|

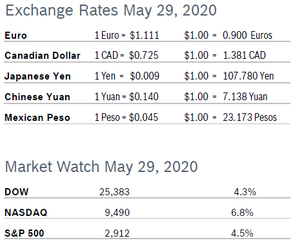

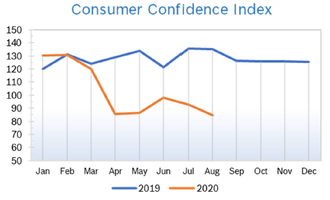

The markets have had a massive run up over the past two months, with the S&P, the index most followed by economists, now up 38% from its March low and only 10% below the record high set in February. Stocks did well throughout the month as more states began reopening their economies. Markets tumbled the end of the month but reversed losses after President Trump announced a series of measures aimed at punishing China for its treatment of Hong Kong but did not undermine the phase one trade deal reached earlier this year. On average, it takes markets about 24 months to fully recover from a major downturn, but markets now are reacting as if the economic bottom has already been reached. Analysts say there could be a setback if the country has to deal with another wave of CV19 outbreaks. Consumer Spending Drops 13.6% Consumer spending plunged by a record-shattering 13.6% in April after falling 6.9% in March, a slight improvement over the 7.5% drop first reported. Spending fell across the board, tumbling 17.3% for durable goods, 16.2% for non-durables and 12.2% for services. Personal income jumped 10.5% thanks to an annualized $3 trillion in stimulus support and government aid programs. Spending in brick and mortar stores, which accounts for the vast majority of consumer spending, is down 35% from May 2019. Consumer spending accounts for 70% of US economic activity. Consumer Confidence Rises to 86.6

Consumer Prices Fall 0.8% The Consumer Price Index (CPI) fell 0.8% in April after falling 0.4% in March. Core inflation fell 0.4% in April, the largest monthly decline for core inflation on record, and was up just 1.4% year over year. The CPI was pushed lower by further sharp drops in oil prices, largely due to demand for oil and gas falling around the globe because of stay home orders that limit driving and the very steep decline in air travel. The CPI rose just 0.3% year over year in April, the smallest YOY increase since 2015. Analysts say that consumer prices may decline in the months ahead as the CV19 outbreak depresses demand for some goods and services, outweighing price increases related to shortages caused by disruptions to the supply chain. With consumer prices falling, some analysts caution the economy could actually experience deflation, which could prolong the recovery. Deflation is a broad and prolonged decline in prices and wages and often in the value of homes or other assets. Unemployment Falls to 13.3%

Job Openings Drop The number of job openings dropped by 813,000 in March to 6.2 million after dropping to 6.9 million in February, according to the most recent Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). The survey was for the full month of March, and clearly reflects the impact of CV19 on the economy. Layoffs and discharges increased 9.5 million in March to 11.4 million, the highest number since the government started tracking the series in 2000. The layoffs and discharges rate surged to a record 7.5% in March from 1.2% in February. The number of people voluntarily quitting their jobs dropped by 654,000 to 2.78 million, the lowest since September 2015. The quits rates, which is viewed by policymakers and economists as a measure of job market confidence, dropped to 1.8%. That was the lowest rate since December 2014 and was down from 2.3% in February. The BLS is adjusting how it collects data in order to fairly reflect the impact of the pandemic. Chicago PMI Falls to 32.3 The Chicago Purchasing Managers Index (Chicago PMI) fell to 32.3 in May after dropping to 35.4 in April. It was the eleventh consecutive sub-50 reading for the index and the lowest reading since March 1982. Among the five indicators, Order Backlogs and Supplier Deliveries saw the biggest declines; Employment actually edged marginally higher. New Orders dropped by 2.3 points to the lowest level since July 1980. Production dropped 6.3% after falling sharply in April and remained at a 40-year low. Order Backlogs plunged to 28%. Prices Paid rose as companies noted higher prices for essential goods and transportation. The special question asked in May was how long panelists expected CV19 to impact their business plans. On the far ends of the spectrum, 18.8% expect an impact on business plans for more than a year; 10.4% see the impact lasting for less than three months. Nearly half expect CV19 to impact business plans between 9 and 12 months. Looking all the way back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Drop 1.3% The Producer Price Index (PPI) fell 1.3% in April after falling 0.2% in March and 0.6% in February. In the 12 months through April the PPI was down 1.2% after being up 0.7% in March. Much of the decline was due to the third consecutive monthly decline in gasoline and energy prices, which plunged more than 19%. More than 80% of the decrease can be traced to a 3.3% drop in prices for final demand goods. Core producer prices, which exclude food, energy, and trade services fell 0.9% in April, the largest decline since the index was introduced in September 2013. Core prices were down 0.3% year over the year, the first time core prices have been down year over year. Q1 GDP Falls 5.0% Q1 GDP fell an upwardly revised 5.0% in the first quarter, according to the second reading from the Commerce Department, which initially reported a 4.8% drop in Q1 GDP. The economy was shut down for just two weeks during the first quarter. Analysts expect GDP to take a much bigger hit during the second quarter. A larger estimate of the drop in private inventory investment was the main reason for the downward revision, which was partially offset by small upward revisions to consumer spending and business investment. The drop in real personal consumption expenditures (PCE) was revised to 6.8% from the 7.6% first recorded. Pre-tax profits dropped 8.5% from Q1 2019. Wells Fargo looks for real GDP to contract at a record-breaking pace in excess of 20% during the second quarter; other analysts predict an even steeper decline. Fed Statement on Recovery Fed Chairman Jerome Powell expects GDP to contract by as much as 20% to 30% in the second quarter, with unemployment peaking around 25%. However, he believes that rapid government and central bank aid helped the country avoid a depression and went on to say that the Fed will issue relief as long as necessary to bridge the virus threat. He also believes growth will resume as soon as the third quarter, but there will not be a full recovery this year. Uncertainty surrounding the course of the pandemic over the rest of the year could push a full recovery until the end of 2021. He says a “Great Depression” is very unlikely. The current downturn was driven by an external event, and the economy and the financial system were both strong before CV19 hit. He stated that eventually we will not only get back to February’s solid economy but will get to an even better one. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|