|

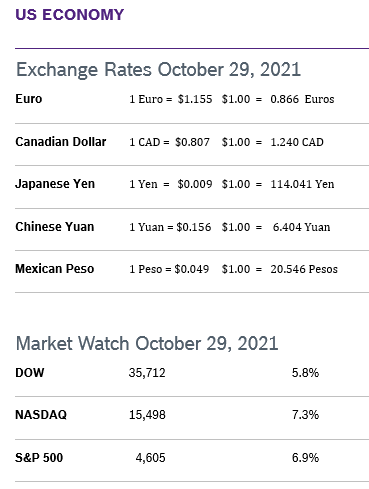

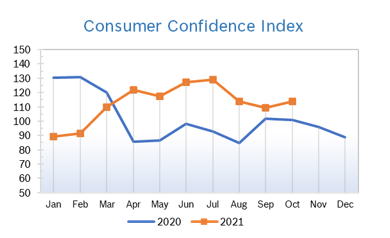

Although October is typically volatile, it proved to be the best month for all three markets all year. All three indexes not only recovered September’s losses but made big gains, thanks to strong corporate earnings and hopes there will be a deal soon on infrastructure and social spending. Consumer Spending Rises 0.6% Consumer spending rose 0.6% in September after rising 0.8% in August. Personal incomes, which fuel consumer spending, fell 1% in September, the steepest decline in four months. Wages jumped 0.8% after rising 0.4% in August, a reflection of the tight job market and extraordinary measures employers are taking to attract and retain workers. The economy is still being hamstrung by CV19 issues and supply chain problems. For the third quarter, consumer spending, which fuels 70% of overall economic activity, weakened to an annual growth rate of just 1.6%. Economists remain hopeful for a bounce-back in the current quarter, with confirmed COVID cases declining, vaccination rates rising, businesses investing and more Americans venturing out to spend money. Many analysts think the economy will rebound at a solid annual growth rate of at least 4% this quarter. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in September and was up 5.4% year over year. Core inflation, which excludes the volatile food and energy categories, rose 0.2% in September after rising 0.3% in August and was up 4.0% year over year for the second consecutive month. Food, rent, new cars and gasoline contributed most to the increase. Supply chain constraints and disruptions are expected to keep inflation elevated into 2022. The core PCE price index is the Fed's preferred measure for its 2% inflation target, which is now a flexible average. Consumer Confidence Rises to 113.8

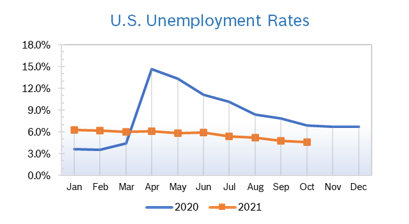

Unemployment Falls to 4.6%

Job Openings Fall in August US job openings fell by 659,000 to 10.4 million jobs at the end of August after rising to an all-time high of 10.9 million in July, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). Hiring dropped and the quits rate hit a series-high of 2.9% as 4.3 million people quit their jobs, equivalent to about 3% of the workforce. As Covid cases surged in August, quits soared in restaurants, hospitality, retail and education. Workers are in such high demand, people are also leaving jobs for ones they see as offering more potential, better benefits or pay or safer conditions. Job openings decreased in several industries but rose in the federal government. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 68.4 The Chicago Purchasing Managers Index (Chicago PMI) rose to 68.4 in October after falling to 64.7 in September. The increase came after two consecutive monthly declines. It was the 16th consecutive month the index remained in positive territory. Production dropped more than two points to 58.0, the lowest reading since August 2020. New Orders rose 3.1 points and recovered from the six-month low of 64.4 reached in September. Prices Paid rose 3.6 points to a 42-year high with many companies reporting that pricing was a serious issue. The majority of firms said that logistics will be the single biggest problem they face next year. More than 75% of companies indicated they will be trying to hire more employees next year. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.5% The Producer Price Index rose 0.5% in September after rising 0.7% in August and was up 8.6% year over year, the largest annual increase since the Labor Department began tracking inflation data in 2010. It was the ninth consecutive monthly increase in wholesale prices. Core inflation, which excludes the volatile food and energy categories, rose 0.1% in September after rising 0.3% in August and was up 5.9% from September 2020. The increase in producer prices was less than economists had expected. Global energy shortages and supply chain issues are keeping pressure on producer prices. Q3 GDP Grows 2.0% The U.S. economy grew 2.0% in the third quarter, according to the first reading from the Commerce Department. It was well below expectations and the slowest rate of quarterly growth since the recovery began in the third quarter of 2020. Declines in residential fixed investment and federal government spending offset gains in other areas, including an anemic 1.6% increase in consumer spending for the quarter. Spending for goods tumbled 9.2%, spurred by a 26.2% plunge in expenditures on longer-lasting goods like appliances and autos. Spending on services rose 7.9%, down from the 11.5% pace in Q2. The decline also included a 0.7% drop in disposable personal income, which fell 25.7% in Q2 as government stimulus payments ended. The personal saving rate declined to 8.9% from 10.5%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|