|

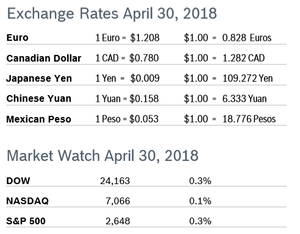

All three indexes finished the month of April little changed despite big gains and losses during the month. Corporate earnings have been good but worries about an international trade war and uneasy foreign relations took their toll, with the DOW and S&P remaining in negative territory for the year; the NASDAQ is up 2.4%. For the month of April, the DOW gained 0.3% to close at 24,163, the NASDAQ gained 0.1% to close at 7,066 and the S&P, the index most closely followed by economists, gained 0.3% to close at 2,648. Consumer Confidence Rises to 128.7 The New York-based Conference Board’s Consumer Confidence Index rose to 128.7 in April after falling to 127.7 in March. The Present Situation Index rose to 159.6 in April after falling to a downwardly revised 158.1 in March. The Expectations Index rose to 108.1 after dropping to 106.2 in March. Consumers’ expectations improved in April, and consumers remain generally confident that the economy will continue to expand over the coming months. Much of the improvement in the index came from improving outlooks on labor and business conditions. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.4% Consumer spending grew 0.4% in March after rising 0.2% in February and was up 1.8% year over year. Personal incomes rose 0.3% after rising 0.4% for each of the previous three months. The savings rate slipped to 3.1% in March, after rising to 3.4% in February. A key inflation gauge rose to a 12-month high of 2%, hitting the Fed’s target for the first time in a year, and the core PCE price index rose to 1.9% from 1.6% in February. It was the biggest yearly gain in the core rate since April 2012. The fact that inflation is rising could signal that the Fed might step up the pace of interest rate increases. Consumer Prices Fall 0.1% The Consumer Price Index (CPI) fell 0.1% in March after rising 0.2% in February. It was the first drop in the CPI in 10 months, but the decline was entirely due to the lower cost of gasoline, which is expected to rise over the summer. The CPI was up 2.2% over the past twelve months. Core inflation, which excludes food and energy, rose 0.2% in March after rising 0.2% in February and was up 2.1% from March 2017, the first time year-over-year core inflation has hit the Fed’s target of 2%. Unemployment Falls to 3.9% The unemployment rate fell to 3.9% and the economy added 164,000 new jobs in April. The unemployment rate was the lowest recorded since 2000. The number of jobs created was below expectations of 193,000. Job increases for March were revised down slightly but increases for February were revised up sharply, resulting in a net addition of 30,000 jobs compared to previous estimates. The late 1960s was the last period during which the unemployment rate consistently remained below 4%. Wages rose by 2.6% after having risen by 2.7% in in March. The largest job gains took place in professional and business services. Construction added 17,000 new jobs and construction employment is up an average of 25,000 over the past three months. Employment in retail was little changed in April. Durable Goods Orders Rise 2.6% Durable goods orders rose 2.6% in March after rising an upwardly revised 3.5% in February. It was the biggest gain in durable goods orders since last summer, and well ahead of economists’ expectations. Excluding the volatile transportation category, orders would have closely watched proxy for business spending plans, dropped 0.1% in March after rising 0.9% in February. Orders for primary metals such as steel rose 1.4%. Shipments of core capital goods, which factor into GDP, fell 0.7% in March after rising 1.4% in February. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Rises to 57.6 The Chicago Purchasing Managers’ Index (PMI) inched up to 57.6 in April after falling to 57.4 in March. The increase snapped a three-month downward trend, but analysts had expected more of a rebound. Three of the five components fell for the month, with only Production and Supplier Deliveries expanding. The New Orders indicator continued its downward trend, hitting a 15-month low. Production and New Orders account for 60% of the index and are now 2.2% and 10.4% below their respective year-ago levels. Input materials’ prices continued to rise in April and are near a seven-year high. Prices Paid surpassed the 70-mark for only the third time since 2012 and is up 22.8% year over year. Supply constraints, longer delivery times and rising materials costs are eating into margins. Most firms expect orders to grow in the second quarter. Wholesale Prices Rise 0.3% The Producer Price Index (PPI) rose 0.3% in March after rising 0.2% in February, continuing the upward climb in producer prices that has been going on since August 2016. Core producer prices, which exclude food, energy and trade services, rose 0.3% in March after rising 0.4% in February. Core prices were up 2.7% compared to March 2017. The PPI for inputs to construction was up 4.3% year over year. While inflation has definitely picked up, analysts say it is doing so at a manageable pace. Q1 GDP Grows 2.3% GDP grew 2.3% in the first quarter after growing 2.9% in the fourth quarter. The reading was better than expected. Consumer spending rose at an annual pace of 1.1%, well below recent trends. The slowdown reflected a decline in spending on durable goods, including motor vehicles. Wells Fargo expects consumer spending to rise 2.5% for the year. Residential construction was flat, but government spending on the local, state and federal levels contributed to growth. Trade was a net addition for the first quarter but is expected to subtract from GDP for the full year. Business fixed investment rose 2.7% and structure investment rose 12.3%; both were up year over year. Core PCE, the Fed’s benchmark for inflation, was up 2.5% compared to just 1.8% a year ago, with the biggest increases in the costs of services, which have outpaced the costs of goods since 2015. Job Openings Little Changed The number of job openings was little changed at 6.1 million on the last business day of February, according to the Job Openings and Labor Turnover Survey, or JOLTS. The job openings rate was 3.9%. Over the month, hires and separations were little changed at 5.5 million and 5.2 million, respectively. Within separations, the quits rate was unchanged at 2.2% and the layoffs and discharges rate was little changed at 1.1%. The quits rate is considered a measure of confidence in the job market and has been steadily rising since hitting a low of 1.3% in late 2009. The number of unfilled jobs in the construction sector declined in February but remains higher than a year ago. According to NAHB analysis of JOLTS data, there were 196,000 open construction sector jobs in February. The post-recession high of open, unfilled construction jobs was 255,000, reached in July of last year. On a smoothed, twelve-month moving average basis, the open position rate for the construction sector remained at 2.9%, a post-recession high. Rising job turnover should eventually lead to accelerated wage growth, which economists say will help push inflation towards the Fed’s target of 2%. The JOLTS report is one of the Fed’s preferred economic indicators. Fed Raises Interest Rates The Fed raised rates by 25 basis points to 1.5% to 1.75% in April. The increase was widely expected. The Fed’s statement pointed to strong job gains and low unemployment, along with moderating consumer spending and business fixed investment. Another two to three rate hikes are expected this year. Analysts say that rates will climb gradually and expect mortgage rates to be up by at least a half a percentage point at this time next year. Borrowing costs are still relatively low, and analysts also expect CD and savings rates to rise. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|