|

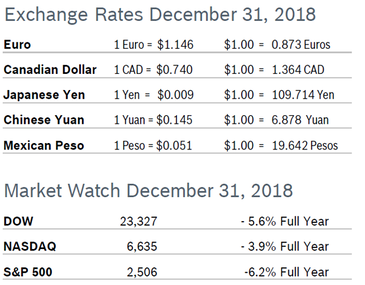

Major market volatility continued in December; instead of a Santa Claus rally, the markets all experienced a visit from the Grinch. All three major indexes finished the month of December as well as the year in the red. The S&P was down 6.2% for the year and the DOW dropped 5.6%, the biggest annual losses for both indexes since 2008, when they plunged 38.5% and 33.8%, respectively. The NASDAQ lost 3.9% in 2018, its worst year in a decade; it dropped 40% in 2008. For the fourth quarter, the DOW fell 12%, the S&P dropped 14%, the NASDAQ fell 17.5%. The “Christmas Eve Crash” that sent the DOW down 653 points came on the heels of phone calls from Treasury Secretary Steven Mnuchin to US banks; the unusual calls spooked investors and triggered a big sell-off. The DOW rallied December 26 and gained 1,086 points, its biggest one-day point gain in history, then dropped 400 points the next day. Market analysts are expecting markets to rally sometime during the first quarter provided as long as the government reopens, there is progress on trade issues and there are no big negative surprises. Consumer Confidence Falls to 128.1 The New York-based Conference Board’s Consumer Confidence Index fell to 128.1 in December after dropping to 135.7 in November, according to the Conference Board’s latest survey. The second consecutive monthly decline was most likely due to choppy and unpredictable financial markets and economic uncertainty both globally and at home. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, declined from 172.7 to 171.6. The Expectations Index, which is based on consumers’ short-term outlook for income, business and labor market conditions, fell from 112.3 in November to 99.1 in December. Despite the decline, confidence remains historically high, and analysts expect it to remain so during the coming year. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.4% Consumer spending rose 0.4% in November after rising an upwardly revised 0.8% in October. It was the ninth consecutive month that consumer spending increased. Personal incomes rose 0.2% in November after rising 0.5% in October. The savings rate dropped to 6%, a five-year low. The personal consumption expenditures (PCE) price index excluding food and energy edged up 0.1% from October and the annual core PCE price index was up 1.9%, still slightly below the Fed’s inflation target of 2.0%. Consumer Prices Unchanged The Consumer Price Index (CPI) was unchanged in November after rising 0.3% in October. The CPI rose 2.2% over the past twelve months, down from a 2.5% annual increase in October. Core inflation, which excludes food and energy, rose 0.2% in November after rising by the same percentage in October and was up 2.2% from November 2017 after being up 2.1% year over year in October. Gasoline prices fell 4.2% in November, although healthcare, food and owners’ equivalent rent all went up. Unemployment Rises to 3.9% The unemployment rate rose to 3.9% in December from 3.7% in November and the economy added a very robust 312,000 new jobs, well ahead of expectations of 190,000 new jobs. In addition, job gains for November were revised higher by 58,000 jobs. The rise in the unemployment rate was credited to more people entering the workforce and more people quitting their jobs. Construction payrolls rose by 38,000 after being unchanged in November. Manufacturing added 32,000 new jobs. Rising wages and weakening inflation increase real buying power and pull more people into the workforce. A total of 2.4 million new jobs were created in 2018 and wages rose 3.2% for the year. The economy needs to create about 120,000 new jobs each month to keep up with growth in the working-age population. Durable Goods Orders Rise 0.8% Durable goods orders rose 0.8% in November after plunging an upwardly revised 4.3% in October. Economists had forecast a 1.6% increase in orders. The increase was primarily driven by aircraft orders for both commercial and military aircraft. Core durable goods orders for non-defense capital goods excluding aircraft, widely regarded as a key indicator of business spending, fell 0.6% after being flat in October. Nondefense capital goods shipments, which factor into GDP, rose 2.4% in November after falling 0.6% in October. