|

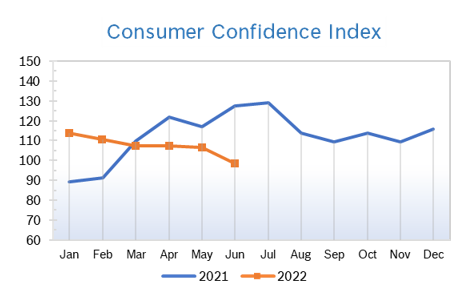

All three indexes finished the month and the quarter solidly in the red. The S&P notched a 21% decline for the first half, its steepest percentage drop for the first half since 1970, the Nasdaq had its largest ever first half drop and the Dow recorded the biggest first-half plunge since 1962. All three indexes also posted their second straight quarterly declines. Consumer Spending Rises 0.2% Consumer spending rose 0.2% in May after rising a downwardly revised 0.6% in April. It was the smallest increase in spending in five months. Data going back to January was also revised down, showing that consumer spending has been softening. Spending on goods dropped 3.2% for the month and spending on services rose 0.7%. The increase was below expectations. Personal income rose 0.3% in April after rising 0.5% in March and the savings rate fell to 4.4%, the lowest rate since 2008, as Americans dipped into savings to support spending. Consumer Prices Rise 1.0% The Consumer Price Index (CPI) rose 1.0% in May to a new 40-year high of 8.6% year over year. Core inflation, which excludes the volatile food and energy categories, rose 0.6% for the second consecutive month and was up 6.2% year over year. The typical family is spending about $450 a month more to buy the same goods and services as they did last year. Food and energy, the largest parts of many household budgets, have risen sharply over the last 12 months. The energy index is up 34.6% year over year, the largest 12-month increase since the September 2005. The food index increased 10.1%, the first time it has topped 10% since March 1981. The personal consumption expenditures (PCE) price index rose 0.6% last month after gaining 0.2% in April. In the 12 months through May, the PCE was up 6.3%. Excluding the volatile food and energy components, the core PCE price index rose 0.3% for the fourth consecutive month and was up 4.7% year over year, the smallest increase since last November. The PCE price indexes are the Fed's favored measures for their 2% inflation target. Consumer Confidence Falls to 98.7

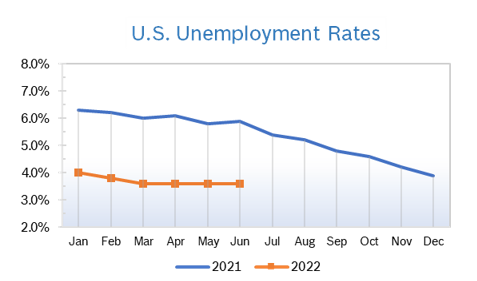

Unemployment Remains at 3.6%

Chicago PMI Falls to 56 The Chicago Purchasing Managers Index (Chicago PMI) fell to 56 in June after rising to 60.3 in May. It was the 24th consecutive month the index remained in positive territory. The index for New Orders fell 9.8 points to 49.9, so slightly into contraction. Order Backlogs dropped by 9.4 points to a 19-month low of 55.2. Inventory growth also slowed after rising at the fastest pace in 50 years in May. Prices Paid fell 9.0 points to 79.6, its lowest reading since February 2021. More than 40% of respondents to a special question reported that they did not plan to slow hiring despite rising employment costs. A PMI number above 50 signifies expanded activity over the previous month. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.8% The Producer Price Index rose 0.8% in May after rising a downwardly revised 0.4% in April and was up 10.8% year over year after being up a downwardly revised 10.9% in April. Core inflation, which excludes the volatile food and energy categories, climbed 0.5% in May after rising 0.6% in April and was up 8.3% from May 2021. Prices of goods climbed 1.4%, driven by a 5% increase in energy. Services prices were up 0.4% from April, after dropping in the prior month. That advance included a 2.9% jump in transportation and warehousing costs. After a slight break, China reimposed CV19-related shutdowns and the war in Ukraine continues to keep fuel prices elevated and disrupt supply chains. However, some commodity prices have declined. Q1 GDP Drops 1.6% GDP shrank a downwardly revised 1.6% in the first quarter from a 1.5% decline in the second reading and a 1.4% drop first reported by the Commerce Department. Consumer spending grew at a revised annual rate of just 1.8% in the first quarter, down from a previous estimate of 3.1%. The Fed believes the US economy is strong enough to deal with rate hikes without going into a recession because of exceptionally strong growth in 2021. IHS Markit economists forecast second-quarter gross domestic product growth of an annualized 0.1%, weaker than 1% growth they forecast earlier in June. The Atlanta Fed’s closely watched forecast is projecting 0.3% growth for the second quarter. Fed Raises Rates 0.75% The Fed raised rates by 0.75% to a range of 1.5% to 1.75% at their meeting in mid-June. The biggest increase in rates since 1994 was in line with expectations but three times the usual rate increase. The Fed is using the only tool at its disposal to try and tamp down inflation and demonstrate that they believe that the economy is strong enough to continue to recover without further support from the Fed. Market watchers expect another 0.75% at the next meeting. Traders generally see the benchmark rate ranging between 3.25% and 3.50% by the end of the year, rates that are still quite low by historical standards. The Fed sees inflation topping 5% by the end of the year before rapidly falling back in the wake of aggressive rate hikes. The committee's median forecast for the unemployment rate in 2022 rose to 3.7% from 3.5%. The rate is then seen rising to 3.9% in 2023 and 4.1% the following year. The outlook suggests the Fed's efforts to cool inflation will have some adverse effects on the labor market. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|