|

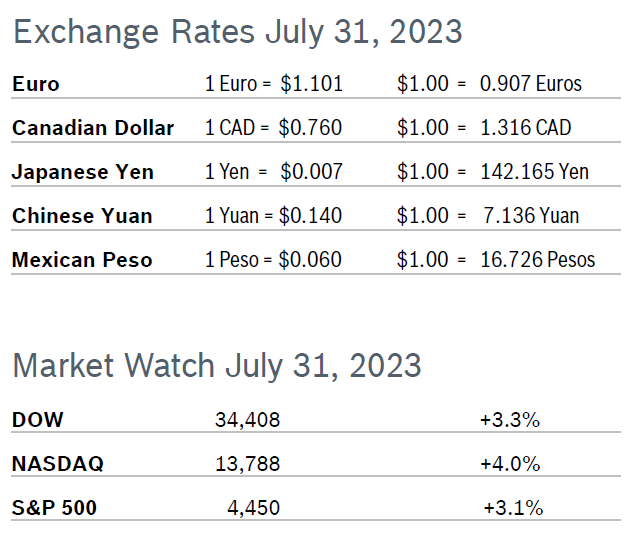

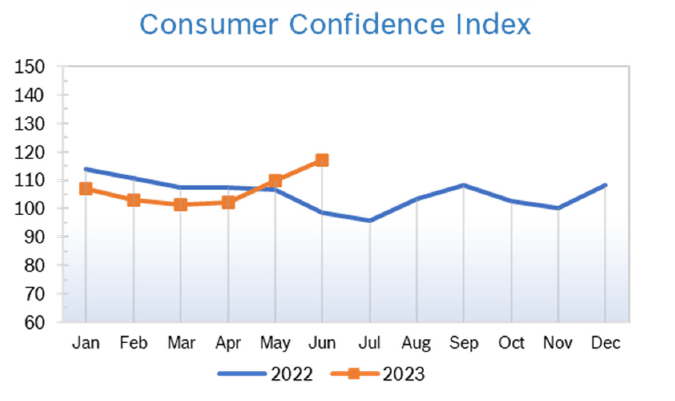

All three major indexes finished the month off with solid gains after good economic news, falling inflation and good earnings. The NASDAQ continued to add to its strong winning streak. The S&P, the index most closely watched by professionals, has now gained 19% year to date, after losing 19% in 2022. The Dow added 3.3% and recorded its longest winning streak of the year. Consumer Spending Rises 0.5% Consumer spending jumped 0.5% in June after inching up just 0.1% in May, the slowest pace in more than two years. Core consumer spending rose 0.4% after being unchanged in May. While spending on services led consumer spending in GDP, spending on durables rose 1.7% in June. Households are benefitting from solid income gains, with personal income rising 0.3% in June. Other than a 0.03% decline in April, real disposable income has risen in each of the past eleven months. Falling inflation and the still tight labor market has helped sustain consumer spending despite rising interest rates. Consumer Prices Rose 0.2% in June The Consumer Price Index (CPI) rose 0.2% in June after rising 0.3% in May and was up 3.0% year over year after being up 4.0% in May. It was the smallest increase since 2021 and the twelfth consecutive month year-over-year inflation has fallen since peaking at 9.1% in June 2022. Core inflation, which excludes the volatile food and energy categories, rose 0.2% in June after rising 0.1% in May and fell to 4.8% year over year after falling to 5.3% in May. Inflation is gradually slowing and getting closer to the Fed’s preferred level of 2.0%. The personal expenditures price index (PCE) rose 0.1% in June after rising 0.1% in May and was up 3.0% year over year, the smallest increase since April 2021. Core prices rose 4.1% year over year in June after being up 4.6% year over year in May. The Fed closely tracks the PCE price indexes for monitoring their 2% inflation target. Consumer Confidence Rises to 117.0

Unemployment Falls to 3.5%

Chicago PMI Rises to 42.8 The Chicago PMI rose to 42.8 in July after rising to 41.5 in June. The reading was slightly below expectations and the eleventh consecutive month the PMI remained below 50, the level that indicates expansion. The PMI was close to 50 in April. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.1% The Producer Price Index (PPI) rose 0.1% in June after falling an upwardly revised 0.4% in May and was up just 0.1% year over year for the second consecutive month. Stripping out volatile food and energy prices, core PPI rose 0.1% for the third consecutive month in June and was up 2.6% year over year after being up 2.8% year over year in May. Increased costs for services accounted for most of the increase. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q2 GDP Rises 2.4% Q2 GDP surprised to the upside, growing a robust 2.4% after growing 2.0% in the first quarter, according to the first reading from the Commerce Department. Growth was significantly better than expectations. Economists were anticipating a slowdown in consumer spending from strong 4.2% growth in the first quarter, but spending grew a respectable 1.6% and remained strong across most categories. Spending on services rose three times more than spending on goods. GDP also got a lift from a 5% increase in corporate spending on equipment and structures, the biggest jump in six quarters. Analysts termed it a strong report that shows the resiliency of the US economy. Fed Raises Rates 0.25% The Fed raised rates 0.25% at the end July to 5.25% to 5.50% after holding rates steady at their meeting in mid-June. The increase was widely expected. It was the 11th increase since the Fed began raising rates from near zero in 2022. The decision was unanimous. Fed Chairman Jerome Powell indicated that the Fed could raise rates again in September or could hold rates steady, depending on economic conditions. The Fed still wants to push inflation back down into their target range of 2%. The Fed did not update any other projections. Fed officials have more than doubled their outlook for 2023 economic growth to 1% from 0.4% projected in the March and now think unemployment will only rise to 4.1% by the end of the year compared to 4.5% in the March outlook. The annual Jackson Hole Economic Symposium August 24-26 will give Powell an opportunity to offer his assessment of the U.S. economic outlook. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|