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Falls to 65.4 The Chicago Purchasing Managers’ Index (PMI) fell one point to 65.4 in December after jumping eight points to an 11-month high of 66.4 in November. Three of the five components dropped for the month, but solid gains in Production and Order Backlogs held the decline in the Index to a minimum. It was the 34th consecutive month the PMI was above 50, the level that indicates growth. Inflationary pressures continued to ease, with Prices Paid falling for the fifth consecutive month, and prices for steel and wood dropping. A vast majority of those surveyed about business growth for 2019 believed their business would expand, with 46.8% believing expansion would be below 5% and an equal percentage believing expansion would be between 5% and 10%. The remaining respondents believed their business would grow more than 10%. Virtually no one thought their business would decline in 2019. Shortages and tariffs continue to be a concern. Wholesale Prices Rise 0.1% The Producer Price Index (PPI) rose just 0.1% in November after rising 0.6% in October. The PPI was up 2.5% from November 2017. Core producer prices, which exclude food, energy and trade services, rose 0.3% in November after rising 0.2% in October and were up 2.7% from November 2017. Economists noted that the modest increase suggested that pipeline inflationary pressures were moderating, meaning there would be little risk of core consumer price inflation rising further over the next year or so. In the summer the 12-month rate had hit a seven-year high of 3.4%, fueling worries about inflation. The price of raw materials is now 0.7% lower than it was one year ago. However, it is possible that prices will rise if new tariffs go into place. Q3 GDP Growth Slows to 3.4% GDP growth slowed to 3.4% in the third quarter, according to the third and final reading from the Commerce Department. Growth was previously reported at 3.5% in both the first and second reading. The revision was due to downward revisions to consumer spending, which grew 3.5% rather than the 3.6% first reported and a further downward revision to exports. Inventories were revised upward from $86.6 billion to $89.8 billion, and added 2.3% to GDP growth, the biggest contribution since the fourth quarter of 2011. Consumer spending accounts for more than two-thirds of US economic activity. Job Openings Rise The number of job openings rose by 119,000 to 7.1 million in October after dropping to a downwardly revised 6.96 million in September, according to the Job Openings and Labor Turnover Survey (JOLTS). That lifted the job opening rate to 4.5% from 4.4% in September. In October hires edged up to 5.9 million, matching August’s high. Separations were little changed at 5.6 million. Within separations, the quits rate was little changed at 2.3% and the layoffs and discharges rate was unchanged at 1.1%. Hires have outpaced separations every month since August 2010. With 7 million job openings and only 6 million unemployed workers the job market is tight and employers have fewer options. The worker shortage appears to be more pronounced in the Midwest and Northeast. The JOLTS report is one of the Fed’s preferred economic indicators. Fed Raises Rates 0.25% The Fed raised interest rates 0.25% to a range of 2.25% to 2.5% at its regular meeting in mid-December after leaving them unchanged in November. The Fed forecast fewer rate hikes during 2019 than previously estimated. The Fed also slightly lowered its forecasts for real GDP growth in 2018 and 2019 to 3.0% and 2.3%% respectively, from 3.1% and 2.5% previously forecast. Fed Chairman Jerome Powell has promised to hold a press conference after all Fed meetings beginning in January 2019. Government Shutdown The US government partially shutdown at midnight on December 22, 2018. Some essential work, like mail delivery and law enforcement, is still being performed, but the shutdown has affected the operations of nine departments, including Homeland Security, Justice, State, Interior and Treasury, and several agencies, including the Environmental Protection Agency and NASA. Most of the work of the I.R.S. has stopped, with only 12% of the agency’s 80,000 employees working. All in all, about 800,000 government workers are feeling the effects. Less than half are on unpaid leave, while more than half are working without pay. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|