|

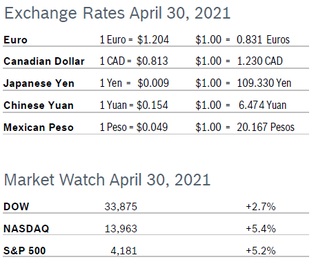

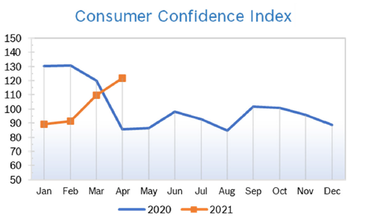

Despite a pullback the last week of the month, all three indexes closed out April with solid gains. Markets were encouraged by President Biden’s wide-ranging proposal to invest in America, the accelerating pace of vaccinations and progress toward reopening the country. Consumer Spending Rises 4.2% Consumer spending jumped 4.2% in March after falling 1.0% in February. It was the biggest increase in consumer spending in nine months. Consumer incomes surged a record-breaking 21.1% in March after falling 7% in February. The gain reflected the delivery of billions of dollars in relief payments with individuals getting up to $1,400 payments as well as a bump in wages. Consumers saved some of their windfall, with the savings rate rising to 27.6% from 13.9% in February. Excess household savings now totals around $2.3 trillion. Analysts believe consumers will start spending their savings as the country returns to more normal activities. The increase in spending reflected an 8.1% increase in the purchase of goods and a 2.2% rise in the purchase of services, a category that includes restaurant dining, entertainment and other activities affected by the pandemic. Consumer Prices Rise 0.6% The Consumer Price Index (CPI) rose 0.6% in March after rising 0.4% in February and was up 2.6% year over year. Core inflation, which excludes the volatile food and energy categories, rose 0.3% after being up 0.1% in February and was up 1.6% from March 2020. The year-over-year changes are distorted by the base effect. Many economic data points declined at the start of the pandemic amid lockdowns and widespread business closures. Compared to those depressed figures, the year-over-year increases will appear abnormally large. Nearly half the current increase was driven by a 9.1% jump in gas prices, which have been climbing due to increased demand, production problems following severe winter storms and production cuts by OPEC. The personal consumption expenditures (PCE) price index excluding the volatile food and energy component, increased 0.4% after edging up 0.1% in February and was up 1.8% year over year. The core PCE price index is the Fed's preferred inflation measure for its 2% target, which is now a flexible average. Consumer Confidence Rises to 121.7

Unemployment Rises to 6.1%

Job Openings Jump to Two-Year High US job openings jumped to a two-year high in February after rising substantially in January. Job openings rose by 268,000 to 7.4 million the end of February, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). This is up considerably from the pandemic low of under 5 million jobs. Job openings increased substantially in many of the industries that were hit hard by the pandemic, including recreation and foodservice. Demand for labor could increase further as more service businesses reopen. The CDC also issued new guidelines saying that fully vaccinated people can travel safely at low risk. Hiring in February rose by 273,000 to 5.7 million, the largest gain in nine month. The quits rate, which is regarded as an indicator of worker confidence, was unchanged at 2.3%, with 3.4 million people voluntarily quitting their jobs in February. There are still 8.4 million fewer Americans working than at the start of the pandemic, down from 9.5 million in January. There were 1.4 Americans per job opening in February, up from just 0.8 Americans pre-pandemic. The high level of openings is a signal firms are expecting the ambitious vaccination program to fuel economic reopening and further activity. Wells Fargo noted that due to the relatively small sample size, JOLTS may be painting a distorted picture, as data is coming from stronger businesses that have kept their doors open and are responding to the survey. JOLTS is a lagging indicator, but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 72.1 The Chicago Purchasing Managers Index (Chicago PMI) rose to 72.1 in April after rising to 66.3 in March. It was the highest level for the index since December 1983 and the tenth consecutive month the index remained in positive territory after spending a full year below 50. New Orders rose 9.9 points to a seven-year high and Production rose 0.9 points after jumping 10 points in March. Firms are reportedly overbuying in an attempt to deal with shortages of raw materials. Prices Paid jumped 11.9 points, rising for the eighth month in a row and hitting the highest level in 41 years. The special question for April asked if firms plan to expand their workforce over the next three months. The majority do, with 54.8% planning to add staff. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 1.0% The Producer Price Index rose 1.0% in March after jumping 0.5% in February. Prices were up 4.2% from March 2020, the largest year-over-year increase in the past twelve months. Core inflation, which excludes the volatile energy and food categories, rose a much higher than expected 0.7% in March and was up 3.1% year over year. Analysts noted that year-over-year inflation numbers will be higher going forward because of the year-over-year comparison to very low numbers caused by the pandemic as well as near-term pressures from supply chain bottlenecks. Q1 GDP Rises 6.4% GDP grew 6.4% in the first quarter as stimulus checks went out, vaccinations accelerated, states lifted restrictions and consumers stepped up spending. For all of 2020, the economy shrunk just 2.4%, well below initial forecasts. Consumer spending was fueled by federal payments of $1,400 or more to most households. In addition, many households have been able to save money during 2020 because people curbed eating out, traveling, recreation and entertainment. Economists expect economic growth to pick up further in the second quarter and remain steady in the second half of the year. Many forecasts call for GDP to grow between 6% and 7% this year, which would be the strongest performance since a 7.2% gain in 1984 when the economy was emerging from a deep recession. There are worker shortages in some service industries as people either stay home and collect unemployment or defect to industries like construction that pay higher wages than foodservice or retail. Fed Holds Rates Near Zero The Fed left its benchmark short-term interest rate near zero, where it’s been since the pandemic erupted nearly a year ago, to help keep loan rates down and encourage borrowing and spending. The Fed also commented that it would keep buying $120 billion in bonds each month to try to keep longer-term borrowing rates low. The Fed expressed a brighter outlook, saying the economy has improved along with the job market. The Fed noted that inflation has risen, but ascribed it to temporary factors. The Fed also signaled its belief that the pandemic’s threat to the economy has diminished, a significant point given Chair Jerome Powell’s long-stated view that the recovery depends on the virus being brought under control. In March, the Fed cautioned that the virus posed “considerable risks to the economic outlook.” Most economists say they detect the early stages of what could be a robust and sustained recovery, with coronavirus case counts declining, vaccinations rising and Americans spending their stimulus-boosted savings. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|