewed by policymakers and economists as a measure of job market confidence. Chicago PMI Falls to 43.2 The Chicago Purchasing Managers’ Index (PMI) fell to 43.2 in October after dropping to 47.1 in September. It was the lowest level for the index since December 2015 and the second consecutive month the index was below 50. New Orders declined to 37.0, the lowest level since March 2009 and Order Backlogs fell 13.6 points to 33.1. Production rose to 46.8, Inventories rose to 47.1 and Prices Paid fell to 54.8. October’s special question asked respondents what impact the latest interest rate cuts by the Federal Reserve would have on their business. A majority (51%) expect no impact, while 31% expect a positive impact. A second question about how the government’s tariffs will affect business revealed that 56% of respondents expect little negative impact while 26% expect a major negative impact. The strong dollar, slowing global economy and trade disputes have curbed demand for goods made in America. Stable although softer growth in the much larger service side has been keeping the economy growing. Wholesale Prices Fall 0.3% The Producer Price Index (PPI) fell 0.3% in September after rising 0.1% in August and was up 1.4% year over year, the smallest increase since November 2016. Core producer prices, which exclude food, energy and trade services, were unchanged in September after rising 0.4% in August and were up 1.7% year over year after being up 1.8% year over year in August. The wholesale cost of services fell 0.2% after climbing 0.3% in August but the wholesale cost of goods fell 0.5%. Q3 GDP Growth Falls to 1.9% GDP growth was revised down to 1.9% but was still ahead of expectations for 1.6% growth, according to the third and final reading from the Commerce Department. Year-over-year growth slowed to 2.0% in the third quarter from 2.3% in the second quarter. Consumer spending moderated to a 2.9% annual rate in the third quarter from 4.6% in the second. Business (nonresidential) fixed investment fell 3.0%, driven by a sharp 15.3% decline in spending on structures. Residential investment rose at a 5.1% annual pace following six consecutive quarters of declines, likely reflecting lower short-term interest rates fueling construction and improvements. The price index for personal consumption expenditures (PCE), the Fed’s preferred measure of inflation, rose at a 1.5% pace in the third quarter, well below the 2.0% pace the Fed prefers. Core prices, which exclude food and energy, rose 2.2% for the quarter. The uncertain outlook for trade and tariffs is weighing on business investment in new equipment and plants, which declined at an unrevised 0.6% rate, the first contraction since the beginning of 2016. Trade during the quarter was broadly neutral. Heavy industry has been hurt by the ongoing trade dispute with China, a strong US dollar and a faltering global economy. Corporate profits rose a solid 2.7% year over year. Fed Cuts Rates 0.25% The Fed issued its third rate cut of the year in October, dropping the benchmark rate by another 25 basis points to a target range between 1.50 % and 1.75%, apparently in reaction to data showing that the economy is slowing. Fed watchers are divided over whether there will be another rate cut at the Fed’s final meeting in December. Two voting members dissented. The Fed painted a relatively positive picture of the US economy in their statement, pointing to solid job gains and strong household spending but noted that business investment and exports remain weak. The committee left the door open to another cut, stating that they will continue to monitor the economic situation and respond accordingly. The Fed first began raising rates in 2015 after keeping them near zero for eight years. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.to edit.

|

|