|

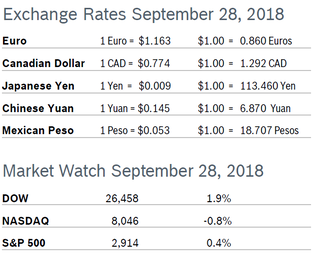

The major indexes turned in mix results for the month of September but finished out the third quarter with gains, with the S&P rising 7.2% and posting the best quarter since 2013. The NASDAQ gained 7.1% for the quarter and the DOW rose 9.3%. In September markets were tempered by worries about trade deals as investors try to assess how protectionist policies could impact the global economy and corporate profits. Consumer Confidence Rises to 138.4 The New York-based Conference Board’s Consumer Confidence Index rose to 138.4 in September after rising to an upwardly revised 134.7 in August, according to the Conference Board’s latest survey. It was the highest level of confidence since October 2000, and close to the index’ all-time high of 144.7 reached in October 2000. Analysts noted that to put that in perspective, confidence is lower than September’s reading 98% of the time. Consumers’ assessment of the current situation improved slightly and expectations for the future soared. The Present Situation Index rose to 173.1 after rising to an upwardly revised 172.8 and the Expectations Index jumped to 115.3 after rising to an upwardly revised 109.3. High levels of confidence should continue to support healthy levels of consumer spending. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.3% Consumer spending rose 0.3% in August after rising 0.4% in July. The increase was in line with economists’ expectations. Core consumer spending rose 0.2% after climbing 0.3% in July. Consumer spending is being driven by a tightening labor market that is starting to lead to wage and income growth, as well as high consumer confidence. Spending on goods rose 0.3% in August after rising an upwardly revised 0.5% in July. Spending on services rose 0.4% for the second consecutive month, with much of the increase due to healthcare spending. Personal income rose 0.3% after growing by 0.3% in July. Wages jumped 0.5% after rising 0.4% in July. Spending is being supported by a robust labor market and an economy at what is regarded as full employment. The savings rate was unchanged at 6.6%. The personal consumption expenditures (PCE) price index excluding food and energy was unchanged after rising 0.2% in July, leaving the annual core PCE price index at the Fed’s inflation target of 2.0% for the fourth time this year. The PCE has not been at target since 2012. Consumer Prices Rise 0.2% The Consumer Price Index (CPI) rose 0.2% in August after rising 0.2% in July. The CPI was up 2.7% over the past twelve months after being up 2.9% year over year in June and July. Core inflation, which excludes food and energy, rose 0.1% in August after rising 0.2% in July and was up 2.2% from August 2017, down from 2.4% in July. Both increases were below expectations. Increases in gasoline and rents were offset by declines in healthcare and apparel costs, and analysts noted that underlying inflation pressures appeared to be slowing. Wages adjusted for inflation rose just 0.1% in August and were up 0.2% over the past twelve months. Analysts believe the current expansion still has room to run, but no one is sure why the very hot labor market has not spurred income growth. Slow income growth has a tendency to dampen consumer spending. Unemployment Drops to 3.7% The unemployment rate fell to a lower-than-expected 3.7% in September and the economy added just 134,000 new jobs, well below expectations. However, job gains for August were revised up by 69,000 jobs, to a level of 270,000, and gains for July were revised up by 22,000. The unemployment rate was the lowest since 1969. Construction payrolls rose by 23,000 and manufacturing added 18,000 new jobs. Retail shed 20,000 jobs. Hurricane Florence may have affected the numbers for the month, as the Labor Department said that 299,000 people were not at work due to bad weather. The drop in unemployment reinforced market expectations for a fourth increase in interest rates by the Federal Reserve this year and at least three more increases in 2019. The economy needs to create about 120,000 new jobs each month to keep up growth in the working-age population. Average hourly earnings rose 0.3% in September after advancing a downwardly revised 0.3% in August. That dropped the annual increase in wages to 2.8% from 2.9% in August. Durable Goods Orders Rise 4.5% Durable goods orders rose 4.5% in August after falling an upwardly revised 1.2% in July. The increase in orders, which was more than twice what economists were expecting, was largely driven by a big jump in orders for commercial aircraft. Core durable goods orders for non-defense capital goods excluding aircraft, widely regarded as a key indicator of business spending, fell 0.5% after rising an upwardly revised 1.5% in July. Nondefense capital goods shipments, which factor into GDP, rose 3.0% in August after falling a downwardly revised 4.4% in July. