|

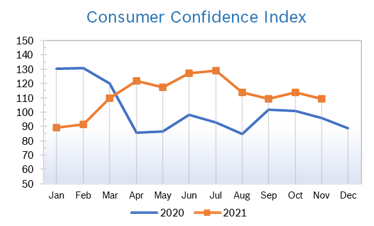

Volatility returned to the markets in November with investors concerned about the economic impact of the CV19 Omicron variant and the possibility that the Fed may raise interest rates sooner than expected to help combat inflation. Consumer Spending Grows 1.3% Consumer spending rose 1.3% in October after rising 0.6% in September. Personal incomes, which fuel consumer spending, fell 1% in September, the steepest decline in four months. Wages jumped 0.8% after rising 0.4% in August, a reflection of the tight job market and the extraordinary measures employers are taking to attract and retain workers. The economy is still being hamstrung by CV19 issues and supply chain problems. For the third quarter, consumer spending, which fuels 70% of overall economic activity, weakened to an annual growth rate of just 1.6%. Economists remain hopeful for a bounce-back in the current quarter, with confirmed CV19 cases declining, vaccination rates rising, businesses investing and more Americans venturing out to spend money. Many analysts think the economy will rebound at a solid annual growth rate of at least 4% this quarter. Consumer Prices Jump 0.9% The Consumer Price Index (CPI) rose 0.9% in October and was up 6.2% year over year. Core inflation, which excludes the volatile food and energy categories, climbed 0.6% in October after rising 0.2% in September and was up 4.6% year over year, the biggest increase since 1991. Prices increased across most categories, with big jumps in gasoline, energy costs and new and used vehicles, furniture and rent. The personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, rose 0.4% in October after rising 0.2% in September. The core PCE was up 4.1% year over year. The core PCE price index is the Fed's preferred measure for its 2% inflation target, which is now a flexible average. On a regional basis, prices were up more in the South and the Midwest. Supply chain constraints and disruptions are expected to keep inflation elevated into 2022. Consumer Confidence Drops to 109.5

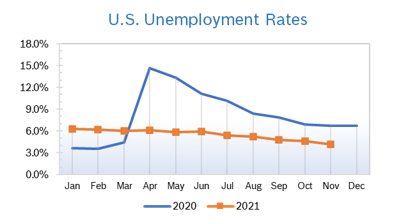

Unemployment Falls to 4.2% The unemployment rate fell to 4.2% in November after falling to 4.6% in October. That’s the lowest rate of unemployment since the start of the pandemic, when it stood at just 3.5%.

Job Openings Steady US job openings remained at 10.4 million at the end of September after rising to an all-time high of 10.9 million in July, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). Hiring dropped and the quits rate hit another series-high of 3.0% as 4.4 million people quit their jobs, equivalent to about 3% of the workforce. Demand remains high and businesses continue to report that finding qualified workers is very challenging. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Falls to 61.8 The Chicago Purchasing Managers Index (Chicago PMI) fell more than six points to 61.8 in November. It was the 17th consecutive month the index remained in positive territory. Inventories rose 8.5 points to 59.6, the highest since late 2018. Some firms reported stockpiling to get ahead of further supply chain disruptions and counteract logistical issues. Order Backlogs dropped 13.8 points to 60.8, 6 points below the 12-month average, as firms reported a reduction in the size of incoming orders. Prices Paid dropped to 93.8 after hitting a 42-year high in October. The majority of firms said that they have not seen any real easing in supply chain issues and disruptions. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.6% The Producer Price Index rose 0.6% in October after rising 0.5% in September and was up 8.6% year over year for the second consecutive month. It was the largest annual increase since the Labor Department began tracking inflation data in 2010 and the tenth consecutive monthly increase in wholesale prices. Core inflation, which excludes the volatile food and energy categories, rose 0.4% in October after rising 0.1% in September and was up 6.8% from October 2020. More than 60% of the increase was due to the rising cost of gasoline and other goods. Trucking freight costs jumped a record 2.5% in October and compensation rose by the most on record. Nearly one-third of all companies stated they will increase compensation over the next three months in hopes of retaining and/or attracting workers. The big increases added to worries about climbing inflation at all levels. Q3 GDP Grows 2.1% US economic growth in the third quarter inched up to 2.1% from the 2.0% growth first reported, according to the second reading from the Commerce Department. The small increase was due to a slightly higher revision to consumer spending, which grew an upwardly revised 1.7%. The contribution to GDP from business inventory was also revised up slightly. The Fed now expects the economy to grow 5.5% for the year, which would be the best growth since 1984 and a big improvement from 2020, when the economy shrank by 3.4%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|