|

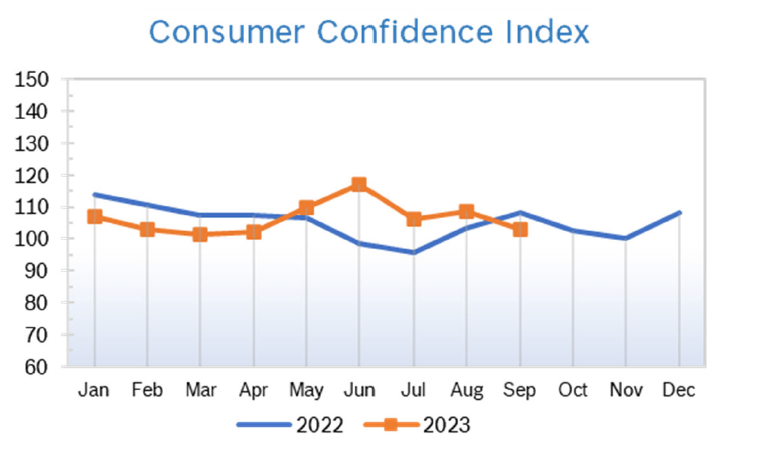

September lived up to its reputation as the worst month of the year for the markets, with all three major indexes finishing in the red for both the month and the quarter. For the third quarter, the DOW dropped 2.6%, the NASDAQ fell 4.1% and the S&P, the index most closely tracked by professionals, fell 3.7%. Consumer Spending Rises 0.4% Consumer spending rose 0.4% in August after jumping an upwardly revised 0.9% in July, but much of the increase was driven by rising gas prices. Spending was up just 3.9% year over year, the first time the year-over-year increase has been below 4.0% in more than two years. Core consumer spending was up just 0.1% in August after rising 0.6% in July. Spending was supported by incomes, which rose 0.4% due to a 0.5% increase in wages. Households also dipped into savings, with the saving rate slipping to 3.9%, the lowest since last December, from 4.1% in July. Rising gasoline prices, declining savings and the resumption of student loans repayments could crimp spending. Consumer Prices Rise 0.6% The Consumer Price Index (CPI) jumped 0.6% in August after rising 0.2% for the previous two months and was up 3.7% year over year after increasing 3.2% year over year in July. Rising gas prices accounted for much of the increase. Core inflation, which excludes the volatile food and energy categories, rose 0.3% in August after being up 0.2% for the previous two months. Core inflation fell to 4.3% year over year after falling to 4.7% year over year in July. The personal consumption expenditures (PCE) price index increased 0.4% in August, largely due to rising gas prices. Excluding food and energy prices, the core PCE price index rose just 0.1% in August, down from 0.2% in July, and the lowest rate since November 2020. The Fed closely tracks the PCE price indexes for monitoring their 2% inflation target. Inflation peaked at 9.1% in June 2022. Consumer Confidence Falls to 103.0

Unemployment Steady at 3.8%

Chicago PMI Drops to 44.1 The Chicago PMI dropped to 44.1 in September after rising to 48.7 in August, which had been the highest reading in a year. It was the 13th month in a row the PMI remained below 50, the level that indicates expansion. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.7% The Producer Price Index (PPI) rose 0.7% in August after rising a downwardly revised 0.4% in July and was up 1.6% year over year after being up 0.8% in July. Stripping out volatile food and energy prices, core PPI rose 0.2% in August after increasing 0.1% for three consecutive months. Core prices were up 3.0% year over year after being up 2.9% in July. It was the biggest increase in 14 months, but more than half of the increase was due to gas prices rising after OPEC production cuts. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q2 GDP Grew 2.1% Q2 GDP grew 2.1%, unrevised from the second reading but revised down from 2.4% growth first reported, according to the third reading from the Commerce Department. Growth remained slightly above the 2.0% pace in Q1. Economists had expected GDP to be unchanged from the second reading. Personal consumption expenditures (PCE) increased 0.8% in the second quarter from Q1, the fifth consecutive increase. In addition, prices measured in PCE terms rose 2.5% in the second quarter and rose at an annual rate of 3.9%, according to the Bureau of Economic Analysis’ final estimate. Fed Holds Rates Steady, Adjusts Forecast for 2024 As widely expected, the Fed held interest rates steady at 5.25% to 5.50% at their policy meeting in mid-September. The decision to keep rates unchanged was unanimously supported by all twelve voting members of the Committee. The statement noted that job gains remain strong, but inflation remains elevated, and that another rate hike is not off the table, and 12 of 19 committee members thought another 25 bps increase would be appropriate before the end of the year. The FOMC also seems to think that a "soft landing" for the economy is increasingly likely. The median forecast for real GDP growth in 2024 was revised up to 1.5% from 1.1% in the June, while the forecast for the unemployment rate fell to 4.1% from 4.5%. The median forecast for core PCE inflation at the end of this year edged down to 3.7% from 3.9% in the June SEP. Notably, all FOMC members forecast that PCE inflation, whether measured by the overall rate or by the core rate, will remain above 2% at the end of next year. Last-Minute Deal Averts Shutdown With just three hours to go, President Biden signed a Congressional Resolution (CR) that will keep the government open for 45 days, or until mid-November. The CR required bipartisan support to pass. Congress vowed to go back to work and get a budget passed before the next deadline. A shutdown in mid-November would put millions of federal workers and contractors out of work, interrupt government services and put a real damper on the holidays. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|