|

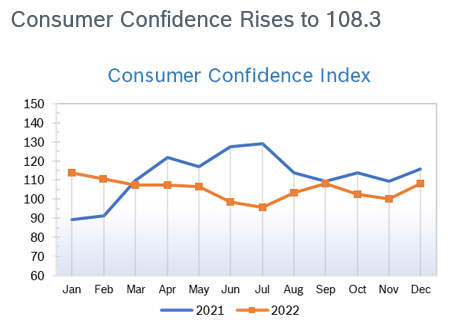

Stocks floundered in December and Santa Claus gave way to the Grinch as the markets turned in their worst year in a decade after three years of gains. The bear market was led by a dismal performance by the tech-heavy Nasdaq. Market watchers are hoping for a mild recession in the first half of 2023 that will encourage the Fed to begin cutting interest rates and spur a market rally in the second half. Consumer Spending Rises 0.1% Consumer spending edged up 0.1% in November and spending for October was revised up from 0.8% to 0.9%. Economists had forecast consumer spending would rise 0.2% in November. Some of the moderation in spending last month reflected a shift of demand from goods to services. Slowing price increases for some goods also lowered the dollar amount of consumer spending. Spending on goods fell 1.0%, led by declines in purchases of motor vehicles and falling gas prices. Outlays on services increased 0.7%, lifted by housing and utilities as well as financial services and insurance. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose just 0.1% in November after rising 0.4% in October and 0.6% in September and was up 7.1% year over year after being up 7.7% year over year in October. Core inflation, which excludes the volatile food and energy categories, rose 0.2% in November after rising 0.3% in October and 0.6% in September and was up 6.0% year over year. It was the smallest monthly increase in core inflation since August 2021. Both numbers were well below expectations. Gas prices are coming down but food and rents are still on the rise. Personal income rose 0.4% in November after jumping 0.7% in October. The saving rate rose to 2.4% in November from 2.2% in October. The saving rate was as high as 26.3% in March 2021. It is now near levels seen during the 2007-09 Great Recession. Core PCE rose 0.2% after increasing 0.3% in October and was up 4.7% from November 2021, down from 5% in October and the smallest increase since October 2021.

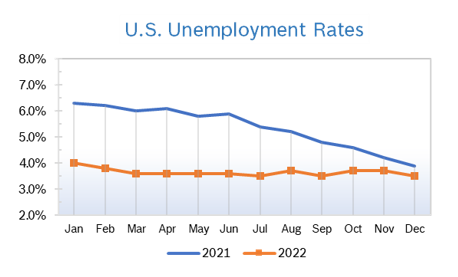

Unemployment Falls to 3.5%

Chicago PMI Rises to 44.9 The Chicago PMI rebounded in December and rose more than seven points to 44.9 after dropping sharply to 37.2 in November. The increase was greater than expected but still left the index below the level that signifies expansion. Economists had expected the PMI to rise into the 40+ range. A PMI number above 50 signifies expanded activity over the previous month; readings below 50 signify contraction. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.3% The Producer Price Index (PPI) rose 0.3% in November after rising an upwardly revised 0.3% in October, slightly above the estimate of a 0.2% increase. Stripping out volatile food and energy prices, core PPI rose 0.4% from October and was up 7.4% year over year in November, down from the revised 6.8% increase in October. The PPI peaked at a whopping 11.7% year-over-year increase in March. Q3 GDP Rises 3.2% Q3 GDP rose an upwardly revised 3.2%, according to the third and final reading from the Commerce Department. Upward revisions in consumer and business spending accounted for much of the revised growth. Residential investment contracted for the sixth consecutive quarter. Rapidly rising mortgage rates contributed to residential investment plunging by more than 26% in Q3. Residential investment has declined by more than 15% since peaking in early 2021. Fed Raises Rates 0.5% The Fed raised interest rates by 0.5% in mid-December to a range of 4.25% to 4.5%, the highest level since 2007. Comments by Fed Chair Jerome Powell suggested that rate hikes would continue in 2023 as part of their efforts to return inflation to their target of around 2%. The 0.5% increase was a slowdown from the four consecutive 0.75% increases that preceded it. The Fed has now raised rates by a total of 4.25% this year. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|