|

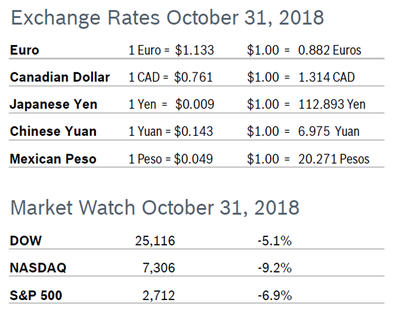

The month of October was extremely volatile, with the markets reacting badly to corporate earnings and continued worries about an escalating trade war with China. All three indexes finished the month in the red, with the S&P posting the biggest monthly lost since 2011 and the NASDAQ turning in the worst monthly performance since November 2008. The DOW fell 5.1% to 25,116, the tech-heavy NASDAQ dropped 9.2% to 7,306 and the S&P, the index most watched by economists, fell 6.9% to 2,712. Analysts noted that there is not a real long-term reason for the markets decline; in actuality, earnings are generally good or there is some optimism that there could be a breakthrough on trade. Market experts note that a sharp drop that comes out of the blue is generally a sign of a market correction; a bear market usually rolls out more slowly. Consumer Confidence Rises to 137.9 The New York-based Conference Board’s Consumer Confidence Index rose to 137.9 in October after rising to a downwardly revised 135.3 in September, according to the Conference Board’s latest survey. It was the highest level of confidence since October 2000, and close to the index’ all-time high of 144.7 reached in October 2000. The Present Situation Index rose to 172.8 from a downwardly revised 169.4 and the Expectations Index rose to 114.6 from a downwardly revised 112.5. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Increases 0.4% Consumer spending rose 0.4% in September after rising 0.3% in August. It was the seventh consecutive month that consumer spending increased. Core consumer spending rose 0.3% after rising 0.2% in August. Higher interest rates and falling household wealth after the sharp pullback in the stock market are casting doubts on the resiliency of consumer spending going forward. Spending on goods surged 0.6% in September after rising 0.3% in August. Spending on services rose 0.3% after rising 0.4% for the previous two months. Personal incomes rose 0.2% in September after rising 0.3% in August. Wages rose 0.2% after jumping 0.5% in August. The savings rate fell to the lowest level since December 2017. The personal consumption expenditures (PCE) price index excluding food and energy rose 0.2% in September after being unchanged in August, leaving the annual core PCE price index at the Fed’s inflation target of 2.0% for the fifth time this year. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose just 0.1% in September after rising 0.2% in both August and July. The CPI was up 2.3% over the past 12 months, after being up 2.7% in August and 2.9% year over year in June and July. The modest price increases were due to rents rising more slowly and energy prices falling. Core inflation, which excludes food and energy, rose 0.1% in September after rising 0.1% in August and was up 2.2% from September 2017. Inflation is close to the Fed’s target of 2.0%, and the slowdown in acceleration relieved fears that the Fed would move to increase interest rates more quickly than expected. Wages adjusted for inflation rose just 0.1% in August and were up 0.2% over the past twelve months. Analysts believe the current expansion still has room to run, but no one is sure why the very hot labor market has not spurred income growth. Slow income growth has a tendency to dampen consumer spending. Unemployment Remains at 3.7% The unemployment rate remained at 3.7% in October and the economy added 250,000 new jobs, well ahead of expectations. However, job gains for September were revised down from 134,000 to 118,000. The unemployment rate remained unchanged at the lowest level since 1969 despite strong job creation because the labor force rose by 771,000 during the month. Job gains were broad-based, with construction adding 30,000 new jobs, manufacturing adding 32,000 and retailers adding 2,400 following a steep decline of 32,400 in September. Both private and government payrolls increased. Average hourly earnings rose by 0.2%, bringing the year-over-year increase to 3.1%. Most analysts expect the Fed to raise rates by 0.25% at their last meeting of the year in December and continue to gradually raise rates in 2019. The economy needs to create about 120,000 new jobs each month to keep up growth in the working-age population. Durable Goods Orders Rise 0.8% Durable goods orders rose 0.8% in September after rising an upwardly revised 4.6% in August. Economists had forecast a 1.9% decrease in orders. Headline orders were boosted by a 119.1% surge in defense aircraft. Over the past year, durable goods orders are up 6.5%, reaching the second-highest level on record. Core durable goods orders for non-defense capital goods excluding aircraft, widely regarded as a key indicator of business spending, fell 0.1% in September after falling 0.5% in August but are up 6.6% over 2017. Despite the overall growth, core capital goods orders have been essentially flat for the past two months. Concerns over trade policy and global economic growth may be causing some companies to defer investment. Nondefense capital goods shipments, which factor into GDP, stalled out after rising 3.0% in August. