|

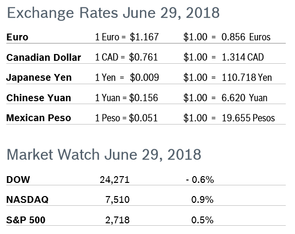

The major indexes posted mixed results for the month of June, ending with either minor gains or losses. There was a high degree of volatility over the month, caused primarily by worries about trade wars. It was also the end of the second quarter. The DOW fell 0.6% for the month, was up 0.7% for the quarter and was down 1.8% for the year. The NASDAQ gained 0.9% for the month, 6.3% for the quarter and was up 8.8% for the year. The S&P, the index most closely followed by economists, gained 0.5% for the month, 2.9% for the quarter and 1.7% year to date. Experts say fundamentals haven’t changed and expect GDP and corporate earnings for the second quarter to be robust. Consumer Confidence Falls to 126.4 The New York-based Conference Board’s Consumer Confidence Index fell to 126.4 in June after rising to an upwardly revised 128.8 in May. The Present Situation Index was relatively flat at 161.1 after rising to a downwardly revised 161.2 in May. The Expectations Index accounted for most of the decline, dropping to 103.2 in June after rising to an upwardly revised 107.2 in May. Expectations are still high by historical measures, but the slight drop in confidence could indicate that consumers do not foresee the economy gaining much momentum in the months ahead. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.2% Consumer spending grew 0.2% in May after rising a downwardly revised 0.5% in April. Spending was below economists’ expectations. Core consumer spending was little changed in May after rising 0.4% in April. Personal incomes rose 0.4% in May after rising 0.3% in April and the savings rate rose to 3.2% after remaining at an upwardly revised 3.0% in April. Core PCE inflation rose 0.2% in May and was up 2.0% from May 2017, the first time in six years the core index has been up 2.0%, the Fed’s target rate for inflation. Consumer Prices Rise 0.2% The Consumer Price Index (CPI) rose 0.2% in May after rising by the same percentage in April. The CPI was up 2.8% over the past twelve months, the biggest annual gain in more than six years. Core inflation, which excludes food and energy, rose 0.3% in May after rising 0.1% in April and was up 2.1% from May 2017. Gasoline prices rose 1.7% seasonally adjusted in May, driving much of the overall increase, but the rise in core inflation is being driven by rising prices for services. Gasoline prices typically rise as the summer driving season gets underway. Unemployment Rises to 4.0% The unemployment rate rose to 4.0% in June after falling to 3.8% in May and the economy added a robust 213,000 new jobs. In addition, gains for April and May were revised up by 37,000. The uptick in the unemployment rate was due to an additional 600,000 job seekers who had stopped looking for work re-entering the work force. The number of new jobs created was above expectations of 195,000. Job gains were broad based, with the private sector adding 202,000 new jobs. Construction added 13,000, but retailers cut 22,000. Economists noted that the retail sector continues to experience fallout from the increase in online shopping. Wages rose by 2.7% for the second consecutive month. Economists said that the solid jobs report along with other economic news is evidence that the 9-year economic expansion is still moving forward and the economy is on solid footing. Durable Goods Orders Fall 0.6% Durable goods orders fell 0.6% in May after dropping an upwardly revised 1.0% in April. Economists had expected orders to fall 1.0%. Excluding the volatile transportation category, orders fell 0.3% after rising 0.9% in April. Nondefense capital goods orders excluding aircraft, widely regarded as a proxy for business spending plans, fell 0.3%. Nondefense capital goods shipments, which factor into GDP, rose 3.0%; excluding aircraft they dropped by 0.1%. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Rises to 64.1 The Chicago Purchasing Managers’ Index (PMI) rose to 64.1 in June after rising 5.1 points to 62.7 in May and was up 0.8% from June 2017. It was the highest level for the index since January. Four of the five components rose for the month, but the big jump was primarily driven by an increase in New Orders, which rose to a five-month high. Somewhat offsetting the growth was a slight fall in Production. The Prices Paid indicator rose to the highest level since May 2011. It was the third consecutive month this indicator remained above 70, which means that Prices Paid is at a seven-year high on a quarterly basis as well. About 25% of respondents to one of two special questions posed indicated that ongoing trade talks were having a significant impact on their business and an additional 39.2% indicated they were having a minimal impact. In addition, 38.6% of firms said that they had increased starting salaries to attract prospective employees. Wholesale Prices Rise 0.5% The Producer Price Index (PPI) jumped 0.5% in May after