|

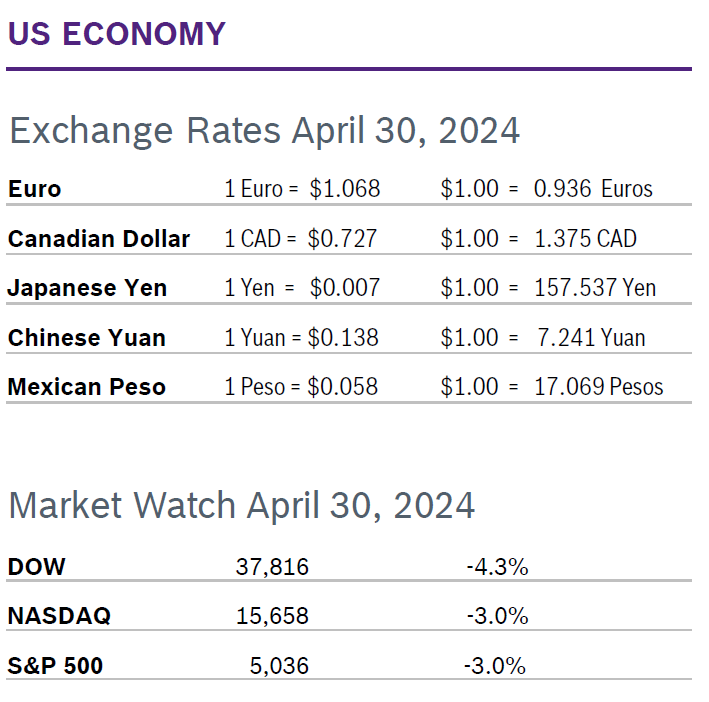

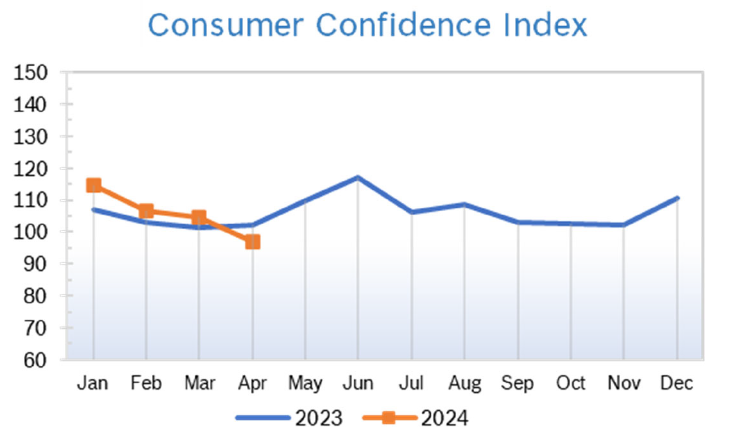

Stocks ended a five-month winning streak in April, with all three indexes finishing out the month in the red after the biggest monthly decline since September 2022. Markets were concerned about rising labor costs, deteriorating consumer confidence, higher than expected inflation, pending earnings and interest rates. Consumer Spending Rises 0.8% Consumer spending rose a solid 0.8% for the second consecutive month in March. Adjusted for inflation, real consumer spending rose 0.5% in March and spending for February was revised from a gain of 0.4% to 0.5%. Disposable household income after accounting for inflation and taxes rebounded 0.2% after slipping 0.1% in February. Consumers saved less and also tapped into savings. The saving rate fell to a 16-month low of 3.2% from 3.6% in February. But economists say they are not concerned, as the low savings rate reflects healthy household balance sheets and reasonable confidence in the future. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in March after rising 0.4% in February and was up 3.5% year over year. The increase was ahead of expectations. Core prices rose 0.4% for the third consecutive month and were up 3.8% year over year. Inflation was hotter than expected and dampened hopes for an interest rate cut. The core CPI inflation rate peaked at a 40-year-high of 6.6% in September 2022. The personal consumption expenditures (PCE) price index rose 0.3% in March, matching February’s gain; core PCE rose 0.3% in March after rising 0.3% in February and was up 2.8% year over year. Consumer Confidence Falls to 97

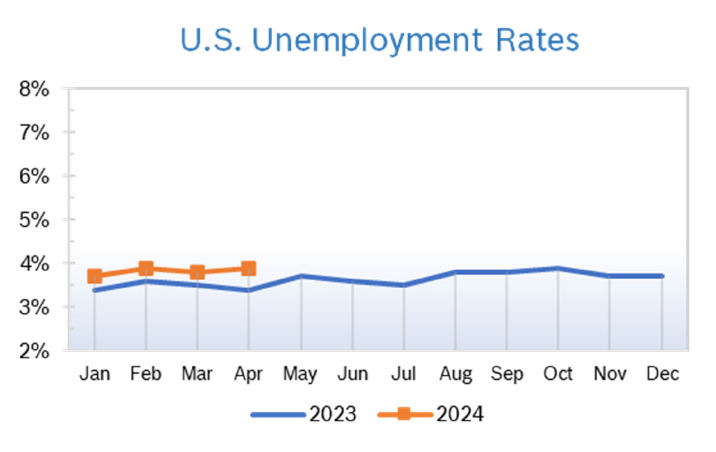

Unemployment Rises to 3.9%

Chicago PMI Falls to 37.9 The Chicago PMI fell to 37.9 in April after dropping to a seven-month low of 41.4 in March. Economists had expected the PMI to climb to 44.9. The Index has been below the break-even midpoint of 50 for the past 19 months. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.2% The Producer Price Index (PPI) rose 0.2% in March after rising 0.6% in February and was up 2.1% year over year, well below expectations. Stripping out volatile food and energy prices, core PPI rose 0.2% in March after rising 0.3% in February and was up 2.4% year over year, up from 2.0% for the previous two months. PPI peaked at an 11.7% year-over-year increase in March 2022. Q1 GDP Grows 1.6% First quarter 2024 GDP grew 1.6%, well below expectations of 2.4% growth and quite a slowdown from the 3.4% growth recorded in the fourth quarter of 2023. A surge in imports and businesses trimming inventories were responsible for much of the slowdown. Consumer spending, which accounts for more than two-thirds of US economic activity, grew 2.5% in the first quarter, down from 3.3% in the final quarter of 2023 and well below estimates of 3% growth. Spending patterns also shifted in the quarter. Spending on goods declined 0.4%, in large part to a 1.2% slide in bigger-ticket purchases for long-lasting items classified as durable goods. Services spending increased 4%, its highest quarterly level since the third quarter of 2021. However, in a bit of good news for the housing market, residential investment surged 13.9%, its largest increase since the fourth quarter of 2020. The personal consumption expenditures price index (PCE) rose 3.4%, its biggest gain in a year. Excluding food and energy, core PCE prices rose 3.7%. Both components were well above the Fed’s 2% target. Central bank officials tend to focus on core inflation as a stronger indicator of long-term trends. Analysts said the report showed higher-than-expected inflation and lower-than-expected growth, not a good combination. Fed Holds Rates Steady The Fed held interest rates at between 5.25% and 5.5% for the sixth consecutive meeting at their latest policy meeting May 1. Citing a lack of "further progress" in returning inflation to 2%, the FOMC voted unanimously to keep rates on hold for now. Analysts believe the Fed will need greater confidence that inflation is returning to 2% on a sustained basis before they feel comfortable lowering rates and consensus is that will not happen until the meeting in mid-September at the earliest. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|