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Drops to 58.4 The Chicago Purchasing Managers’ Index (PMI) fell to 58.4 in October after falling to 60.4 in September. It was the lowest level for the index in the past six months and the third consecutive monthly decline. The decline left the PMI down 10.7% from October 2017, the biggest year-over-year fall since December 2015. However, the PMI is still above its five-year average, and analysts pointed out that the decline may simply be a reversion to more normal levels after 12 months of very strong performance. New Orders fell for the sixth time this year, settling at the lowest level since January 2017. Output rose slightly, and Order Backlogs dropped. Prices Paid remained elevated, indicating continuing input pressure. Shortages and tariffs are expected to continue to push some prices higher. Wholesale Prices Rise 0.2% The Producer Price Index (PPI) rose 0.2% in September after falling 0.1% in August. The PPI was up 2.7% from September 2017, the smallest increase since January. Core producer prices, which exclude food, energy and trade services, also rose 0.2% in September and were up 2.5% from September 2017. There were some signs of rising costs; transportation and warehousing prices rose 1.8%, the largest monthly gain in nearly nine years. However, the increase was primarily driven by higher prices for airline tickets, which jumped 5.5%. Q3 GDP Rises 3.5% GDP growth slowed to 3.5% in the third quarter after growing 4.2% in the second quarter. Results exceeded economists’ expectations of 3.2% growth. A surge in inventory investment and solid government and consumer spending balanced a tariff-related drop in soybean exports, declining residential investment and stagnant business spending. Farmers front-loaded shipments to China before the first round of tariffs took effect in early July, which boosted second quarter growth. Since then, petroleum, nonautomotive capital goods and soybean exports have dropped every month. The widening trade gap trimmed 1.78% from GDP growth in the third quarter. Inventories increased $76.3 billion after declining $36.8 billion in the second quarter, so inventory investment added 2.1% to GDP growth after subtracting 1.1% in the second quarter. The GDP report also showed that the Fed’s preferred inflation gauge, the personal consumption expenditures price index excluding food and energy, (PCE) rose 1.6% in the third quarter after climbing 2.1% in the second quarter. Consumer spending, which accounts for more than two-thirds of US economic activity, rose 4.0% in the third quarter after rising 3.8% in the second quarter. Economists warned that headwinds for the economy are growing, with business spending on equipment falling to 0.4% after rising at a 4.6% pace in the second quarter. Businesses are struggling to find workers and import tariffs are increasing manufacturing costs, which will eventually result in higher costs for consumers on everything from televisions and major appliances to luggage. Higher interest rates are also pressuring the housing market, which contracted in the third quarter. Job Openings Hit Record High The number of job openings increased 4.6% to a record-high 7.14 million in August after climbing to 6.9 million in July, according to the Job Openings and Labor Turnover Survey (JOLTS). Hiring increased to a record high 5.78 million in August from 5.71 million in July. The quits rate was unchanged at 2.4%; 3.58 million Americans quit their jobs, down slightly from 3.61 million in July. Job postings exceeded the number of unemployed people by 902,000 in August and there were 0.9 unemployed persons per job opening, compared with 1.9 people when the recession began at the end of 2007. Openings increased in many sectors, including construction and business services, but fell in state and local government. In the 12 months through August the economy created a net 2.4 million jobs. Hires have outpaced separations every month since August 2010. The JOLTS report is one of the Fed’s preferred economic indicators. GDP Forecasts GDP in 2019 will be slightly lower than this year’s, according to the 51 economists and business professionals surveyed by the National Association for Business Economics (NABE). The forecasters predict 3.1% growth for the full year of 2018 and 2.5% growth next year. The expectation for lower growth is based on worries about trade and moderately increased inflation forecasts. The survey was completed in mid-September and did not reflect the trade accord reached between the US and Canada at the end of September. S&P Global Ratings also trimmed forecasts for US growth, and now expects GDP to expand 2.9% this year and 2.3% in 2019, down from the respective 3.0% and 2.5% growth forecast in June. S&P ranked trade and investment interruption as the top global risk and said the possibility of an all-out trade war between the US and China weighed on projections. Fed Striving for Interest Rate Neutral The Federal Reserve has a “little bit more to go” before interest rates will reach a level where they will neither stimulate nor restrain economic growth, according to Chicago Fed President Charles Evans. Evans believes “neutral” rates to be between 2.7% to 3.0%. He said the economy is doing “extremely well,” and inflation is only expected to rise a few tenths of a percent above its current 2.0% level. USPS Announces Rate Increases The US Postal Service (USPS) wants to broadly increase the price of sending mail and packages, with requested price changes expected to take effect January 27, 2019. The Postal Regulatory Commission (PRC) is expected to approve the increases, which will raise the price of a Forever stamp from the current fifty cents to fifty-five cents. Flat rate package prices will also go up, as will the price of metered mail. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|