|

The year got off to a turbulent and rocky start for all three indexed, with both the tech-heavy Nasdaq and the S&P 500, the index most closely followed by analysts, notching their worsts months since March 2020 at the beginning of the pandemic. Markets are pricing in at least five quarter-point increases in interest rates from the Fed. Heavy volume, big swings and uncertainty about what lies ahead all contributed to exceptional volatility. Consumer Spending Falls 0.6% Consumer spending fell 0.6% in December after rising 0.6% in November. It was the first decline in consumer spending in ten months but was slightly less than expected. However, core consumer spending fell 1.0%. Personal incomes, which fuel consumer spending, jumped 7.3% in 2021 owing to rising wages and massive government stimulus spending for individuals and families. Consumer spending is expected to grow a more modest but still solid 3.5% this year. Consumer Prices Rise 0.5% The Consumer Price Index (CPI) rose 0.5% in December after rising 0.8% in November and was up 7.0% year over year, the largest year-over-year increase in thirty years. Core inflation, which excludes the volatile food and energy categories, rose 0.6% in December after rising 0.5% in November and was up 7.0% year over year, the biggest increase since 1982. Prices increased across most categories, with big jumps in groceries, gasoline, energy costs, new and used vehicles, furniture, apparel, appliances and rent. Adobe reported that online prices rose 3.1% year over year and were up 0.8% from November. A narrower measure of inflation that omits volatile food and energy costs, known as the core PCE, rose by 0.5% in December, matching forecasts, after increasing 0.6% in November. The increase in the core rate in 2021 totaled 4.9%, compared to a mild 1.5% gain in the prior year. That’s the highest annual level since 1982.The core PCE price index is the Fed's preferred measure for its 2% inflation target, which is now a flexible average. Consumer Confidence Falls to 113.8

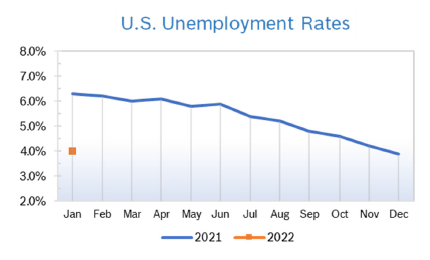

Unemployment Rises to 4.0% Job Openings Drop The number of job openings decreased to 10.6 million in November, according to the most recent Jobs Openings and Labor Turnover Survey (JOLTS) from the U.S. Bureau of Labor Statistics. Hires were little changed at 6.7 million and total separations increased to 6.3 million. Within separations, the quits rate increased to 3.0%, matching a series high last seen in September. The layoffs and discharges rate was unchanged at 0.9%. Jobs openings decreased in November to 10.6 million from 11.1 million in October. The number of job openings were up 56% year-over-year. Quits were up 37% year-over-year. Demand remains high and businesses continue to report that finding qualified workers is very challenging. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 65.2 The Chicago Purchasing Managers Index (Chicago PMI) rose to 65.2 in January after rising to an upwardly revised 64.3 in December. It was the 19th consecutive month the index remained in positive territory. Results were well ahead of expectations. A PMI number above 50 signifies expanded activity over the previous month. While remaining in positive territory, the index has been on a downward trend since last May, when scarcity of supply amid booming demand began having an impact. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.2% The Producer Price Index rose 0.2% in December after jumping an upwardly revised 1.0% in November and was up 9.7% year over year, the highest increase since the federal government started tracking this data in 2010. The moderation in price increases was due to a 3.3% drop in energy prices. Core inflation, which excludes the volatile food and energy categories, rose 0.5% in December after rising 0.8% in November and was up 8.3% from December 2020. The slowdown in December reflected declining prices for gasoline and food; the price of services went up. Q4 GDP Grows 6.9% The economy grew 6.9% in the fourth quarter after growing 2.3% in the third quarter, according to the first reading from the Commerce Department. It was the fastest pace of growth since 1984 and much better than expected but is not likely to be repeated in the immediate future. Inventory stockpiling contributed 4.9% to headline growth as retailers stocked up for the holiday season and businesses pulled out all the stops to source needed inventory. That means inventories probably won’t give the first quarter a boost as originally anticipated. Despite the Omicron variant aggravating already severe supply chain issues at the end of last year, business fixed investment rose at a 2% annualized pace in the fourth quarter. There was strong spending on intellectual properties including software and research and development. Spending on equipment was also strong. All told, the economy grew at essentially double its expected growth rate. Fed Holds Interest Rates The Fed made no major policy moves at their meeting in January, leaving interest rates at 0.00% to 0.25%. However, the Fed signaled that with inflation running well above 2% and the labor market and economy strong it would soon be time to start raising rates. Analysts expect a 0.25% rate increase at their next meeting in March and a total of seven 0.25% rate increases by the end of 2023. The Fed will also continue to "taper" purchases of Treasury securities and mortgage-backed securities (MBS) by $20 billion and $10 billion respectively per month, which means that asset purchases will end in March. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|