|

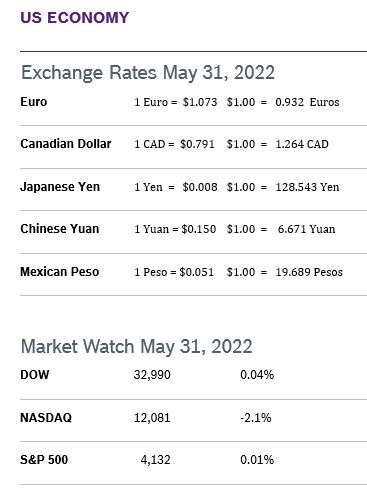

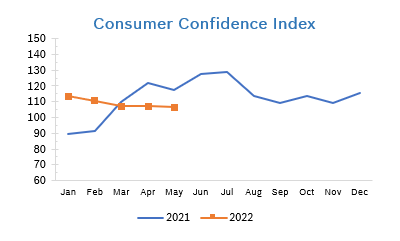

It was another roller coaster month for the markets, with indexes plunging mid-month and the S&P flirting with bear territory amid fears of inflation and recession. Then better corporate news and solid consumer spending sent markets into positive territory during the last week of the month before they fell back again the last day of trading. Consumer Spending Rises 0.9% Consumer spending rose 0.9% in April after rising 1.1% in March. Spending was well above expectations as Americans dealt with higher prices to treat themselves to airline flights, road trips, sporting events and other experiences they did without during the pandemic. Spending on goods rose 1% for the month and spending on services rose 0.5%. However, the cost of goods is rising faster than the cost of services. Personal income rose 0.3% in April after rising 0.5% in March and the savings rate fell to 4.4%, the lowest rate since 2008, as Americans dipped into savings to support spending. Consumer Prices Rose 0.3% The Consumer Price Index (CPI) rose 0.3% in April after rising 1.2% in March and was up 8.3% year over year, down from 8.5% in March. It was the first time since last August that the rate of inflation slowed. Core inflation, which excludes the volatile food and energy categories, rose 0.6% in April after rising 0.3% in March and was up 6.2% year over year, slightly lower than the year-over-year increase in March. The shelter index, which includes rents and homeownership costs, increased 0.5% for the second consecutive month and was up 5.1% year over year. Analysts caution that much of the surge in shelter costs, which make up the largest single component of the CPI, is still to come, since it takes about a year for rising rents and home ownership costs to show up in inflation measures. The personal consumption expenditures (PCE) price index rose 0.3% in April after jumping 0.9% in March. In the 12 months through April the PCE was up 4.9%, a drop from the 6.6% year-over-year increase in March. The decrease in the PCE was in line with economists’ expectations as last year's large gains drop out of the calculation. Consumer Confidence Falls to 106.4

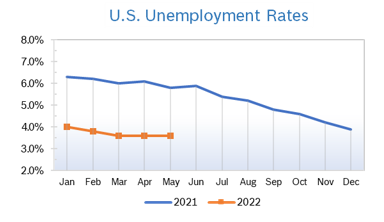

Unemployment Remains at 3.6%

* The economy needs to create about 120,000 new jobs each month to keep up with growth in the working-age population. Chicago PMI Rises to 60.3 The Chicago Purchasing Managers Index (Chicago PMI) rose to 60.3 in May after falling to 56.4 in April. It was the 23rd consecutive month the index remained in positive territory. The reading was well above expectations; economists had expected the PMI to fall slightly. A PMI number above 50 signifies expanded activity over the previous month. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.5% The Producer Price Index rose 0.5% in April after jumping an upwardly revised 1.6% in March and was up 11% year over year, a slight decline from March’s record-setting increase and the first drop in year-over-year prices since the beginning of the pandemic. Core inflation, which excludes the volatile food and energy categories, climbed 0.6% in April after rising a hefty 0.9% in March and was up 6.9% from April 2021. Prices for services were unchanged in April, with big spikes in transportation and warehousing being offset by declines in prices for other services. Climbing oil prices are pushing up prices overall. Continuing CV19-related shutdowns in China and the war in Ukraine are expected to keep prices elevated. Q1 GDP Falls 1.5% Economic growth for the first quarter was revised to down 1.5% from the 1.4% reduction first reported, according to the second reading from the Commerce Department. The first quarter was the weakest quarter since spring 2020 when the CV19 pandemic and related shutdowns plunged the economy into a deep, albeit short, recession. The reduction was largely due to a record trade deficit and the first decline in corporate profits in five quarters. Consumer spending, the economy’s main driver, was upwardly revised to a solid 3.1% from the 2.7% increase first reported, up from 2.5% growth in the fourth quarter. Businesses poured money into equipment and research, sending business spending soaring 9.2%. Disposable income fell for the fourth consecutive quarter. Over the last four quarters, the purchasing power of after-tax household incomes plunged by $2.2 trillion (in 2021 dollars). That's a 10.9% decline, by far the largest in records dating back to 1947. Many economists are revising forecasts for the year and now anticipate growth around 2.6%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|