|

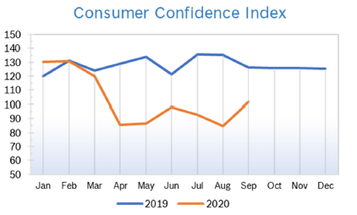

Markets churned much of the month and all three indexes finished with their first monthly losses since March. Political and economic uncertainty weighed on sentiment, as did the prospect of a contentious presidential election that is unlikely to be decided election night due to the high percentage of mail-in ballots. Consumer Spending Rises 1.0% Consumer spending rose 1.0% in August after rising 1.9% in July. The drop in spending was in line with economists’ expectations. Consumer incomes fell by 2.7% after a huge 14.8% drop in the category that covers government payments, including unemployment. The extra $600 weekly benefit that many people relied on and which helped prop up spending expired at the end of July and thus far Congress has not been able to agree on a second stimulus package. Economists are concerned that without further support consumer spending will slow dramatically during the final quarter of the year. Consumer spending accounts for 70% of US economic activity. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in August after rising 0.6% in both June and July and was up 1.3% year over year after being up 1.0% in July. Excluding the volatile food and energy components, core prices rose 0.4% in August after rising 0.6% in July and were up 1.7% year over year. The increases in both overall and core CPI were once again above expectations. Increases were driven by a jump in gasoline prices and prices for used vehicles. Economists say the increase in used vehicle sales is being driven by people who want to avoid the need to rely on public transportation due to exposure to CV19. Consumer Confidence Rises to 101.8

Unemployment Drops to 7.9%

Job Openings Rise in July Job openings rose to 6.62 million on the last day of July after rising to an upwardly revised 6.0 million in June and the number of hires fell to 6.7 million from a record high of 7.2 million in May, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). The number of hires, which includes rehired employees, declined 1.18 million to a still-solid 5.79 million in July and the hires rate decreased to 4.1% from 5.1% in June. Separations, which include layoffs and quits, rose by 108,000 in July, reflecting an increase in the number of people voluntarily leaving their jobs, which is generally regarded as a vote of confidence. The quits rate increased to 2.1%, edging closer to where it was at the start of the year, when the unemployment rate was at its lowest in decades. The rate of layoffs and discharges dropped to 1.2% in July from 1.4%. The increase in job openings occurred in all four regions and across many industries, including construction and manufacturing. The BLS warned that the pandemic is affecting their ability to collect reliable data and response rates have dropped since the pandemic began. JOLTS is a lagging indicator, but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 62.4 The Chicago Purchasing Managers Index (Chicago PMI) jumped more than ten points to 62.4 in September after slipping to 51.2 in August and remained in positive territory for the third consecutive month after spending a full year below 50. All five main indicators rose for the month, with Production and New Orders leading the way. Prices Paid jumped nearly ten points, with companies reporting rising costs for PPE, cleaning supplies and raw materials. The special question asked in September concerned business costs; 52% of respondents reported that costs had increased during the pandemic and just over a third of respondents replied that the pandemic had not affected their costs. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.3% The Producer Price Index (PPI) rose 0.3% in August after rising 0.6% in July. In the 12 months through July the PPI fell 0.2%. Excluding the volatile food, energy and trade services components, producer prices rose 0.3% in August. In the 12 months through August, the core PPI was up 0.3%. The overall increase in the PPI was driven by increases in core goods and services. Analysts noted that while pandemic-related price distortions are reversing, the trend in inflation is expected to remain subdued for some time. Q2 GDP Contracts 31.4% GDP dropped 31.4% in the second quarter, according to the third and final estimate from the Commerce Department. The final figure was an improvement from the 32.9% decline first reported. Nevertheless, the decline was by far the steepest on records dating back to 1947. Consumer spending contracted by a slightly downwardly revised 33.2% and the real Personal Consumption Expenditures (PCE) Index declined by a 1.6% annual rate rather than the 1.8% decline first recorded. The economy contracted 5% during the first quarter. Analysts believe the economy will bounce back sharply in the third quarter. Wells Fargo estimates that GDP will grow at an annualized rate of 18% in Q3 and other estimates call for growth of 25%+, assuming that there is not another full lockdown of the economy. Analysts remain concerned that a full business recovery could take longer as the virus drags on and many business sectors remain under pressure. Q4 Growth Estimates Slashed Analysts are slashing estimates for Q4 2020 growth because economists no longer expect a second stimulus package to be released before the end of the year. Goldman Sachs cut their growth forecast in half, dropping it to 3% from 6%, JPMorgan’s estimate fell from to 2.5% from 3.5% and Bank of America cut its forecast to 3% from 5%. Morgan Stanley had originally made one of the most bullish estimates at 9.3% growth, but now estimates 3.5%. They also noted that if the election produces a divided government, it may indicate fiscal gridlock ahead, whereas a unified government may result in fiscal expansion. Morgan Stanley dropped their full-year GDP forecast from –1.5% to –2.7%. Fed Holds Rates Near Zero The Fed announced that short-term rates would remain targeted at 0% to 0.25% through 2023. The Fed’s GDP forecast improved; they now expect GDP to decline 3.7% this year rather than the 6.5% decline originally forecast. The Fed also dropped their growth outlook for 2021 to 4% from 5% and for 2022 to 3% from 3.5%. They expect unemployment this year to average 7.6%, an improvement from the 9.3% originally forecast. The Fed also elaborated on the newly announced policy that they will allow inflation to run somewhat above the 2% target rate rather than increasing rates to control inflation. Chairman Jerome Powell said that they are committed to keeping the economy healthy over a long term horizon. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|