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Falls to 60.4 The Chicago Purchasing Managers’ Index (PMI) fell to 60.4 in September after falling to 63.6 in August. It was the lowest level for the index in the past five months and only the second time the index has been down year over year since January 2017. Nevertheless, the PMI still indicates strong overall business conditions, with all key measures above their historic levels. Growth across Production and New Orders was solid, although Production was at a 6-month low and New Orders growth was the slowest pace in five months. Order Backlogs rose in September; healthy demand has left firms unable to fill all orders. About half the firms questioned thought that their delivery times would lengthen in the final quarter of the year and expect ongoing trade disruptions to continue to weigh on their suppliers. Wholesale Prices Fall 0.1% The Producer Price Index (PPI) fell 0.1% in August after being unchanged in July. The PPI was up 2.8% from August 2017, down from a 3.3% annual rise in July. Core producer prices, which exclude food, energy and trade services, also fell 0.1% in August after rising 0.3% in in both June and July. Core PPI was up 2.9% from August 2017, matching the record high of 2.9% reached in March of this year. Both the headline and core indexes were held down by the second consecutive monthly drop in the volatile “trade services” component, which measures profit margins for retailers and wholesalers, and dropped 0.1% in August after plunging 0.8% in July. Q2 GDP Grows 4.2% GDP growth of 4.2% in the second quarter was unrevised from the second reading and up from 4.1% in the first reading. Growth remained the fastest pace in nearly four years and puts the economy on track to hit the administration’s goal of 3.0% annual growth. Upward revisions to spending on residential structures and on nondurable goods like gasoline were offset by lower numbers for inventory investment. The economy expanded 3.2% in the first half of the year, with growth in the second quarter driven by the $1.5 trillion tax cut package, which boosted consumer spending after it threatened to stall earlier in the year. Consumer spending remained strong in the current third quarter, but the housing market continued to weaken. Job Openings Rise 1.7% The number of job openings increased 1.7% to 6.9 million in July, with US employers advertising the most jobs on record and the number of workers quitting their jobs hitting an all-time high of 3%, or 3.58 million people, according to the Job Openings and Labor Turnover Survey (JOLTS). Average hourly pay rose 2.9% in August compared to August 2017, the best annual gain since June 2009, when the Great Recession ended. Hires have outpaced separations in every month since August 2010. The JOLTS report is one of the Fed’s preferred economic indicators. Fed Raises Rates 0.25% The Federal Reserve Board raised interest rates 0.25% to a range of 2.0% to 2.25% at their regular meeting the end of September. The increase was approved by a unanimous vote of the Fed board, which said the economy had been growing at a “strong rate,” and also removed the word “accommodative” from the announcement. That means the short-term rate is approaching a more normal level after years of being kept very low to help the economy recover from the Great Recession. The Fed also confirmed they expect to make further gradual increases in rates. It was the third time the Fed has raised rates since Fed Chairman Jerome Powell took over from Janet Yellen in February. One more rate increase is widely expected this year. Fed officials also projected three more rate increases for 2019, which would bring the target rate to between 3% and 3.25% by the end of next year. Core PCE inflation has been very close to the Fed’s target of 2.0%. Economists say that Fed is closer than it has been in a long time to achieving the Fed’s dual mandate of maximum employment and stable prices. Trade Wars Intensify Both the US and China imposed new tariff hikes on each other’s goods in late September. US regulators went ahead with a planned 10% tax on a $200 billion list of 5745 Chinese imports. China responded by beginning to collect taxes of 5% to 10% on a $60 billion list of 5,207 American goods. China accused the US of bullying and being unwilling to compromise. Canada and US Reach Trade Agreement The US and Canada reached an agreement that will replace the North American Free Trade Agreement (NAFTA). The US had previously made a solo deal with Mexico. Canada is America’s second largest trading partner. Negotiations involved offering more market access to US dairy farmers, as well as Canada agreeing to an arrangement that effectively caps automobile exports to the US. The deal will also modernize what was covered by NAFTA by adding provisions on digital trade and intellectual property. The US and Canada issued a joint statement saying that the agreement will “strengthen the middle class and create good, well-paying jobs and new opportunities.” The plan is for the leader of all three countries to sign before the end of November, at which point the agreement will be submitted to Congress. One US official pointed out that it was an exceptionally enforceable trade agreement, and comes up for review every six years. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|