|

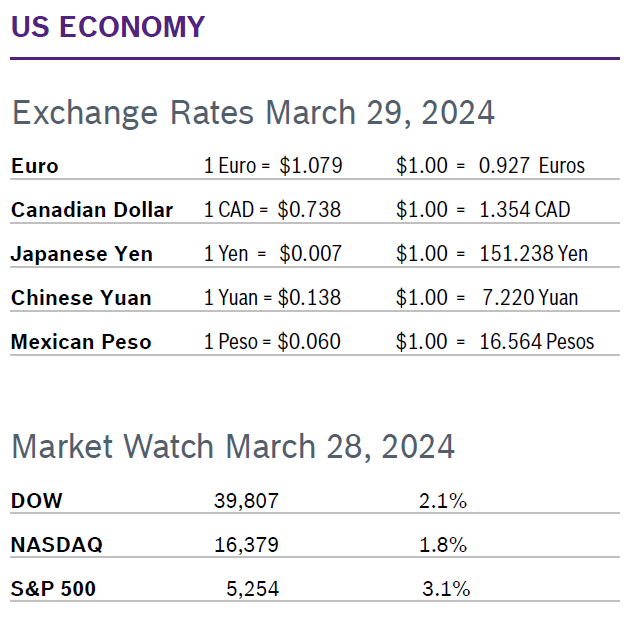

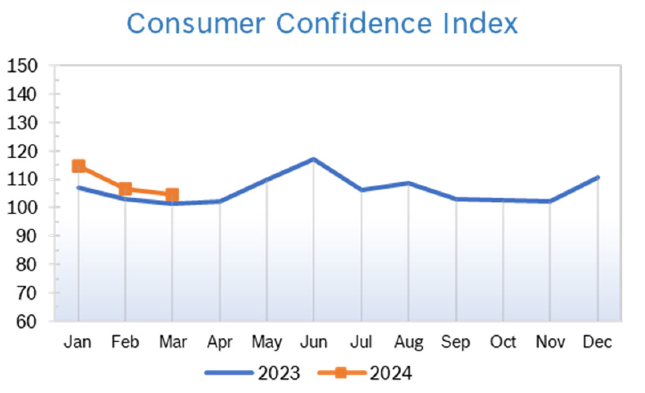

Stocks turned in their fifth consecutive winning month as investors were cheered by cooling inflation and the hope that the Fed will begin to lower interest rates later this year. The major indexes also turned in winning quarters, with the DOW up 5.62%, the NASDAQ up 9.11% and the S&P, the index most closely watched by economists, up 10.16%. Consumer Spending Jumps 0.8% Consumer spending jumped 0.8% in February after rising 0.2% in January, the biggest increase in more than a year. Adjusted for inflation, real consumer spending rose 0.4% after falling a downwardly revised 0.2% in January. Much of spending was funded from savings as growth in personal income slowed. The saving rate dropped to 3.6%, the lowest level since December 2022, from 4.1% in January. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in February after rising 0.3% in January. The increase was in line with expectations. The CPI was up 3.2% year over year after being up 3.1% for the previous two months. Core prices rose 0.4% for the second consecutive month and were up 3.9% year over year. Housing and gasoline accounted for more than 60% of the increase. The core CPI inflation rate peaked at a 40-year-high of 6.6% in September 2022. The personal consumption expenditures (PCE) price index rose 0.3% in February after rising an upwardly revised 0.4% in January; core PCE rose 0.4% after rising a downwardly revised 0.1% in January. In the 12 months through February, the PCE price index increased 2.5% after increasing 2.4% in February. Inflation peaked at 9.1% in June 2022. Consumer Confidence Falls to 104.7

Unemployment Falls to 3.8%

Chicago PMI Falls to 41.4 The Chicago PMI fell to a seven-month low of 41.4 in March after dropping to 44 in February. The Index has been below the break-even midpoint of 50 for the past 18 months. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.6% The Producer Price Index (PPI) rose 0.6% in February after rising 0.3% in January and was up 1.6% year over year. Stripping out volatile food and energy prices, core PPI rose 0.3% in February after rising 0.6% in January and was up 2.0% year for the second consecutive month. PPI peaked at an 11.7% year-over-year increase in March 2022. Q4 GDP Grows 3.4% Fourth quarter GDP growth was revised up to 3.4% in the third and final reading; GDP growth was first reported at 3.3%. The revision reflected upgrades in consumer spending, nonresidential fixed investment and state and local government spending. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased 3.3% rather than the 3.0% first reported, and added 2.2% to GDP growth. The upward revision was all in services. The upgrade to business spending reflected higher outlays on manufacturing as well as commercial and healthcare structures than previously estimated. Spending on intellectual property products was also revised up, while the decline in outlays on equipment was not as steep as previously estimated. Inventory investment was lowered to a $54.9 billion rate from the previously estimated $66.3 billion pace. While that subtracted 0.47% from GDP growth, the outlook for this year is encouraging. The core PCE deflator, which Fed officials view as the best measure of the underlying pace of consumer price inflation, rose slightly more than initially reported, coming in at 2.1% instead of 2.0%. Fed Holds Interest Rates Steady The Fed held interest rates at between 5.25% and 5.5% for the fifth consecutive meeting at their latest policy meeting in March. The Fed stuck to their forecast that they will lower rates by a total of three-quarters of a percent to a range of 4.50% to 4.75% by the end of the year but did not commit to when the expected series of three rate cuts would begin. The Fed reiterated that they don’t think it is good policy to begin to cut rates until inflation, now hovering around 3%, moves closer to their target of 2%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|