|

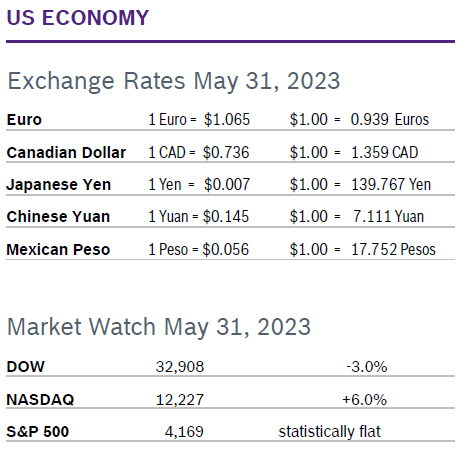

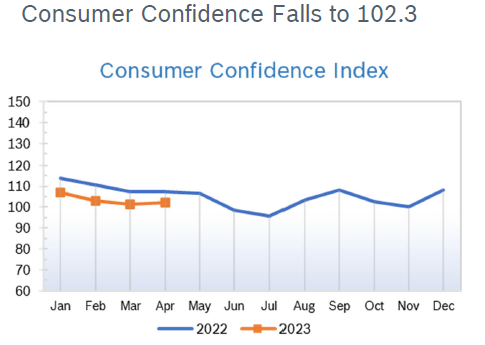

Markets struggled near the end of May as the debt ceiling loomed, no final deal was approved and the markets worried that dissenting fringes might hold up the vote and insist on changes that couldn’t be approved before the June 5 extended deadline imposed by Treasury Secretary Janet Yellen. The tech-heavy Nasdaq was boosted by excitement around the potential impact of artificial intelligence. Consumer Spending Rises 0.8% Consumer spending jumped 0.8% in April after an upwardly revised 0.1% gain in March. Core consumer spending rose 0.5%. The increase was greater than expected. Spending rose on services and vehicles, and was driven partially by strong wage growth. Consumer spending was included in the first report for Q1 GDP, which showed that consumer spending surged 3.7% in the first quarter. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in April after rising 0.1% in March. Consumer prices were up 4.9% year over year after being up 5.0% in March. The year-over-year increase was the smallest since 2021 and the tenth consecutive month that year-over-year inflation has cooled down. Core inflation, which excludes the volatile food and energy categories, rose 0.4% in April for the second consecutive month and fell to 5.5% year over year from 5.6% in March. Though inflation is gradually slowing, it remains well above the Fed’s preferred level of 2.0%. The personal expenditures price index (PCE) rose 4.4% year over year in April after being up 4.2% in March. Core prices, which exclude volatile food and energy categories, rose 4.7% year over year in April after rising 4.6% in March. Economists see core inflation as a better predictor of future inflation than overall inflation. The Fed tracks the PCE price indexes for monitoring their 2% inflation target. Consumer Confidence Falls to 102.3

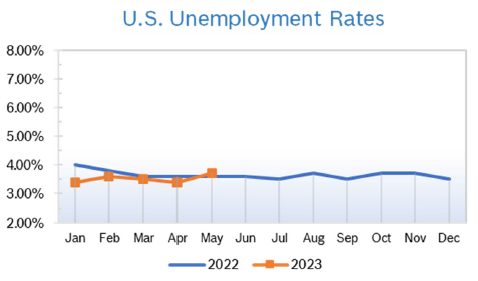

Unemployment Rises to 3.7%

Chicago PMI Falls to 40.4 The Chicago PMI fell to 40.4 in May after rising to 48.6 rose to 48.6 in April. The unexpectedly large decline left the index well below 50, the level that signifies expansion, for the ninth consecutive month. A PMI number above 50 signifies expanded activity over the previous month; this was the sixth consecutive reading below 50, the level which indicates contraction. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.2% The Producer Price Index (PPI) rose 0.2% in April after falling 0.5% in March and was up 2.3% year over year, down from a 2.7% year-over-year increase in March. It was the mildest year-over-year increase since January 2021. Stripping out volatile food and energy prices, core PPI rose 0.2% in April after dropping 0.1% in March and was up 3.2% year over year after being up 3.4% year over year in March. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q1 GDP Revised Up to 1.3% Growth Q1 GDP was revised up to 1.3% growth from the anemic 1.1% growth first reported, according to the second reading from the Commerce Department. GDP grew 2.5% in the fourth quarter of 2022. Most of the growth in the first quarter was spearheaded by consumer spending, the main engine of the economy. Spending rose at a strong 3.8% clip after an initial 3.7% reading. Real GDP is still expected to decline in the fourth quarter of this year and the first quarter of 2024 and send the country into a mild recession, according to minutes from the Fed Board that came out prior to the GDP reading. However, that forecast was based on GDP gradually declining in the first three quarters of the year. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|