|

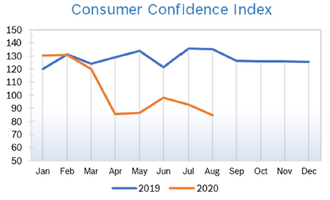

It was the best August since the 1980s for the Dow and S&P. Since their March lows, both indexes are up 55.7% and 59.4%, respectively. The Fed’s new relaxed stance on inflation means rates should stay low for some time to come. All three indexes posted their fifth consecutive monthly gain. Consumer Spending Rises 1.9% Consumer spending rose 1.9% in July after rising an upwardly revised 6.2% in June and a record 8.6% in May. Core consumer spending rose 0.3%. The July increase left spending about 4.6% below the pre-pandemic level in February. The savings rate slipped to 17.8% in July from 19.2% in June. The government pumped massive amounts of money into the economy from April to June when the economy was largely shut down; aid slowed in July but did not dry up entirely. Most economists think growth could soften or even stall moving forward without more federal aid. The loss of income could force consumers to spend less and try to save even more, which would slow non-essential purchases and create challenges for businesses that need sales to pick up so they can bring back more workers. Consumer spending accounts for 70% of US economic activity. Consumer Prices Rise 0.6% The Consumer Price Index (CPI) rose 0.6% in July after rising 0.6% in June and was up 1.0% from July 2019. Excluding the volatile food and energy components, core prices rose 0.6% in July after rising 0.2% in June and were up 1.6% year over year. The increases in both overall and core CPI were well above expectations. Economists are not concerned that the jump heralds a big rise in inflation because there are at least 31.2 million people on unemployment benefits, which will keep wage pressure subdued. About a quarter of the increase was due to rising gasoline prices. The personal consumption expenditures (PCE) price index excluding the volatile food and energy components rose 0.3% in July, matching June’s advance. In the 12 months through July, the core PCE price index climbed 1.3% after increasing 1.1% in June. The core PCE index is the preferred inflation measure for the Fed's 2% target, which is now a flexible average. Consumer Confidence Falls to 84.8

Unemployment Falls to 8.4%

Job Openings Jump 9.6% Job openings jumped 9.6% to 5.9 million on the last day of June and the number of hires fell to 6.7 million from a record high of 7.2 million in May, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). The number of people quitting their jobs rose 25% to nearly 2.6 million, a big jump that is unusual in the depths of a recession. Analysts speculate that it’s possible many workers may be reluctant to remain in jobs that they believe put their health or their family’s health at risk. It is also possible that many people are quitting jobs in order to look after or home school children. These improvements in the labor market reflected the easing of restriction and resumption of business in the new-normal in much of the country in June, when many retailers, restaurants and entertainment venues reopened. The BLS warned that the pandemic is affecting their ability to collect reliable data and response rates have dropped since the pandemic began. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Falls to 51.2 The Chicago Purchasing Managers Index (Chicago PMI) slipped to 51.2 in August after rising to 51.9 in July but remained in positive territory for the second consecutive month after spending a full year below 50. Among the five indicators, Order Backlogs was the only category that showed a monthly decline, while Supplier Deliveries recorded the largest gain. Production rose to the highest level since June 2019 and New Orders edged up to a one-year high. Inventories fell 9 points in August, hitting the lowest level since March, as companies run down their stocks. Prices Paid at the factory gate dropped 1.9 points in August after three consecutive monthly gains. This month’s special question asked when people expected to get back to normal capacity. The majority (55.6%) say sometime in 2021 or later, while 26.7% report they are already back at normal capacity. Another 8.9% expect to be back at full capacity in the third or fourth quarter of this year. Looking all the way back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.6% The Producer Price Index (PPI) rose 0.6% in July after falling 0.2% in June. In the 12 months through July the PPI fell 0.4%. Excluding the volatile food, energy and trade services components, producer prices rose 0.5% in July after rising 0.3% in June. In the 12 months through July, the core PPI was up 0.3%. The overall increase in the PPI was about twice what economists were expecting. Inflation has been held in check by the sharp recession caused by CV19. Oil prices have bounced off pandemic lows and wholesale gas prices have risen but food prices have fallen slightly overall. Washington is spending trillions of dollars to prop up the economy, but overall lack of demand is forcing companies in some sectors to keep prices down, while pandemic demand and short supply is inflating prices in other sectors, making accurate analysis difficult. Q2 GDP Revised Up to 31.7% Decline GDP dropped a revised 31.7% in the second quarter rather than the 32.9% decline first reported. Nevertheless, the decline was by far the steepest on records dating back to 1947. Consumer spending dropped 34.6% and real Personal Consumption Expenditures (PCE) declined 34% rather than the 35% initially reported. The economy contracted 5% during the first quarter. Analysts believe the economy will bounce back sharply in the third quarter. Wells Fargo estimates that GDP will grow at an annualized rate of 18% in Q3, assuming that there is not another full lockdown of the economy, but analysts remain concerned that a full business recovery remains a ways off as the virus drags on, businesses remain under pressure and lawmakers are at a stalemate regarding further stimulus. Fed Changes Inflation Policy Fed Chairman Jerome Powell announced a major shift in the way the Fed will try to manage inflation and achieve maximum employment and stable prices, based on lessons learned from the most recent economic expansion. The Fed won’t increase interest rates to respond to low unemployment levels and also won’t worry as much about low rates triggering a rise in prices. The Fed adjusted their inflation goal to an average target of 2%. In practical terms, that means they won’t be raising rates any time soon and are not currently worried about the economy overheating. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|