|

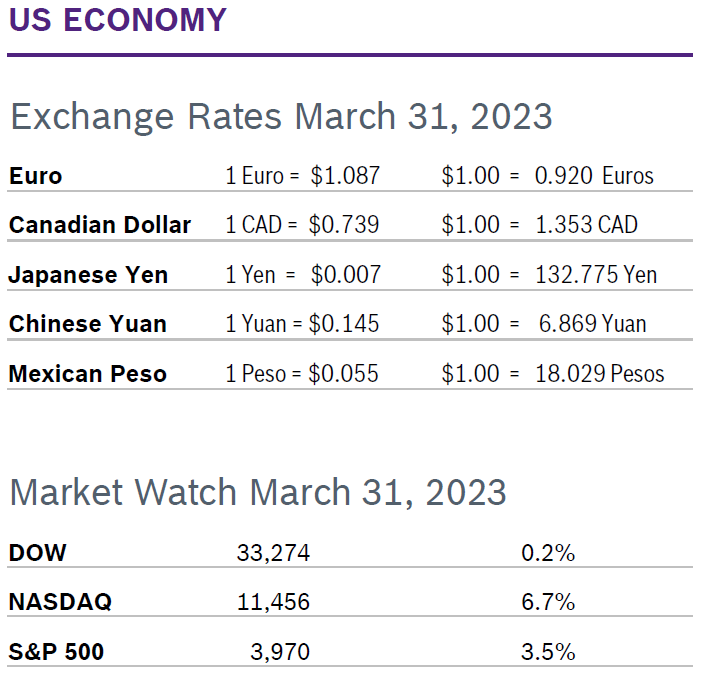

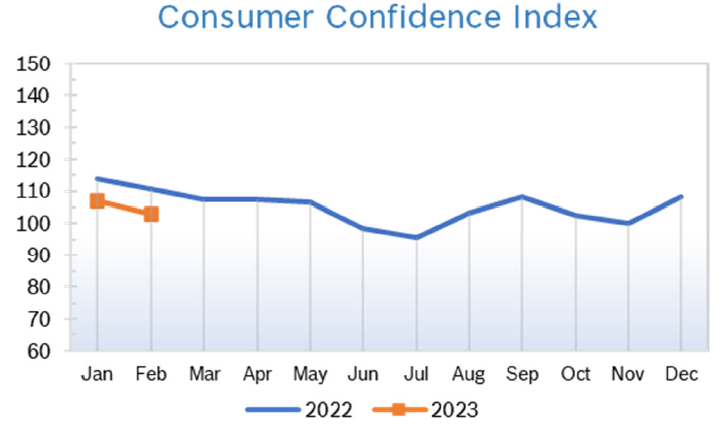

It was March Madness in the markets as well as on the basketball court. Expectations about the economy, the Fed and policy swung from one extreme to another and the sudden collapse of two large regional banks and one international powerhouse threatened to send the economy into a downward spiral. But instead, the Treasury Secretary reassured an anxious public, the FDIC came through and the markets ended up having their best month and quarter in more than a year. For the quarter, the DOW inched up 0.4%, the NASDAQ gained 16.77% and the S&P, the index most closely watched by professionals, rose 7%. Consumer Spending Rises 0.2% Consumer spending rose 0.2% in February after jumping an upwardly revised 2.0% in January, which had been the largest monthly gain in two years. Core consumer spending fell 0.1% in February after rising an upwardly revised 1.5% in January. Spending on goods jumped 2.8% and spending on services rose a strong 1.3%. The overall surge in spending came as wages and salaries jumped 0.9%. A whopping 8.7% cost of living adjustment for more than 65 million Social Security beneficiaries offset a drop in government benefits. Personal income rose 0.2%, the smallest gain since April, making the outlook for spending uncertain. Wages rose 0.3%, matching November's increase. Consumers increased savings as well, with the saving rate rising to 4.7%, the highest in a year, from 4.5% in December. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in February after rising 0.5% in January. Consumer prices were up 6.0% year over year after being up 6.4% in January. It was the eighth consecutive month that year-over-year inflation has cooled down. Core inflation, which excludes the volatile food and energy categories, rose 0.5% in February after rising 0.4% in January but dropped to 5.6% on an annual basis from 5.7% in December. The personal consumption expenditures (PCE) price index rose 0.3% in February after jumping 0.6% in January. In the 12 months through February, the PCE price index accelerated 5% after rising 5.3% in January. Excluding the volatile food and energy components, the PCE price index increased 0.3% in February after rising a downwardly revised 0.5% in January. Consumer Confidence Rises to 104.2

