|

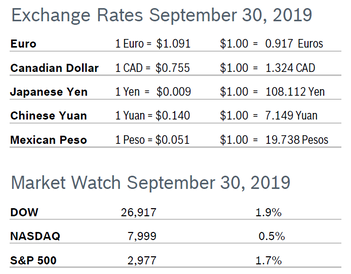

The markets all eked out gains for September and the DOW and S&P were both up more than 1% for the quarter, while the Nasdaq fell 0.1%. Both the month and the quarter were tumultuous for the markets, but the Fed’s interest rate cut in September pointed to easier monetary policy moving forward. Market fundamentals remain strong, but investors are skittish and worried about the outcome of the US - China trade war. Consumer Confidence Falls to 125.1 The New York-based Conference Board’s Consumer Confidence Index fell to 125.1 in September after slipping slightly to 134.2 in August, according to the Conference Board’s latest survey. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, dropped to 169.0 after rising to a downwardly revised 176.0 in August. The Expectations Index, which is based on consumers’ short-term outlook for income, dropped to 95.8 after falling to a downwardly revised 106.4 in August. The Conference Board said that the escalating and unstable situation on trade and tariffs rattled consumers. Consumers were also less optimistic about the short-term outlook and the labor market. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.1% Consumer spending inched up 0.1% in August after rising a downwardly revised 0.5% in July. Core consumer spending rose 0.1% in August after rising 0.4% in July and increasing 4.6% year over year in the second quarter. Personal income rose 0.4% in August after rising 0.1% in July. Wages increased 0.6% and savings rose to $1.35 trillion from $1.29 trillion in July. Inflation pressures remained low, with the personal consumption expenditures (PCE) price index excluding the volatile food and energy components edging up 0.1% in August after rising 0.2% in July. That lifted the annual increase for core PCE to 1.8%, the biggest gain since January. The core PCE index is the Fed’s preferred inflation measure and has been under the central bank’s target of 2% all year. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose a seasonally adjusted 0.1% in August after rising 0.3% in July. The year-over-year CPI was up 1.7% in August after being up 1.8% in July. Excluding the volatile food and energy categories, core prices were up 0.3% in August after rising 0.3% in July and were up 2.4% from a year ago, the biggest increase in six months. Unemployment Drops to 3.5% The unemployment rate dropped to 3.5% in September and the economy added 136,000 new jobs, below expectations of 150,000 jobs. It was the slowest pace of job growth in four months, but employment gains for August and July were revised up by a combined 45,000 jobs. The increase in the average worker pay over the past 12 months fell to 2.9% from 3.2% in August and average hourly earnings were little changed in September after rising by 11 cents an hour in August. Job gains were concentrated in the services sector. Retailers shed 11,000 jobs and gains in construction payrolls were minimal. The relatively weak report coupled with continuing tensions over trade and a slowdown in the global economy fueled hopes that the Fed will cut interest rates again this year. The economy needs to create about 120,000 new jobs each month to keep up with growth in the working-age population. Durable Goods Orders Rise 0.2% Durable goods orders rose 0.2% in August after rising 2.0% in July. The continued increase surprised economists, who had expected orders to slump by 1.0%. The increase in order was held back by a big 0.4% drop in orders for transportation equipment; ex-transportation orders increased 0.5% in August, reflecting strong growth for primary metals and fabricated metal products. Orders for non-defense capital goods excluding aircraft, a key indicator of business spending, fell 0.2% in August after being unchanged in July. Analysts say that businesses have put the brakes on investment plans due to uncertainty over how the tariff situation will be resolved. Nondefense capital goods shipments, which factor into GDP, rose 0.4% in August after falling a downwardly revised 0.6% in July. The durable goods report is very volatile and often subject to sharp revisions. Chicago PMI Slips to 47.1 The Chicago Purchasing Managers’ Index (PMI) fell to 47.1 in September after rising to 50.4 in August. Analysts had expected the Index to remain around 50. Production saw the largest decline, falling 7.6 points to 40.4, the lowest level since May 2009. Order Backlogs fell to 468, Inventories slipped further into contraction and hit a forty-month low of 41.7, and Prices Paid dropped for the month but rose for the quarter rose to 57.7. September’s special question concerned supplier delivery times. The majority (65%) expect supplier delivery times to remain unchanged, while 24% anticipate longer times and 11% forecast shorter delivery times. Economists use the Chicago PMI and other regional indicators to gauge the health of the ISM manufacturing index. Analysts noted that eroding business conditions in the Chicago region mirror a nationwide trend. The strong dollar, slowing global economy and trade disputes have curbed demand for goods made in America. Stable although softer growth in the much larger service side has been keeping the economy growing. Wholesale Prices Rise 0.1% The Producer Price Index (PPI) rose 0.1% in August after rising 0.2% in July and was up 1.7% year over year. Core producer prices, which exclude food, energy and trade services, rose 0.4% after falling 0.1% in July and were up 1.9% year over year after being up 1.7% year over year in July. The wholesale cost of services climbed 0.3% in August but the wholesale cost of goods fell 0.5%. Q2 GDP Unrevised at 2.0% GDP growth was unrevised at 2.0% in the final reading, down from the surprisingly strong growth of 3.1% in the first quarter but still ahead of expectations for 1.8% growth, according to the third and final reading from the Commerce Department. Consumer spending was revised slightly downwards to 4.6%. Business fixed investment dropped at a 1.1% annualized rate, the steepest decline since the fourth quarter of 2015. The category was pulled down by a steep 11.1% decline in spending on structures. Heavy industry has been hurt by the ongoing trade dispute with China, a strong US dollar and a faltering global economy. Corporate profits rose a solid 2.7% year over year after dipping in the first quarter, but business investment declined at an unrevised 0.6% rate, the first contraction since the beginning of 2016. Job Openings Little Changed The number of job openings was little changed at 7.2 million on the last business day of July, according to the most recent Job Openings and Labor Turnover Survey (JOLTS) from the U.S. Bureau of Labor Statistics. Over the month, hires edged up to 6.0 million and separations increased to 5.8 million. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.4% and 1.2%, respectively. The quits rate is viewed by policymakers and economists as a measure of job market confidence. Fed Cuts Rates 25 Basis Points The Fed issued its second rate cut of the year in September, dropping the benchmark rate by another 25 basis points to a target range between 1.75% and 2.0%. Fed watchers predict there will be another quarter-point rate cut before the end of the year if trade and geopolitical tensions don’t abate. If the US rolls back tariffs levied against China, it is likely that the Fed will sit on the sidelines and not increase rates. The decision was split, with seven out of ten Open Market Committee members voting for the cut. Two preferred to see rates unchanged and one wanted a cut of 50 basis points. The Fed has raised the interest rate nine times since late 2015 after keeping it near zero for eight years. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.to edit.

Comments are closed.

|

|