|

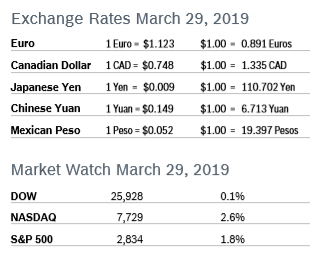

The markets were all up modestly in March but turned in the best first quarter in decades after a rocky end to 2018, with all three indexes posting gains of more than 10%. The S&P, the broadest measure of large-cap stocks and the index most watched by analysts, rose 13.1% for the quarter, its biggest quarterly rise since 2009. The DOW rose 11.2% and the tech-heavy NASDAQ rose 16.5%. The markets were cheered by the Fed’s promise to hold off raising interest rates and fresh signs that inflationary pressures are under control. The positive close to the month came after stocks fell sharply March 22 as disappointing news from Europe and an inversion of the US Treasury yield curve heated up concerns about global growth. The yield curve inversion means the yield on a 10-year T-note is below the yield on the 3-month T-bill. Inversion is seen as a reliable indicator of a recession, typically preceding the downturn by a year or more. However, many analysts don’t believe the yield curve is an accurate predictor of recession under the current economic circumstances of solid job growth and low inflation. Consumer Confidence Drops to 124.1 The New York-based Conference Board’s Consumer Confidence Index dropped to 124.1 in March after rising to 131.4 in February, according to the Conference Board’s latest survey. Analysts had expected the index to remain about the same. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, dropped to 160.6 after rising to a downwardly revised 172.8 in February. The Expectations Index, which is based on consumers’ short-term outlook for income, dropped to 99.8 in March after jumping to an upwardly revised 103.8 in February. The Conference Board noted that confidence was adversely affected by the stock market plunge at the end of 2018 and a host of other economic uncertainties, and confidence has generally been softening since reaching a high of 137.9 last October. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.1% Consumer spending rose just 0.1% in January after dropping a downwardly revised 0.6% in December. Economists had expected consumer spending to grow 0.3%. The release of January figures was delayed by the government shutdown that ended January 25. Core consumer spending also rose 0.1% after dropping 0.6% in December. Spending on goods fell 0.2% in January after dropping an upwardly revised 2.4% in December. Spending on services rose 0.2% after rising an upwardly revised 0.3% in December. With demand softening, inflation pressures were moderate, with the personal consumption expenditures (PCE) price index excluding the volatile food and energy components rising 0.1% after rising 0.2% in December. That dropped the annual increase in core PCE to 1.8% from 2.0% in December, only the second time core PCE has been at 2.0% since April 2012. The core PCE index is the Fed’s preferred inflation measure. Personal income increased 0.2% in February after falling 0.1% in January. Wages rose 0.3% in February, matching January’s gain. Savings fell to $1.19 trillion in February from $1.22 trillion in January. Consumer spending reports are lagging due to the government shutdown. Consumer Prices Rise 0.2% The Consumer Price Index (CPI) rose 0.2% in February after being flat in January. The CPI was up 1.5% over the past twelve months, down from a 1.6% annual increase in January. Core inflation, which excludes food and energy, rose 0.1% in February after rising 0.1% per month during each of the previous four months. Core CPI was up 2.1% year over year, after being up 1.9% in January. The strengthening dollar is also depressing inflation. The Fed expects inflation to be tame for what they described as “a time” due to declining energy prices. Unemployment Remains at 3.8% The unemployment rate remained at 3.8% in March after falling in February. The economy added 196,000 new jobs, a big improvement from the upwardly revised 33,000 jobs added in February. Job gains for January were also revised up slightly. February’s soft job gains had caused some economic jitters, but analysts say it was just a “blip” and they do not see any drop in demand for workers. Payrolls increased in construction after dropping by 31,000 in February. Through the first three months of the year, employers added an average of 180,000 new jobs each month, a slowdown from the 223,000 jobs, on average, added each month in 2018. The job situation has gotten tight enough some companies are shifting customer advertising dollars to recruitment efforts like job fairs and recruiters are working hard to keep applicants interested and urging employers to act quickly if they want someone. The job report is a good