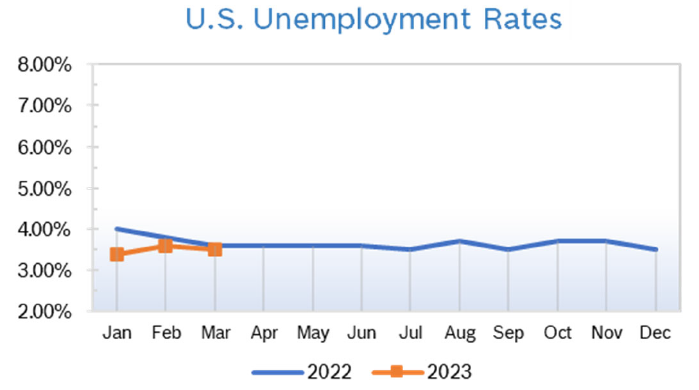

Unemployment Falls to 3.5%

Chicago PMI Rises to 43.8 The Chicago PMI inched up to 43.8 in March after falling to 43.6 in February. The marginal increase left the index below 50, the level that signifies expansion, for the seventh consecutive month. Economists had expected another decline. A PMI number above 50 signifies expanded activity over the previous month; this was the sixth consecutive reading below 50, the level which indicates contraction. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Fall 0.1% The Producer Price Index (PPI) fell 0.1% in February after jumping 0.7% in January and was up 4.6% year over year after being up 6.0% in January and 7.3% in December. Stripping out volatile food and energy prices, core PPI rose 0.3% in February after being up 0.5% in January and was up 5.4% year over year for the second consecutive month. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q4 GDP Grows 2.6% Q4 GDP was revised down to 2.6% growth from 2.7% in the second reading and an initial reading of 2.9%, according to the third and final reading from the Commerce Department. GDP rose 3.2% in the third quarter. Economists had generally expected growth to be unrevised and now expect the reading for the first quarter of this year to be in the same range. The increase in consumer spending was reduced in the latest estimate to 1% from 1.4% in the second reading and an original 2.1%. Business investment, on the other hand, turned out to be much stronger and mostly offset the drag from consumer spending. Overall business investment was raised to an annual growth rate of 4.5% from an original 1.4%. The PCE index was unchanged at 3.7% Full-year GDP growth this year is expected to be anemic, with NRF forecasting growth of about 1.1%, about half the level in 2022. The personal consumption expenditures price index, (PCE) the Fed's preferred gauge, advanced at a seasonally adjusted annual rate of 3.7%, a substantial upward revision from the first reading of 3.2%. Core PCE, which strips out food and energy costs, was revised up to a 4.3% increase from an initial estimate of 3.9%. The Fed targets a 2% inflation rate. The Fed would like to see the economy cool off more before they ease up on interest rate increases. Fed Raises Rates 0.25% As widely predicted, the Fed scaled back their planned rate increase in March in the wake of several bank failures that rattled confidence in the economy. They raised interest rates just 25 basis points to a level of 4.75% to 5.0%, the highest rate in more than sixteen years. They did not give any specific guidance about further increases but said more action may be needed to bring stubborn inflation down from its current 6% to closer to the preferred range of around 2%. However, rates at the end of the year are still projected to be 5.1%, which would indicate one more small rate increase. The notes issued said that inflation will probably fall less than originally hoped this year. Recent developments will most likely result in credit tightening which could depress economic activity but it is impossible to project what the actual impact might be. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|