|

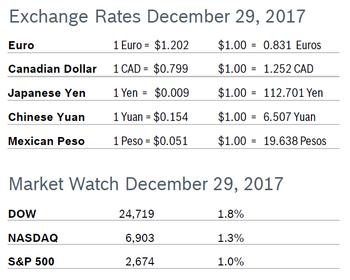

All three indexes posted strong gains for December and recorded their best years since 2013, with the DOW reaching 71 new record highs during the year. The DOW rose 1.84% for the month and 25.2% for the year, closing at 24,719; the tech-heavy NASDAQ rose 1.3% for the month and 28.2% for the year, closing at 6,903 and the S&P, the index most closely followed by economists, rose 0.1% for the month and 19.5% for the year, closing at 2,674. Consumer Confidence Slips to 122.1 The New York-based Conference Board’s Consumer Confidence Index slipped to 122.1 in December after rising to a downwardly revised 128.6 in November. Despite the downward revision, the November reading remained the highest level of consumer confidence in almost 17 years. The Present Situation Index edged up to 156.6 from an upwardly revised 154.9 in November and reached the highest level since 2001.The Expectations Index fell to 99.1 from a downwardly revised 111 in November. The Conference Board noted that despite the decline the level of confidence remains historically high among consumers, and they are generally upbeat about the future. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.6% Consumer spending rose 0.6% in November after rising a downwardly revised 0.2% in October. Core consumer spending rose 0.4% in November after rising 0.1% in October. Personal incomes rose 0.3% in November following a 0.4% increase in October. Wages rose 0.4% and the savings rate dropped to a 10-year low of 2.9% as consumers dipped into savings to finance robust consumer spending. The Federal Reserve's preferred inflation measure, the personal consumption expenditures (PCE) price index excluding volatile food and energy prices, rose 0.1% in November after gaining 0.2% in October. The core PCE price index was up 1.5% in the 12 months through November, picking up from 1.4% in October. It has undershot the Fed's 2% target since mid-2012. Shipments of non-defense capital goods orders excluding aircraft, which is a closely watched proxy for business spending and calculates into GDP, rose 0.3% after surging 1.3% in October. Core capital goods shipments have risen every month since last February, the longest stretch of increases since the series started in 1992. Consumer spending is closely watched by economists because it accounts for 70% of U.S. economic activity. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in November after rising 0.1% in October. The CPI was up 2.2% from November 2016. Core inflation, which excludes food and energy, rose 0.1% in November after rising 0.2% in October and was up 1.7% year over year. Core inflation has consistently been below the Fed’s target of 2%. Inflation was held down by weak healthcare costs and prices for airline fares, household furnishing and apparel also fell. Energy prices rose 3.9%. Unemployment Remains at 4.1% The unemployment rate remained at a 17-year low of 4.1% for the third consecutive month in December and the economy added 148,000 new jobs. Job gains for October were revised down and gains for November were revised up; the revisions resulted in a net gain of 9,000 fewer jobs than first reported. After revisions, job gains have averaged 204,000 over the last 3 months. Construction added 30,000 jobs in December, with most of the increase among specialty trade contractors (+24,000). In 2017, construction employment increased by 210,000, compared with a gain of 155,000 in 2016. Employment also increased in manufacturing. Employment in many other sectors was relatively unchanged. Employment in retail fell by 20,300 in December despite a strong holiday shopping season. It was the biggest drop in retail employment since March 2017. Average hourly earnings rose 0.3%, or 9 cents, lifting the annual increase in wages to 2.5% from 2.4% in November. For all of 2017, the economy created 2.1 million jobs, below the 2.2 million added in 2016. Economists expect job growth to slow this year as the labor market hits full employment, which will most likely boost wage growth as employers are forced to compete for workers. Durable Goods Orders Rise 1.3% Durable goods orders rose 1.3% in November after dropping 0.4% in October, which was significantly better than the 0.8% decline first reported. Orders were below economists’ expectations of a 2% gain. The increase was driven by a jump in orders for civilian aircraft, a typically volatile category. Excluding the volatile transportation category, durable goods orders fell 0.1% in November after rising by 0.4% in October. Orders for non-defense capital goods excluding aircraft, a closely watched indicator of business spending, fell 0.1% in November after falling 0.5% in October. Shipments in the same category, which factor into GDP, rose 1.0% in November. Shipments of core capital goods have now risen for ten consecutive months. