|

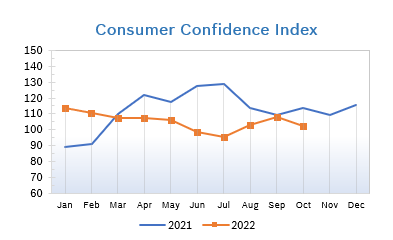

Stocks slid at the end of the month but still snapped a two-month losing streak. The Dow turned in its best monthly performance since 1976 and all three indexes recovered nicely from September’s bloodbath and posted positive results. The NASDAQ lagged behind a bit because tech stocks are taking a beating as online sales growth slows. Consumer Spending Rises 0.6% Consumer spending rose 0.6% in September after rising a downwardly revised 0.3% in August. The increase was about twice as much as economists expected. Core consumer spending rose 0.3% in September after rising 0.1% in August. Wages and salaries climbed 1.3% last quarter after rising 1.4% in the second quarter and were up 5.1% on a year-over-year basis after rising 5.3% in the prior quarter. Private sector wages rose 1.2%, down from a 1.6% jump in the second quarter. That lowered the annual increase in private industry wages to 5.2% from 5.7% in the second quarter. The saving rate fell to 3.1%, a 14-year low, signaling Americans are tapping into their savings rather than accumulating more. The saving rate was as high as 26.3% in March 2021. It is now near levels seen during the 2007-09 Great Recession. Consumer Prices Rise 0.6% The Consumer Price Index (CPI) rose 0.6% in September after creeping up just 0.1% in August was up 8.2% year over year after being up 8.3% in August. Core inflation, which excludes the volatile food and energy categories, rose 0.6% year over year in September after rising at the same rate in August. Increases in both the CPI and the core index were above expectations. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) price index, rose 0.3% in September and was up 6.2% year to date, in line with the August increase. After stripping out food and fuel, core PCE was up 5.1% over the past year after a 4.9% increase in August. Consumer Confidence Falls to 102.5

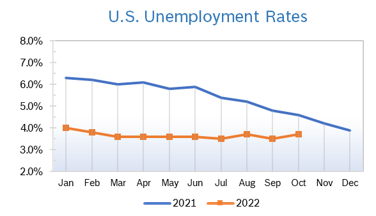

Unemployment Rises to 3.7%

Chicago PMI Falls to 45.2 The Chicago PMI fell slightly to 45.2 in October after dropping sharply to 45.7 in September. Economists had expected the PMI to rise into the 47+ range. A PMI number above 50 signifies expanded activity over the previous month. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.4% The Producer Price index (PPI) rose 0.4% in September after falling 0.1% in August and was up 8.5% year over year, down from 8.7% year over year in August. The increase, which was larger than expected, was pushed up by a big jump in the cost of services. Stripping out the volatile categories of food, energy, and trade services, the PPI increased by 0.3% in September after rising 0.2% in August and was up 7.2% year over year after being up 5.6% year over year in August. Q3 GDP Rises 2.6% Q3 GDP rose 2.6%, well above expectations, according to the first reading from the Commerce Department. GDP shrank 0.6% in the second quarter. The positive growth snapped two consecutive quarterly declines and raised questions about whether the economy had been in a mild recession. Growth came despite cooling consumer spending and rising interest rates. Inflation is denting some consumers' appetites for big-ticket purchases. Most Americans think it is a bad time to buy a car or large household goods such as furniture, refrigerators or stoves, with a large share attributing their viewpoint to high prices and the need to cut back on discretionary spending, according to a University of Michigan survey. Real personal consumption expenditures (PCE), which accounts for roughly two-thirds of spending, rose an annualized 1.4% in Q3. Spending on durable goods, which tends to be sensitive to higher interest rates, edged down by 0.8%, while spending on non-durable goods slid 1.4%. Spending on services, which is still being boosted significantly by pent-up demand, grew 2.8%. Rapidly rising mortgage rates contributed to residential investment plunging by more than 26% in Q3. Residential investment has declined by more than 15% since peaking in early 2021. Real final sales to domestic purchasers, which is the sum of consumer spending and fixed investment and measures the "core" part of spending in the economy, was essentially flat in Q3 relative to Q2. Analysts continue to predict that further tightening by the Fed will push the economy into recession by the second quarter of next year. Fed Raises Rates 0.75% The Fed raised interest rates by another three-quarters of a percent in early November to a range between 3.75% and 4.0%. Fed Chair Jerome Powell indicated that rate increases would continue until inflation slows down and the economy cools off, although the pace and amount of increases may slow down. The last time rates were this high was during the first three weeks of 2008 when the economy was sliding into a deep recession. A series of steep rate cuts quickly followed then, but the Fed stated that rates would remain elevated until the economy cooled off enough to tamp down persistently high inflation and wage growth. The job market remains very tight; unemployment will need to tick up before wage growth will slow significantly. Officials forecast that rates would reach 4.4% by the end of this year and 4.6% in 2023, a more aggressive outlook than the previous one which had rates leveling out at 3.5%, which they have already surpassed. The Fed still expects GDP to contract 0.2% this year and inch up to 1.2% growth in 2023, well below the 5.7% in 2021. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

|

|