|

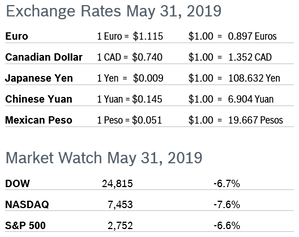

The markets all turned in their worst performances since January as looming new tariffs and an unexpected ultimatum to Mexico to stop illegal border crossings or face escalating tariffs that would threaten the recent trade deal with Mexico and Canada rattled investors and sent stocks plummeting. The Dow dropping 771 points during the last week of May, the sixth consecutive week of declines for the index. Consumer Confidence Rises to 134.1 The New York-based Conference Board’s Consumer Confidence Index rose to 134.1 in May after rising to 129.2 in April, according to the Conference Board’s latest survey. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, rose to 175.2 after rising to an upwardly revised 169.0 in April. The Expectations Index, which is based on consumers’ short-term outlook for income, climbed to 106.6 after rising to 103.0 in April. The Conference Board stated that consumers expect the economy to continue growing at a solid pace into the summer months, which should support consumer spending in the near-term. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.4% Consumer spending rose 0.4% in April and the increase for March was revised up to 1.1%. Core consumer spending was unchanged in April after rising 0.9% in March. Consumer spending was up 1.3% year over year in the first quarter, the slowest quarterly growth in a year. Personal income rose 0.5% in April after inching up 0.1% in March. Savings increased to $990.3 billion in April from $963.7 billion in March. Inflation pressures remained low, with the personal consumption expenditures (PCE) price index excluding the volatile food and energy components rising 0.2% in April after edging up 0.1% in March. In the 12 months through April, the core PCE price index increased 1.6% after being up 1.5% in March, well below the Fed’s preferred inflation reading of 2.0%. Consumer Prices Rise 0.3% The Consumer Price Index (CPI) rose 0.3% in April after rising 0.4% in March. The year-over-year CPI was up 2.0% in April, up from a 1.9% increase in March and 1.5% in February. Core inflation, which excludes food and energy, rose 0.1% for the seventh consecutive month. Core CPI was up 2.1% year over year, up from 2.0% in March. Unemployment Steady at 3.6% The unemployment rate held at a 49-year low of 3.6% in May but the economy added just 75,000 new jobs as hiring slowed significantly and was well below the 175,000 additional jobs forecast. Job gains for March and April were revised down by a net of 75,000 jobs. Since the start of the year, employers have added an average of 161,000 jobs compared to 223,000 in 2018. Wages were up 3.1% year over year in May, with wage gains stabilizing rather than accelerating in the tight labor market. The economy needs to create about 120,000 new jobs each month to keep up with growth in the working-age population. Durable Goods Orders Fall 2.1% Durable goods orders fell 2.1% in April after rising 2.7% in March. Orders ex transportation were steady after rising 0.4% in March. Core durable goods orders for non-defense capital goods excluding aircraft, widely regarded as a key indicator of business spending, fell 0.9%, nearly three times the decline expected, after rising a downwardly revised 0.3% in March. Nondefense capital goods shipments, which factor into GDP, were flat after falling a downwardly revised 0.6% in March. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Rises to 54.2 The Chicago Purchasing Managers’ Index (PMI) rose 1.6 points to 54.2 in May after dropping to 52.6 in April. New Orders increased for the first time in three months but did not rise enough to offset the drop in April. Production rose but remained significantly below the 12-month average. Order Backlogs fell into contraction for the second time this year. The contraction in Order Backlogs is evidence of lukewarm demand. The special question asked in May concerned the impact of supply side issues on business operations. About half of the respondents were unsure about the impact while 40% said they were adversely impacted by supply side issues, mentioning that tariffs and delays added to costs and made them less competitive. MNI Indicators noted that they expect business confidence to be weaker in Q2 than it was in Q1, but says conditions are still “not bad.” The PMI averaged 60.1 in the first quarter, down 3.5% from the fourth quarter and 3.3% from the first quarter of 2018. Wholesale Prices Rise 0.2% The Producer Price Index (PPI) rose a modest 0.2% in April after jumping 0.6% in March. The PPI was up 2.2% from April 2018. Analysts had expected prices to rise 0.3%. Core producer prices, which exclude food, energy and trade services, rose 0.4% in April after being flat in March and were up 2.2% from April 2018 after being up 2.0% in March 2018. Analysts noted that tame inflation reinforced the Fed’s decision to put off increasing interest rates. Q1 GDP Revised Down to 3.1% GDP growth was revised down to 3.1% for the first quarter from the 3.2% first reported, according to the second reading from the Commerce Department. Weaker business spending and a steeper drop in housing were behind the slight downward revision, which matched economists’ expectations. Consumer spending increased 1.3%, a slight upward revision from the 1.2% first reported. Residential construction dropped 3.5% rather that the 2.8% first reported. Inventory building has really boosted GDP, with the three largest quarterly inventory builds during the past three and a half year occurring in the past three quarters. Without the boost from inventories, GDP growth in Q1 would have been just 2.5%. Inflation, as measured by the personal consumptions expenditure index (PCE), fell to a 1.4% annual rate in the first quarter from 1.9% in the fourth quarter of 2018. Core PCE slipped to 1.7% from 1.9%, below the Fed’s target of 2.0%. Consumer spending accounts for more than two-thirds of US economic activity. Job Openings Rise 4.8% The number of job openings rose 4.8% in March to 7.5 million after dropping to 7.09 million in February, according to the most recent Job Openings and Labor Turnover Survey (JOLTS). There are now 1.2 million more open jobs than there are unemployed Americans. Total hiring has not increased as much as job postings have, which suggests that employers are struggling to fill jobs with qualified candidates. Job openings have gone up 8.6% in the past year, while total hiring in the JOLTS report has barely increased. In addition, the quits rate remains well above last year’s figure, although quits fell 1.1% in March to 3.4 million. The combination of many people quitting their jobs and rising numbers of job openings can create a climate in which employers feel forced to increase wages, improve benefits and try other tactics to attract and keep employees. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|