reinforcement for the Fed’s wait and see policy and gives them no reason to contemplate raising rates any time soon. Hiring has eased modestly in some industries because it has been very hard to find workers at the wages some companies are willing to pay. Average hourly earnings rose four cents an hour in March to $27.20, and year-over-year wage gains are well ahead of the rate of consumer price increases. The economy needs to create about 120,000 new jobs each month to keep up with growth in the working-age population. Durable Goods Orders Fall 1.6% Durable goods orders fell 1.6% in February after rising a downwardly revised 0.1% in January and were up 2.6% year over year. It was the first decline in durable goods orders in the past four months. Orders ex transportation rose 0.1% after falling 0.1% in January. Core durable goods orders for non-defense capital goods excluding aircraft, widely regarded as a key indicator of business spending, fell 0.1% in February after jumping an upwardly revised 0.9% in January. Nondefense capital goods shipments, which factor into GDP, were steady after rising 0.8% in January. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Falls to 58.7 The Chicago Purchasing Managers’ Index (PMI) fell 6 points to 58.7 in March after rising to 64.7 in February. It was the 26th consecutive month the PMI was above 50, the level that indicates growth. Production and New Orders fell back from big increases in February but remained well above their January levels. New Orders continue to lag. Order Backlogs shrank the most, and actually fell into contraction territory for the first time since January 2017. The Prices Paid indicator fell sharply, hitting the lowest level since August 2017. The PMI averaged 60.1 in the first quarter, down 3.5% from the fourth quarter and 3.3% from the first quarter of 2018. Overall, firms remain optimistic about their business prospects, although enthusiasm has moderated since last year. Wholesale Prices Rise 0.1% The Producer Price Index (PPI) rose 0.1% in February after falling 0.1% in January and 0.2% in December. The PPI was up 1.9% from February 2018. Core producer prices, which exclude food, energy and trade services, rose 0.1% in February after rising 0.3% in January and were up 2.5% from February 2018. The Labor Department said that the increase was fueled by rising prices for gas, lodging and airplane tickets. Q4 GDP Revised Down to 2.2% GDP growth was revised down to 2.2% in the fourth quarter from 2.6% growth reported in the second estimate, according to the Commerce Department. The downward revision was greater than economists had expected. GDP grew 2.9% in 2018, the best performance since 2015 and much better than the 2.2% the economy grew in 2017. Consumer spending increased at a downwardly revised 2.5%, after growing 3.5% in the third quarter. The Congressional Budget Office (CBO) estimated that the 35-day government shutdown will cost the government about $3 billion and will shave about 0.4% from annualized GDP in the first quarter. Current estimates for first quarter GDP are as low as 0.9%. Economists believe a big slowdown in China’s economy and slower growth in Europe are reducing demand for American exports and making companies more reluctant to begin long-term projects. Consumer spending accounts for more than two-thirds of US economic activity. Job Openings Rise The number of job openings rose by 102,000 to 7.6 million in January after jumping to 7.3 million in December, according to the most recent Job Openings and Labor Turnover Survey (JOLTS). There were about one million more job openings than there were people available to hire. The labor market has enjoyed a record 101 consecutive months of job gains, but the growing shortage of workers is expected to slow job growth down to about 150,000 jobs per month. Nearly 3.5 million people quit their jobs in January, up 2.9% from December, which may cause employers to increase wages in an attempt to retain workers. Fed Leaves Rates Unchanged As widely expected, the Fed left interest rates unchanged at 2.25% to 2.5% when the Fed Open Market Committee met in mid-March. However, the Fed also downgraded their view of the US economy, trimming the forecast for GDP growth this year down to 2.1% from the previous forecast of 2.3%, stating that economic growth has slowed. The Fed also trimmed the forecast for PCE inflation for this year and next year, and sees unemployment remaining around 3.8%. In December, forecasters felt that unemployment might drop as low as 3.5% this year. Forecasters also believe it is quite possible the Fed will not raise rates at all this year. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|