|

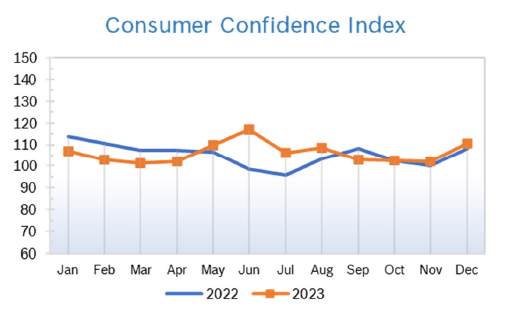

The Santa Claus rally continued in December, with all three indexes reversing the losses incurred in 2022 and turning in years for the bulls. Markets were cheered by rising confidence, falling bond yields and cooling PCE prices, which the Fed keeps a close eye on for interest rate policy. Analysts attributed a mild pullback on the last trading day of the year to rebalancing portfolios, and most see interest rate cuts ahead, perhaps as soon as mid-year. Consumer Spending Falls 0.2% Consumer spending fell 0.2% in December and November spending was revised to a 0.1% decline from a 0.1% gain. Spending on services rose 0.5%, matching November’s gain. Spending on long-lasting manufactured goods like motor vehicles, recreational goods and household furniture and equipment decreased 1.9% after plunging 3.0% in November. Spending on nondurables like clothing and footwear declined 1.4% in December. The relatively weak showing in consumer spending and slowing price increases will allow the Fed to consider cutting interest rates next year. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose 0.1% in November after being unchanged and was up 3.1% year over year after being up 3.2% in October. The slight increase was above expectations that prices would be unchanged. The core CPI, which strips out volatile food and energy prices, rose 0.3% from October levels, in line with estimates and was up 4% year over year. The core CPI inflation rate peaked at a 40-year-high of 6.6% in September 2022. Core goods prices fell 0.3% in October but were unchanged year over year. Core services prices rose 0.5% from October and were up 5.5% year over year. The personal consumption expenditures (PCE) price index edged up 0.1% last month after rising by the same margin in November. In the 12 months through December, the PCE price index increased 5.0%. That was the smallest year-on-year gain since September 2021 and followed a 5.5% advance in November. Inflation peaked at 9.1% in June 2022. Consumer Confidence Rises to 110.7

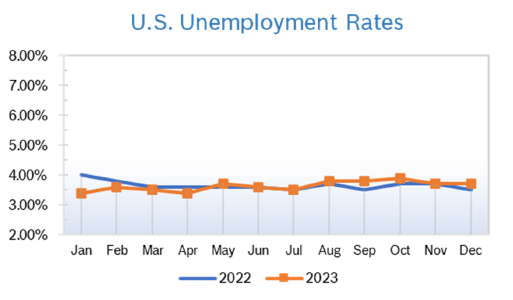

Unemployment Remains at 3.7%

Chicago PMI Falls to 46.9 The Chicago PMI fell nearly ten points to 46.9 in December after jumping to 55.8 in November. The big drop took the index back below 50, the level that indicates expansion. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Unchanged The Producer Price Index (PPI) held steady in November after falling a downwardly revised 0.4% in October and was up 0.9% year to date. Stripping out volatile food and energy prices, core PPI rose 0.1% in November after rising 0.1% in October and was up 2.5% year over year after being up 2.9% in October. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q3 GDP Grows 4.9% Third quarter GDP growth was revised back down to 4.9% from the 5.3% increase reported in the second reading, according to the third and final reading from the Commerce Department. Consumer spending was revised back down to 3.1% from the 3.6% reported in the second reading and imports and exports were also revised down. Business investment spending, the second largest component of GDP, expanded at a slightly stronger 2.6% pace. The annual rate of inflation in the third quarter was revised down to 2.6% from 2.8%. The increase in the core prices (PCE) that excludes food and energy was marked down to 2% from 2.3%. Economic growth is expected to slow down considerably in the final quarter. Fed Holds Rates Steady The Federal Reserve held rates steady at between 5% and 5.25% in December for the third consecutive time, as widely expected. The move signals that the Fed believes inflation is under control and borrowing costs are now high enough to keep it that way. Estimates show they expect a total of three rate cuts in 2024, with cuts beginning in the second half of the year. Rates currently remain at the highest level in 22 years. Projections for 2024 Policymakers closed out the year with a fresh crop of economic projections, outlining their expectations for rates, inflation, the unemployment rate and overall growth. Those estimates showed three rate cuts in 2024. Officials stuck to previous estimates that the unemployment rate will rise slightly in 2024 to 4.1% and expect inflation to slow over the coming 12 months while not quite hitting the Fed’s target of 2.0%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|