|

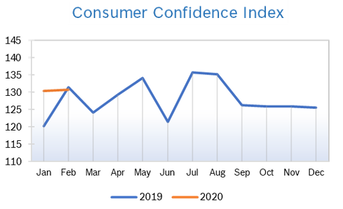

After hitting all-time highs mid-month, markets caught a bad case of coronavirus jitters the last week of February, sliding more than 10% off their highs. The Fed stepped in late in the day, reassuring markets that the economy is sound and the central bank was ready to act if needed, sending indexes up in the last fifteen minutes and preventing even steeper losses. Economists note that the US economy is strong, but the impact of coronavirus virus on the US and global economy in light of the extraordinary precautions being put in place to keep the virus from spreading is unknown. The stock market hates uncertainty; markets will undoubtedly be choppy until the impact of coronavirus can be better projected. Historically, widespread global virus outbreaks have often caused temporary market turmoil but to date have not plunged economies into recession. Consumer Spending Rises 0.2% Consumer spending rose 0.2% in January after rising an upwardly revised 0.4% in December and 0.4% in November, below economists’ expectations. It was the tenth consecutive monthly increase for consumer spending. Core consumer spending rose 0.1% in January after rising 0.1% in December. Personal income jumped 0.6% and savings rose to $1.33 trillion. Wells Fargo expects consumer spending to moderate but not decline in 2020. Consumer spending accounts for more than two-thirds of US economic activity. Consumer Confidence Rises to 130.7

Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose 0.1% in January after rising 0.2% in December. The year-over-year CPI increase rose to 2.5% in January from 2.3% in December. Even though the year-over-year increase was the fastest pace since October 2018, inflation remains very low. Excluding the volatile food and energy categories, core prices rose 0.2% in January after increasing 0.1% in December. Core prices were up 2.3% from a year ago for the second consecutive month. Energy prices dropped; most of the increase in headline inflation came from increases in services and shelter costs. The PCE price index increased 0.3% in January. The core PCE price index, the Fed’s preferred measure of inflation, rose 0.1% for January and was up 1.6% from January 2019. The core PCE index has been below the Fed’s target of 2% for more than a year. Unemployment Falls to 3.5%

Job Openings Fall to Two-Year Low The number of job openings fell to 6.4 million in December, the lowest level in two years, and hiring increased marginally, according to the most recent Job Openings and Labor Turnover Survey (JOLTS) from the U.S. Bureau of Labor Statistics. The drop of 364,000 jobs marked three consecutive months of declines. The drop in job openings was concentrated in the private sector. Analysts say that fewer openings may likely reflect employers being more willing to invest in training and workers in the tight job market. The job openings rate declined to a two-year low of 4.0% in December from 4.3% in November. Hiring rose to 5.9 million in December from 5.8 million in November and the hiring rate edged up to 3.9%. The number of workers voluntarily quitting their jobs fell to 3.5 million from 3.6 million in November, but the quits rate was unchanged at 2.3% for the fourth consecutive month. The quits rate is viewed by policymakers and economists as a measure of job market confidence. Layoffs increased to 1.9 million in December from 1.8 million in November; the layoffs rate was unchanged at 1.2%. Chicago PMI Rises to 49.0 The Chicago Purchasing Managers Index (Chicago PMI), rose to 49.0 in February after tumbling to 42.9 in January. Four out of five major indicators posted gains, with only Employment declining. New Orders rose 7.6 points to 49.1, the highest level since August 2019. Production rose to 51.0, an eight-month high. Order Backlogs rose slightly after falling to a four-year low of 34.6 in January. This component of the Index has been in contraction since September 2019. Prices Paid fell for the second consecutive month, dropping 3.2 points to 52.9. Wholesale Prices Rise 0.5% The Producer Price Index (PPI) rose 0.5% in January after rising 0.1% in December and was up 2.1% year over year. The monthly increase was the largest since Fall 2018, but was primarily due to a spike in trade margins, a category described as being very erratic and having little bearing on what companies actually pay in the long run, as well as a jump in retail margins and an administered increase in Medicare hospital payments. The cost of goods was up just 0.1%. Core producer prices, which exclude food, energy and retail trade margins, rose 0.4% in January after being flat in December. Core PPI was up 1.5% year over year, unchanged from December. Q4 GDP Growth Remains at 2.1% Q4 GDP was unrevised at 2.1%, according to the second estimate from the Commerce Department. It was the third consecutive quarter GDP grew between 2% and 2.1%. Growth for 2019 was 2.3%, thanks to robust growth in the first quarter. There were only minor revisions to the data used to create the first estimate of Q4 growth. Fixed business investment, excluding housing, fell 2.3%, compared to initial estimates of a 1.5% decline, as companies spent less on equipment and oil and gas extraction. Prior to the outbreak of coronavirus, analysts were expecting that a partial trade truce with China would spur more business investment this year, but now China has shuttered many plants, interrupting the supply chains of many industries and putting a damper on any prospects for robust growth for the immediate future. Fed Issues Emergency Rate Cut The Fed cut rates by 50 basis points (0.5%) in early March in response to the risks from coronavirus. It was the biggest rate cut since the financial crisis in 2008, and the first reduction in interest rates since last year. The move took markets by surprise, as the Fed reiterated that the economic fundamentals of the US remain strong, but that a period of prolonged disruption could lead to a big drop in global GDP growth. It is unusual for the Fed to cut rates outside of its normal meeting schedule. Many analysts question whether the rate cut will achieve anything, as rate cuts are generally put in place to stimulate business investment and consumer spending, although it may encourage some investors to “buy the dip” and take advantage of bargains in the market. US-Mexico-Canada Trade Deal The independent U.S. International Trade Commission calculated that the U.S.-Mexico-Canada deal would add 0.35%, or $68 billion, to economic growth and generate 176,000 jobs over six years. According to the White House, the deal will greatly improve protection for workers and boost access to Canadian and Mexican markets for US farmers and ranchers. The deal will also reportedly give US manufacturing a boost. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|