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Rises to 67.6 The Chicago Purchasing Managers’ Index (PMI) rose to 67.6 in December after falling to 63.9 in November. The index closed out the year at the highest level since March 2011. It was the lowest level for the index in three months. The New Orders component reached a three-and-a-half year high. Order Backlogs also grew, and the Production indicator rose to the highest level in 34 years. In December, firms were asked to predict how both their business and the US economy would fare in 2018. Just over 50% thought that their company would grow between 0% and 5% while 37% forecast growth between 5% and 10% and the remaining 12% expected growth above 10%. As far as the US economy goes, 61% of firms responding thought the economy would grow somewhere between 2% and 5% in 2018 while 29% of businesses put growth between 0% and 2%. Only 6% of businesses saw the economy contracting in 2018, while the remaining 5% thought economic growth would be above 5%. Wholesale Prices Rise 0.4% The Producer Price Index (PPI) rose 0.4% in November after rising by the same amount in both October and September and was up 3.1% from November 2016. Core inflation, which excludes volatile food, energy and trade services prices, also rose 0.4% in November after two consecutive months of 0.2% increases. The core CPI was up 2.4% from November 2016. The broad rise in producer prices supports views that weak inflation readings experienced throughout the first half of the year were most likely temporary. The PPI for inputs to construction was up 4.8% year over year. The PPI shows that inflation is building in the pipeline and a stronger dollar and better global growth could cause core PPI to rise in coming months, according to economists. Q3 GDP Rises 3.2% GDP growth for the third quarter was revised down slightly, from 3.3% to 3.2% in the final reading in late December. The economy grew 3.1% in the second quarter. The slight downgrade reflected slightly lower consumer spending in the quarter than was previously estimated. Consumer spending was revised down to a still solid 2.2%. Economists said the slight revision does not change the outlook that the third quarter was strong, especially considering the series of hurricanes that were a drag on growth. Economists were particularly encouraged by the gain in business fixed investment spending, which jumped 10.8% in the quarter, the largest gain in three years. Economists expect growth to slow to 2.5% in the fourth quarter, although some are revising estimates upwards based on strong retail sales in November. The price index for personal consumption expenditures (PCE), which is the Fed’s preferred measure of inflation, rose at a 1.5% annual rate in the third quarter, up from the second quarter’s increase of 0.3%. Repairs and rebuilding could boost economic growth in coming quarters. Job Openings Little Changed Job openings edged back to 6.0 million in October after reaching 6.09 million in September. While job openings are still near record highs, Wells Fargo notes that the leveling off in recent months suggests that the pace of hiring could moderate in the months ahead. The number of unemployed workers per job opening remained at 1.1, which is the lowest level since the series began in 2001.Turnover improved in October as effects from the hurricanes faded, with gross hiring reaching a new cycle high of 5.55 million. Separations declined to a seven- month low as layoffs fell again. The number of workers quitting their job was unchanged in October, keeping the quit rate at 2.2%. The JOLTS report is expected to remain on of the Fed’s preferred economic indicators even though Fed Chair Janet Yellen’s term expires in February. Fed Raises Interest Rates The Federal Reserve raised interest rates a quarter of a percentage point to a range of 1.25% to 1.5% at their meeting in mid-December. The widely expected increase was the Fed’s third rate hike this year. The Fed’s forecast of three additional rate increases in 2018 and 2019 was unchanged from its projections in September. The news was announced at Fed Chair Janet Yellen’s last press conference before her term ends in February. She told assembled reporters that the Fed envisions a burst of growth, ultra-low unemployment below 4% for both 2018 and 2019 and continued low interest rates, with little forward movement on inflation, which continues to run below the Fed’s benchmark of 2%. In justifying the rate increase, the Fed cited solid economic growth and job gains. Tax Cuts and Jobs Bill Passes The House and Senate passed the first tax reform bill since the 1980s just before Christmas. The sweeping changes to the tax code will impact all Americans as well as companies that do business in America. The measure passed largely along party lines, with 12 Republican members of the House, all from states with high income and property taxes, voting against it. President Trump promised that virtually everyone would see lower taxes and higher take home pay in 2018. Among the provisions was a long-awaited tax cut for corporations which reduced the corporate tax rate from 35%, one of the highest rates in the developed world, to 21%. While individual tax cuts could expire in 2025, the corporate tax cut is permanent. After a lot of negotiations, the amount of state property, sales and income tax that can be deducted was limited to $10,000. The NAHB issued a statement of support for the bill, which will allow homeowners to deduct the interest paid on mortgage debt up to $750,000, which includes a primary home plus one other “qualified residence,” which could include a boat or a mobile home. Economic Forecast for 2018 Economists are predicting a benign “Goldilocks” economy, with sustained GDP growth in the US in the 2.25% to 2.75% range and manageable inflation in the US and worldwide, according to Pensions & Investments magazine. Protectionist trade policies by the US could be a potential disrupter. A major war in the Middle East would affect oil supplies and prices. Still, most economists think 2018 will be a continuation of 2017, although gains may not be as pronounced. Wage increases should rise in the US as the unemployment rate drops to 4%, according to Fitch. Economists are anticipating four separate rate increases of 25 basis points each this year. For the first time in about a decade all components of the MSI All Country World Index are in expansion mode, according to Cambridge Associates. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|