rising 0.1% in April, continuing the upward climb in producer prices that has been going on since August 2016. The big jump was primarily due to a 4.6% spike in energy prices. The PPI was up 2.6% from April 2017. Core producer prices, which exclude food, energy and trade services, rose 0.3% in May after rising 0.2% in April and were up 2.6% compared to May 2017. The PPI for inputs to construction jumped 2.2% in May and the cost of all goods used in construction was up 8.8%. Some of the biggest year-over-year increases were in lumber and plywood, diesel fuel and aluminum shapes. While inflation has definitely picked up, analysts say it is doing so at a manageable pace. Q1 GDP Growth Revised Down to 2.0% GDP grew a downwardly revised 2.0% in the first quarter, down from the 2.3% first reported and the second reading of 2.2%. The downward revision was due to the weakest consumer spending in nearly five years as well as a smaller inventory accumulation that first estimated. Growth in consumer spending for the quarter fell to 0.9% from the previously reported 1.0% growth. Consumer spending grew 4.0% in the fourth quarter and is expected to pick up significantly in the second quarter. It was the slowest pace since the second quarter of 2013. First quarter inventories were revised down to $13.9 billion from the $20.2 billion pace estimated in April, leaving inventory investment neutral to GDP growth. Investment in homebuilding fell at a 1.1% rate in the first quarter, an improvement from the 2.0% decline first reported. The smaller inventory accumulation will most likely be good news for second quarter GDP growth, currently being estimated to be as high as 5.3%. Job Openings Rise Slightly The number of job openings rose slightly to 6.70 million in April, a new record high, according to the Job Openings and Labor Turnover Survey, or JOLTS. Over the month, total separations increased slightly to 5.41 million, while the quits rate was little changed at 2.3%. The quits rate is considered a measure of confidence in the job market, and has been steadily rising since hitting a low of 1.3% in late 2009. The number of unemployed workers per job opening dropped below 1.0 for the first time to 0.9, and there is little hope that the tight market for companies looking to hire will loosen up any time soon. Employers hired 5.58 million workers in April. Hires have outpaced separations in every month since August 2010. The JOLTS report is one of the Fed’s preferred economic indicators. Fed Raises Interest Rates 0.25% The Fed raised interest rates to a range of 1.75% to 2.0% in June and increased the number of rate hikes planned for this year from three to four, which would mean we can expect two more increases before the end of the year. The Fed is also forecasting three rate increases in 2019 and one in 2020, which would leave the benchmark rate at 3.1% by the end of 2019, up from the previous forecast of 2.9%. For 2020, the Fed foresees a median of 3.4%, which would mean that rates would finally exceed the 2.9% the Fed regards as neutral, neither stimulating nor restraining growth. Fed Economic Forecast GDP will grow at a 2.8% this year, up from 2.6% in 2017, but will dip to 2.2% in 2019, according to the Fed’s revised economic forecast. Inflation, as measured by the Consumer Price Index CPI) will grow 2.9% this year after growing 2.1% last year and will increase 2.3% in 2019, as oil prices rise before falling later this year. Real personal consumption expenditures will drop to 2.2% this year from 2.8% in 2017, and remain at 2.2% in 2019. The unemployment rate is expected to be 3.8% this year and 3.9% next year. Treasury rates are anticipated to move up this year and keep increasing in 2019, which will keep mortgage rates ticking up. At nine years, the current economic expansion is now the second-longest in history. It will become the longest if it lasts past June 2019. ABA Economic Forecast The American Bankers Association’s (ABA) Economic Advisory Committee predicted that GDP will rise by 2.8% this year, up from their forecast of 2.4% in January. They also forecast that unemployment will fall to 3.6% in 2019 from the current 3.8%. The improved outlook is due to a boost in government spending and an expected increase in business investment. Economic growth should then slow to a more modest 2.2% in 2019 and drop to 1.6% in 2020, according to the consensus projections from the 16 economists. Chairman Ellen Zenter, who is the chief US economist for Morgan Stanley, said there is nothing particularly worrisome about that outlook, it simply represents a natural slowing of the business cycle and is the soft landing policymakers are attempting to achieve. None of the economists had a recession in their forecast, although lingering uncertainty about trade policy poses a risk. They don’t believe inflation will rise much above the Fed’s target of 2%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|