|

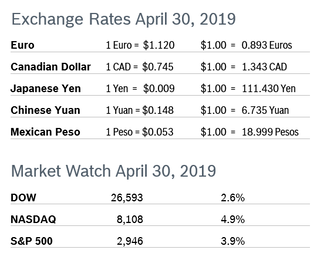

The markets all turned in strong performances in April, with the Dow up 14% for the year, the S&P, the index most followed by financial analysts, up 17% and the tech-heavy NASDAQ up 21%. The markets performed well on solid economic and job news, hopes for a resolution to the trade wars with China and expectations that the Fed will not raise interest rates any time soon. Market analysts disagree over where the markets will go next, but they are off to the best start to the year in decades. Consumer Confidence Rises to 129.2 The New York-based Conference Board’s Consumer Confidence Index rose to 129.2 in April after dropping to 124.2 in March, according to the Conference Board’s latest survey. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, rose to 168.3 in April after dropping sharply to an upwardly revised 163.0 in March. The Expectations Index, which is based on consumers’ short-term outlook for income, climbed to 103.0 in April, recovering most of February’s decline. The Conference Board noted that consumers expect the economy to continue growing at a solid pace into the summer months, which should support consumer spending in the near-term. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.9% Consumer spending jumped 0.9% in March after edging up just 0.1% in February. Spending for January was revised up to 0.3% rather than the 0.1% first reported. Core consumer spending rose 0.7% in March after being unchanged in February. Spending on goods rose 1.7% and spending on services rose 0.5%. Inflation pressures remained low, with the personal consumption expenditures (PCE) price index excluding the volatile food and energy components remaining unchanged after edging up 0.1% in February. The PCE was up 1.6% year over year, the smallest increase since January 2018 and still well below the Fed’s preferred inflation reading of 2.0%. Personal income rose 0.1% after rising 0.2% in February and wages rose 0.4% after rising 0.3% in February. Savings fell to $1.03 trillion in March from $1.16 trillion in February and the savings rate dipped to 6.5% from 7.3% in February. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in March after rising 0.2% in February. The CPI was up 1.9% in March over the past twelve months, up from a 1.5% increase in February. Core inflation, which excludes food and energy, rose 0.1% for the sixth consecutive month. Core CPI was up 2.0% year over year, up slightly from February’s annual increase. Rising gas prices accounted for 60% of the increase in the CPI in March. The strengthening dollar is also depressing inflation. The Fed expects inflation to be tame for what they described as “a time” due to declining energy prices. Unemployment Drops to 3.6% The unemployment rate dropped to 3.6% in April from 3.8% in March and the economy added 263,000 new jobs. It was the lowest level of unemployment since December 1969 and stemmed from a drop in labor force participation. Job gains for February and March were revised up by a total of 16,000 jobs. Job gains were much greater than economists expected. Average hourly wages for private-sector workers grew 3.2% from a year earlier, matching the increase in March. Through the first four months of the year employers added an average of 205,000 jobs each month, a slowdown from the 223,000 jobs added each month in 2018, but well above the job gains needed to keep the economy growing. Payrolls increased in construction by 33,000 jobs, the second consecutive month construction payrolls have increased. Retail payrolls declined by 12,000 jobs. It was the third consecutive month retail payrolls fell. The economy needs to create about 120,000 new jobs each month to keep up with growth in the working-age population. Durable Goods Orders Rise 2.7% Durable goods orders rose 2.7% in March after falling 1.6% in February. Orders ex transportation rose 0.4% after rising in February. Core durable goods orders for non-defense capital goods excluding aircraft, widely regarded as a key indicator of business spending, rose 1.3% in March after falling 0.1% in February. Nondefense capital goods shipments, which factor into GDP, fell 0.2% after being flat in February and rising 0.8% in January. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Drops to 52.6 The Chicago Purchasing Managers’ Index (PMI) dropped 6.1 points to 52.6 in April after falling 6 points to 58.7 in March. Despite two consecutive months of substantial declines, the index remained above 50, the level that indicates growth. Four of the five components of the index fell in April, with only Order Backlogs increasing. New Orders fell for the second consecutive month, dipping below both the three-month and 12-month averages. Production dropped to the lowest level since May 2016. However, more than half of firms surveyed said they plan to hire more workers over the next three months, while one-third thought their current staff was sufficient. MNI Indicators said that the overall drop points to greater business uncertainty amid softer domestic demand and a global slowdown. The PMI averaged 60.1 in the first quarter, down 3.5% from the fourth quarter and 3.3% from the first quarter of 2018. Wholesale Prices Rise 0.6% The Producer Price Index (PPI) jumped 0.6% in March after rising just 0.1% in February. The PPI was up 2.2% from March 2018. Core producer prices, which exclude food, energy and trade services, were flat for March after rising 0.1% in February and were up 2.0% from March 2018 after being up 2.5% year over year in February. Analysts noted that tame inflation reinforced the Fed’s decision to put off increasing interest rates. Q1 GDP Grows 3.2% GDP growth came in a strong 3.2% in the first quarter, according to the first reading from the Commerce Department. Consumer spending increased 1.2%, the slowest quarterly gain in a year. GDP growth was well above even the most optimistic forecasts; some models had predicted first quarter growth of 0.5%. One of the factors behind the unexpected increase was a big surge in spending by state and local governments, which likely picked up due to the partial shutdown of the federal government. Stronger inventory and trade building also fueled the strong growth, adding 0.7% to the topline. Business fixed investment decelerated to a relatively slow 2.7% gain after rising 5.4% in the first quarter. Residential fixed investment in new housing was another weak spot, with residential investment dropping 2.8%, the fifth consecutive quarterly decline. Consumer spending decelerated to a 1.2% gain, the slowest increase in a year. Inflation, as measured by the personal consumptions expenditure index (PCE) fell to a 1.4% annual rate in the first quarter from 1.9% in the fourth quarter of 2018. Core PCE slipped to 1.7% from 1.9%, below the Fed’s target of 2.0%. Consumer spending accounts for more than two-thirds of US economic activity. The strong GDP report is not expected to affect the Fed’s wait and see attitude toward interest rates, although it will probably quiet speculation that the next move might be a rate cut. Job Openings Fall to 7.09 Million The number of job openings decreased in February by 538,000 to 7.09 million jobs after rising to 7.6 million in January, according to the most recent Job Openings and Labor Turnover Survey (JOLTS). It was the biggest decrease in job openings since 2015, but the number of open positions still exceeds the number of people looking for employment. The labor market has enjoyed a record 102 consecutive months of job gains, but the growing shortage of workers is expected to slow job growth down to about 150,000 jobs per month. The quits rate held at 2.3% for the ninth consecutive month, with 3.5 million people quitting their jobs, a good indication that people feel confident they’ll be able to find a new job. Hiring eased to 5.7 million from 5.83 million in January. Fed Leaves Rates Unchanged As widely expected, the Fed left interest rates unchanged at 2.25% to 2.5% when the Fed Open Market Committee met at the end of April. However, Fed Chairman Jerome Powell said in a news conference that recent low inflationary pressures may be transitory and dashed speculation that the central bank was considering a rate cut. President Trump has been urging the Fed to cut rates because of benign inflation but economists agree that the economy is on strong fundamental footing and does not need the stimulus of a rate cut at this time. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|