|

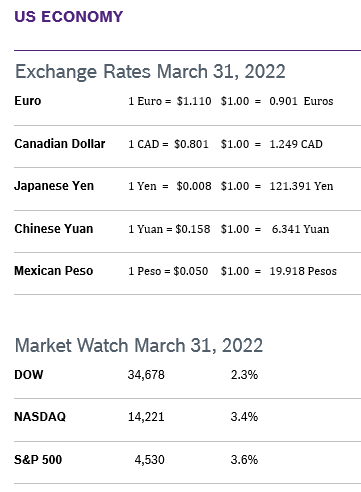

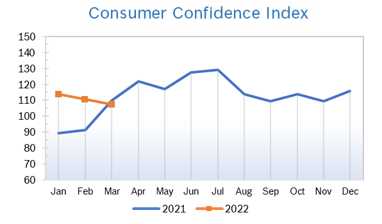

All three major indexes lost ground in the first quarter but finished the month of March in the black. Continued uncertainty about high energy prices, inflation and the impact of the Ukraine war weighed on markets all month, along with the Fed’s statements that despite the conflict, further interest rate hikes will be necessary to curb inflation. Consumer Spending Rises 0.2% Consumer spending rose just 0.2% in February after rising an upwardly revised 2.7% in January, up significantly from the 2.1% increase first reported. Spending on services jumped 0.9% as CV19 infections declined and demand for services like dining out, hotels, travel and entertainment rose. Spending on goods declined 1.0% after jumping 9.5% in January. Core consumer spending rose 0.4% after rising an upwardly revised 2.1% in January. Personal income rose 0.5% in February with wages rising 0.8% and the savings rate climbing to 6.3%. Consumer Prices Rise 0.8% The Consumer Price Index (CPI) rose 0.8% in February after rising 0.6% in January and was up 7.9% year over year. It was the largest year-over-year increase in forty years. Core inflation, which excludes the volatile food and energy categories, rose 0.5% in February after rising 0.6% in January and was up 6.4% year over year. Prices increased across most categories, with the price of gas up 38% from a year earlier. The core PCE, which omits volatile food and energy costs, rose 0.4% in February after rising 0.5% in January and was up 5.4% year over year, the sharpest annual increase in the core rate since 1983. The core PCE price index is the Fed's preferred measure for its 2% inflation target, which is now a flexible average. Consumer Confidence Rises to 107.2

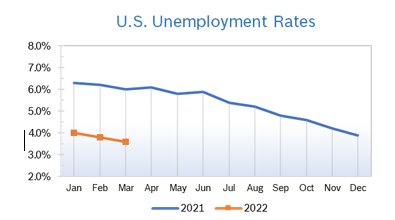

Unemployment Falls to 3.6%

Job Openings Fall Slightly Job openings fell slightly in February, dropping to 11.27 million jobs from an upwardly revised 11.28 million in January, according to the most recent Job Openings and Labor Turnover Survey (JOLTS). Openings have topped 10 million for eight straight months. The tight job market means wage pressures and inflation will persist, although the war in Europe and plunging stock prices may slow down demand. Hiring jumped by 263,000 jobs after inching up in January but was nearly a million jobs below February 2021 numbers. The quit rate remained high, but the number of small businesses planning to hire over the next six months has fallen from 32% to 19%. Hourly earnings were unchanged in February. The job market remains exceptionally tight, with employers offering bonuses to new hires as well as incentives to keep current employees. Chicago PMI Rises to 62.9 The Chicago Purchasing Managers Index (Chicago PMI) rose to 62.9 in March after falling to 56.3 in February. It was the 21st consecutive month the index remained in positive territory. The reading was well above expectations. A PMI number above 50 signifies expanded activity over the previous month. The increase reversed a downward trend that started last May, when scarcity of supply amid booming demand began having an impact. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.8% The Producer Price Index rose 0.8% in February after rising an upwardly revised 1.2% in January and was up 10% year over year, the third consecutive record-setting monthly increase. Core inflation, which excludes the volatile food and energy categories, rose 0.2% in February after rising 0.8% in January and was up 8.4% from February 2021. It was the biggest monthly gain in the price of goods since data going back to 2009, with two-thirds of the increase due to rising energy prices. Q4 GDP Revised to 6.9% Economic growth for the fourth quarter was revised back down to 6.9% after being revised up to 7.0%. This was the third and final reading from the Commerce Department. Consumer spending grew 2.5% rather than the 3.1% previously estimated. Exports also fell more than first reported. Inventory restocking added nearly 6% to Q4 figures; that is expected to have slowed considerably in the first quarter. For all of 2021, GDP grew 5.7%, the fastest rate of growth since GDP surged 7.9% in 1984 in the aftermath of a severe recession. Many economists predict that Q1 GDP growth will slow to less than 1.0% before rebounding and growing a healthy 3% to 4% this year. Fed Raises Interest Rates 0.25% The Federal Reserve raised interest rates by a quarter percentage point to a range of 0.50% - 0.75% and signaled they expect a total of seven rate hikes this year to help get inflation under control. Later in the month Fed Chair Jerome Powell said that the Fed is prepared to be more aggressive if inflation does not go down as hoped, and could increase rates by more than 0.25% at some meetings. The Fed expects inflation to drop to about 4.3% by the end of the year, still well ahead of their goal of 2%. Seven rate increases is more than twice the number markets were expecting when the Fed released projections last December. Fed officials said that the invasion of Ukraine by Russia is causing tremendous economic and human hardship and the implications for the US economy are highly uncertain. Regardless, in the near term the war will most likely continue to create additional upward pressure on inflation and depress economic activity. The events in Ukraine upset several months of careful planning by the Fed, which is trying to cool down the economy without triggering a recession. Rising interest rates cool the economy because higher rates increase the costs associated with a wide range of lending as well as the types of investments businesses make to grow. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|