|

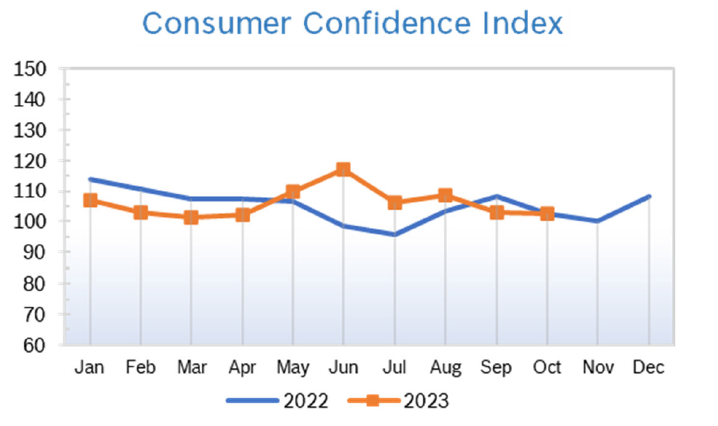

October was a spooky month for the markets, with all three indexes falling despite a month-end rally. Markets were rattled by the Fed’s “higher longer” policy for interest rates, unrest in the Middle East and the looming government shutdown. The S&P, the index most tracked by professionals, turned in its first three-month losing streak since the beginning of the pandemic and is now officially in correction territory. Despite all that, the tech-heavy NASDAQ is up 22% for the year and the S&P is up 9% but the DOW has erased all of its gains for 2023. Consumer Spending Rises 0.7% Consumer spending rose 0.7% in September after rising by 0.4% in August. The majority of data on consumer spending in September was incorporated into the first reading on Q3 GDP. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in September after jumping 0.6% in August and was up 3.7% year over year for the second consecutive month. Rising gas prices accounted for much of the increase. Core inflation, which excludes the volatile food and energy categories, rose 0.3% in September after being up 0.3% in August and was up 4.1% year over year, down from 4.3% in August. The prices for core goods fell 0.4% but the prices for core services rose 0.6%. Core prices year over year are now unchanged after being up 0.2% in August. The increase was slightly higher than expected and increased the chances the Fed will raise rates at their last meeting of the year in December. The personal consumption expenditures (PCE) price index increased 0.4% in September after increasing 0.4% in August. Excluding food and energy prices, the core PCE price index rose 3.7% year over year in September after rising 3.8% in August and 4.3% in July. The PCE still remains well above the Fed’s target of 2.0%. The Fed closely tracks the PCE price indexes for monitoring their 2% inflation target. Inflation peaked at 9.1% in June 2022. Consumer Confidence Falls to 102.6 The New York-based Conference Board’s Consumer Confidence Index fell to 102.6 in October after falling to an upwardly revised 104.3 in September. *

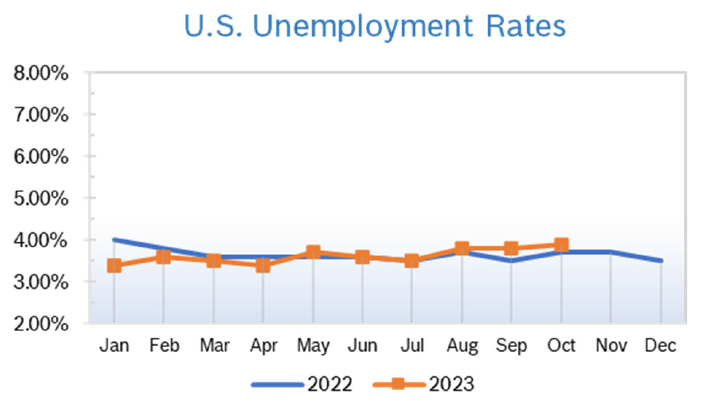

Unemployment Rises to 3.9%

Chicago PMI Drops to 44.0 The Chicago PMI fell slightly to 44.0 in October after dropping to 44.1 in September. It was the 14th month in a row the PMI remained below 50, the level that indicates expansion. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.5% The Producer Price Index (PPI) rose 0.5% in September after rising 0.7% in August and was up 2.2% year over year after being up 0.8% in August. Stripping out volatile food and energy prices, core PPI rose 0.3% in September after rising 0.2% in August. Core prices were up 2.7% year over year after being up 3.0% in August. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q3 GDP Grows 4.9% GDP grew at a blistering 4.9% in the third quarter after growing 2.1% in Q2, according to the first reading from the Commerce Department. It was a remarkably strong rate of growth, particularly because interest rates are at the highest level in 22 years. Growth was fueled by a 4% increase in consumer spending on both goods and services. Residential fixed investment, which reflects conditions in the housing market, grew 3.9% at an annualized rate in the third quarter. Business spending, known as nonresidential fixed investment, declined 0.1%. Fed Holds Rates Steady As widely expected, the Fed held interest rates steady at 5.25% to 5.50% at their policy meeting the first of November. The decision to keep rates unchanged was unanimously supported by all twelve voting members of the Committee. The statement noted that job gains remain strong, but inflation remains persistently too high and that another rate hike is not off the table. The Fed’s target rate for inflation is 2%; the rate as of the end of October was 3.7%; PCE, their preferred measure, was also at an annual rate of 3.7% © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|