|

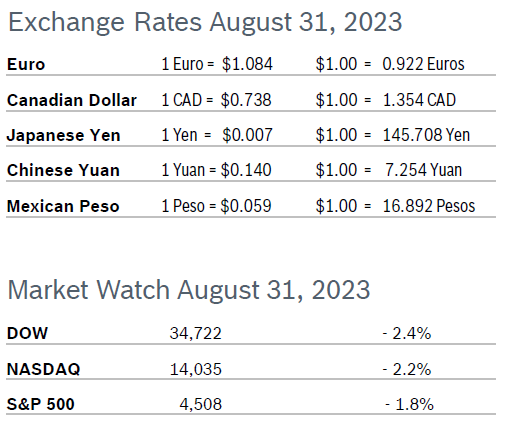

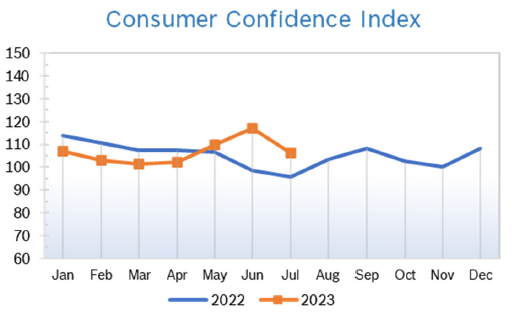

All three major indexes broke months’ long winning streaks and finished the month of August down modestly despite positive economic news. September is typically the worse month of the year for markets. Consumer Spending Rises 0.8% Consumer spending rose a robust 0.8% in July after jumping an upwardly revised 0.6% in June. Core consumer spending rose 0.6% after rising 0.4% in June. The increase was slightly above expectations. Spending on goods increased 0.7%, mostly reflecting spending on non-durable goods such as pharmaceuticals, recreational items, groceries and clothing. There were also increases in spending on recreational goods and vehicles as well as household furnishings and equipment and other durable goods. Services spending increased 0.8%, driven by portfolio management and investment advice services, housing and utilities, restaurants and healthcare. Economists said the jump in consumer spending was driven mainly by one-time factors, such as the “Barbenheimer” phenomenon, that are unlikely to be repeated. Utility spending leapt as an unprecedented heat wave caused Americans to crank up air conditioning. Back-to-school shopping also likely fueled some spending. Consumer Prices Rise 0.2% in July The Consumer Price Index (CPI) rose 0.2% for the second consecutive month in July and was up 3.2% year over year after being up 3.0% in June. Shelter costs accounted for 90% of the increase. Inflation peaked at 9.1% in June 2022. Core inflation, which excludes the volatile food and energy categories, rose 0.2% in July, matching June’s increase. Core inflation fell to 4.7% year over year after falling to 4.8% in June. Inflation is gradually slowing and getting closer to the Fed’s preferred level of 2.0%. The personal consumption expenditures (PCE) price index increased 2.5% in the second quarter, down 0.1% from a previous estimate. Excluding food and energy prices, the PCE price index rose 3.7%, also down 0.1%. Expectations were for core PCE prices to rise 3.8%. The Fed closely tracks the PCE price indexes for monitoring their 2% inflation target. Consumer Confidence Falls to 106.1

Unemployment Rises to 3.8%

Chicago PMI Rises to 48.7 The Chicago PMI rose to 48.7 in August after rising to 42.8 in July. It was the highest reading in a year and well above expectations. However, it was the 12th month in a row the PMI remained below 50, the level that indicates expansion. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.8% The Producer Price Index (PPI) rose 0.8% in July after rising an upwardly revised 0.2% in June and was up just 0.1% year over year for the second consecutive month. Stripping out volatile food and energy prices, core PPI rose 0.2% in July after increasing 0.1% for three consecutive months. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q2 GDP Growth Revised Down to 2.1% Q2 GDP grew a downwardly revised 2.1% rather than the 2.4% first reported, according to the second reading from the Commerce Department. Growth was still slightly above the 2.0% pace in Q1. Economists had expected GDP to be unchanged. The revision primarily reflects downward corrections in the components of private inventory investment and non-residential fixed investment, which were partially offset by an increase in state and local government spending. In addition imports, which subtract from GDP, were upwardly revised. Spending on services rose three times more than spending on goods. Fed Could Raise Rates if Needed Fed Chairman Jerome Powell stressed that rates could move higher if that’s what is needed to tame inflation during his much-anticipated remarks at the annual Jackson Hole Economic Symposium. This annual presentation has become a major event as it provides an in-depth look at how the Fed views both the current condition and probable direction of the economy. Powell reiterated that there has been much economic progress, but as long as wage growth continues inflation may remain above the Fed’s target of 2%. The Fed also promised to proceed cautiously and vowed not to bring “unnecessary harm” to the consumer. Most economists believe that the Fed is simply holding the door open and will hold steady in September. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|