|

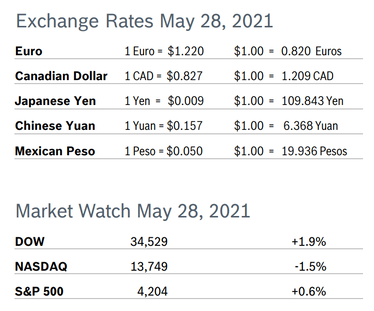

The NASDAQ broke a six-month winning streak and finished modestly lower and the DOW and S&P 500 made modest gains after recording some substantial drops earlier in the month surrounding worries about inflation and bottlenecks inhibiting more robust growth, including supply chain woes and shortages of everything from rental cars to shipping containers. Markets turned positive as vaccinations approached 50% of the eligible population and most pandemic restrictions were lifted for the fully vaccinated. Consumer Spending Rises 0.5% Consumer spending inched up 0.5% in April after jumping an upwardly revised 4.7% in March. Core consumer spending rose just 0.1%. Consumer incomes tumbled 13.1% in April after surging a record-breaking 20.9% in March, fueled by billions in one-time stimulus checks. The April gain in spending was led by a 1.1% rise in spending on services, the sector that covers airline travel, hotels and restaurants, all segments that were devastated by pandemic-caused shutdowns. Spending on goods actually fell 0.6%. The savings rate fell to 14.9% in April from 27.7% in March, but was still twice as high as it was pre-pandemic. Consumer Prices Rise 0.8% The Consumer Price Index (CPI) rose 0.8% in April after rising 0.6% in March and was up 4.2% year over year. It was the biggest jump in inflation since 2008, and far exceeded analysts’ estimates. Core inflation, which excludes the volatile food and energy categories, jumped 0.9% after rising 0.3% in March and was up 3.0% from April 2020, double the year-over-year increase in March. Economists noted that while part of the jump was driven by the base effect of last year’s readings being impacted by the pandemic, prices are rising in many categories, including lumber, auto parts, semiconductors, groceries and gasoline. The personal consumption expenditures (PCE) price index excluding the volatile food and energy component, jumped 0.7% in April and was up 3.1% year over year. The core PCE price index is the Fed's preferred inflation measure for its 2% target, which is now a flexible average. The Fed remains convinced inflation is transitory and is more focused on the employment situation. Consumer Confidence Steady

Unemployment Falls to 5.8%

Job Openings Jump US job openings jumped 8% to a new record high of 8.1 million in March after rising substantially in the previous two months, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). It was the highest number of job openings on record and up substantially from the pandemic low of under 5 million jobs. Job openings increased in many of the industries that were hit hard by the pandemic, including recreation, travel and foodservice. Hiring in March rose by 200,000 to 6 million. Layoffs dropped to a record low 1.5 million in March from 1.7 million in the prior month. Layoffs fell by 93,000 in construction, which has been buoyed by strong demand for housing. The layoffs rate dropped to 1.0% from 1.2% in February. The number of people voluntarily quitting their jobs rose to 3.5 million from 3.4 million in February. The quits rate was unchanged at 2.4%. The quits rate is normally viewed by policymakers and economists as a measure of job market confidence. However, the pandemic has forced millions of women to drop out of the labor force mostly because of problems related to childcare. There are still 8.4 million fewer Americans working than at the start of the pandemic. There were 1.2 Americans per job opening in March, up from just 0.8 Americans pre-pandemic. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 75.2 The Chicago Purchasing Managers Index (Chicago PMI) rose to 75.2 in May after rising to 72.1 in April. It was the highest level for the index since November 1973 and the eleventh consecutive month the index remained in positive territory after spending a full year below 50. New Orders gained 7 points to the highest level since December 1983 but Production slipped 2.3 points after sliding a fraction of a point in April. Prices Paid fell 3.1 points in May after rising in the previous two months, but several respondents noted that prices for steel, plastics, copper, electronic components and other commodities were rising. Firms are reportedly overbuying in an attempt to deal with shortages of raw materials. The special question for April asked if firms had plans to deal with the global shortage of computer chips. The majority did not; 46% don’t use chips and 28.2% who do have no plans in place. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.6% The Producer Price Index rose 0.6% in April after jumping 1.0% in March. The increase was about double what economists were expecting. Prices were up 6.2% from April 2020, the largest advance in more than ten years. Core inflation, which excludes the volatile energy and food categories, rose 0.7% for the second consecutive month and was up 4.1% year over year. Two-thirds of the increase in wholesale prices was concentrated in services such as air travel, transportation, financial advice and medical care as vaccinated Americans are doing things they put off during the pandemic. In addition, some costs that were absorbed by companies are now being passed along to consumers. Analysts noted that year-over-year inflation numbers will be higher going forward because of the year-over-year comparison to very low numbers caused by the pandemic as well as near-term pressures from supply chain bottlenecks. Q1 GDP Unchanged at 6.4% GDP grew an unrevised 6.4% in the first quarter as stimulus checks went out, vaccinations accelerated, states lifted restrictions and consumers stepped up spending, according to the second reading from the Commerce Department. Analysts had expected growth to be revised up to 6.6%. Upward revisions to consumer spending were offset by weaker growth in exports. Consumer spending surged 11.3%, up from the robust 10.7% first reported. Spending was fueled by federal payments of $1,400 or more to most households, the reopening of many businesses and Americans coming out of their pandemic-induced hibernation and traveling, eating out, shopping in stores and going to events. Economists expect growth to pick up further in the second quarter and remain steady in the second half of the year. Many forecasts call for GDP to grow between 6% and 7% this year, which would be the strongest performance since a 7.2% gain in 1984 when the economy was emerging from a deep recession. Yellen Warns of Bumpy Recovery Treasury Secretary Janet Yellen told the House Appropriations subcommittee the economic recovery will be “bumpy” with high inflation readings likely to last through the end of this year. Yellen believes that inflation pressures will be temporary and reassured the committee that if they threaten to persist the government has the tools needed to address that scenario. Yellen said that the April increase in consumer prices was the result of a number of special factors related to the economy opening back up, reflecting big gains in the prices of airline tickets, hotel rooms and recreation, all areas where prices had fallen dramatically during the worst of the pandemic. In addition, prices are being driven up by supply chain shortages in critical areas such as computer chips and auto production, which were affected by temporary factory shutdowns and inventory diversions during the pandemic. Yellen said she was studying economics and began her professional career during the 1970s, the last period of high inflation. She told the committee that she well remembers “those terrible times” and no one wants a repeat. They will be watching the current situation very closely. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|