|

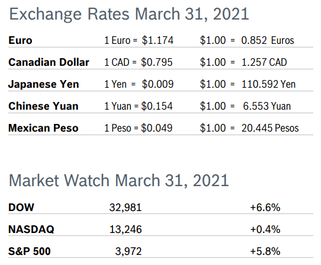

All three indexes closed out March in the black, with the DOW and the S&P 500 posting hefty gains. Markets responded well to the continuing rollout of CV19 vaccine and a $2.25 trillion infrastructure plan soon to be unveiled by President Biden. Economic forecasts for the year were all revised up. Markets were also up for the first quarter, with the DOW gaining 7.8%, the S&P 500 up 5.8% and the Nasdaq up 2.8%. Consumer Spending Falls 1.0% Consumer spending fell 1.0% in February after jumping an upwardly revised 3.4% in January. Personal income tumbled 7.1% after jumping 10.1% in January. Core consumer spending dropped 1.2% after rising 3.0% in January. Economists attributed the big drop to unusually harsh weather, particularly in Texas and other parts of the densely populated South, that depressed home building, production at factories, and orders and shipments of manufactured goods. Spending is expected to rebound in March as weather improved and stimulus checks began going out. Spending on goods fell 3.0% in February while spending on services edged up 0.1%. The personal consumption expenditures (PCE) price index excluding the volatile food and energy component rose 0.1% after rising 0.2% in January and was up 1.4% year over year. The core PCE price index is the Fed’s preferred inflation measure for what they have termed a “flexible average” of 2%. Consumer spending accounts for 70% of US economic activity. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in February after rising 0.3% in January and was up 1.7% year over year. Core inflation, which excludes the volatile food and energy categories, rose just 0.1% after being unchanged for the previous two months. Core inflation was up 1.3% over the past 12 months, down from a 1.4% year-over-year increase in January. The overall increase was the largest in six months and was once again driven by a sharp jump in gasoline prices, which have risen 19% since December. Wells Fargo expects inflation to firm up over 2021 as consumer spending rebounds during the second half of the year. Economists believe it will be quite some time before inflation returns to a steady pace consistent with the Fed’s target of 2%. Consumer Confidence Jumps to 109.7

Unemployment Falls to 6.0%

Job Openings Rise in January US job openings rose unexpectedly in January to 6.92 million in January after rising to 6.65 million in December, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). This is up considerably from the pandemic low of under 5 million jobs. Job openings increased in education, services and recreation. Total hiring fell slightly to 5.3 million in January from 5.4 million in December. The quits rate, which is regarded as an indicator of worker confidence, slipped to 2.3% in January from 2.4% in December. There are still 9.5 million fewer Americans working than at the start of the pandemic in March 2020. Openings were at the highest level in nearly a year, a signal firms are expecting the ambitious vaccination program to fuel economic reopening and further activity. Wells Fargo noted that due to the relatively small sample size, JOLTS may be painting a distorted picture, as response is coming from stronger businesses that have kept their doors open and are responding to the survey. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 66.3 The Chicago Purchasing Managers Index (Chicago PMI) rose to 66.3 in March after falling to 59.5 in February. It was the highest level for the index since July 2018 and the ninth consecutive month the index remained in positive territory after spending a full year below 50. New Orders rose 7.1 points and Production jumped 10 points. Prices Paid rose for the seventh month in a row, remaining at the highest level since 2018, with firms reporting higher prices for raw materials, especially steel. The special question asked if firms planned to alter their inventory plans; virtually all responded that they did, with 68% citing issues with supplier lead times and 43% noting logistics issues. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.5% The Producer Price Index (PPI) rose 0.5% in February after jumping 1.3% in January. Price increases slowed despite a 6% surge in energy and a 13.1% increase in gasoline costs in February. In the 12 months through January the PPI was up 2.8%, the largest year-over-year increase in the past twelve months. Core inflation, which excludes the volatile energy and food categories, rose 0.2% in February and was up 2.5% over the past 12 months. Analysts had expected the trend in inflation to remain subdued for some time but note that there are few indicators that inflation will rise enough to threaten economic growth any time soon. Q4 GDP Growth Revised Up to 4.3% GDP growth for the fourth quarter was once again revised up slightly to 4.3%, from an initial reading of 4% and a second reading of 4.1%, according to the third and final reading from the Commerce Department. Upward revisions reflected stronger inventory restocking by businesses. Economists now believe that all the government relief measures now in place will boost GDP in the first quarter to 5% or higher and are forecasting growth for the entire year between 6% and 6.5%, which would be the strongest performance since a 7.2% gain in 1984 when the economy was emerging from a deep recession. Fed Holds Interest Rates Near Zero The Fed repeated their pledge to hold interest rates near zero for years to come at their meeting in mid-March, while projecting a big jump in economic growth and a rise in inflation as the pandemic winds down and life returns to “normal.” The Fed now sees the economy growing 6.5% this year, which would be the largest annual jump in GDP since 1984. They expect unemployment to fall to 4.5% by the end of the year. This is compared to projections of 4.5% growth and 5% unemployment made in December, before the new stimulus growth package was passed. They also anticipate inflation will run a bit ahead of the target of 2% for the first time in a decade. Four of the Fed directors now expect to raise rates in 2022 and seven expect to raise them in 2023. The nation is still 9.5 million jobs short of pre-pandemic employment. Fed Chairman Jerome Powell made a point of stating that the improved outlook does not mean that the Fed will remove support for the economy. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|