|

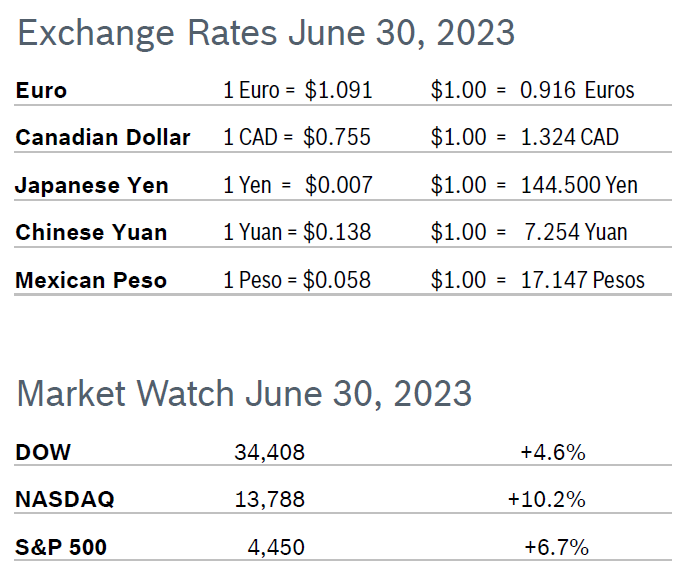

Markets ended a strong first half of the year with an end-of-the month surge that left the Nasdaq up more than 30% year to date, the best first half performance for the tech-heavy index since 1983. The S&P, the index most closely watched by professionals, gained 16% in the first half. The Dow posted a more modest 4% gain. Gains the end of June came after a strong upward revision to Q1 GDP that showed the economy is stronger than first thought. Consumer Spending Rises 0.1% Consumer spending inched up just 0.1% in May after rising a downwardly revised 0.6% in April. It was the slowest pace in more than two years. Core consumer spending was unchanged after rising a downwardly revised 0.2% in April. While a big slowdown from April, economists noted the deceleration was expected and the economy was still chugging along. Consumer spending for the first quarter was upwardly revised from the 3.7% first reported to 4.2%. Consumer Prices Rise 0.3% The Consumer Price Index (CPI) rose 0.3% in May after rising 0.4% in April. Consumer prices were up 4.0% year over year after being up 4.9% year over year in April. The year-over-year increase was the smallest since 2021 and the eleventh consecutive month that year-over-year inflation has cooled down since peaking at 9.1% in June 2022. Core inflation, which excludes the volatile food and energy categories, rose 0.1% in May after rising 0.4% in April and fell to 5.3% year over year from 5.5% year over year in April. Though inflation is gradually slowing it remains well above the Fed’s preferred level of 2.0%. The personal expenditures price index (PCE) rose 0.1% in May after rising 0.4% in April and was up 3.8% year over year, the smallest increase since April 2021. Core prices, which exclude the volatile food and energy categories, rose 4.6% year over year in May after being up 4.7% in April. Economists see core inflation as a better predictor of future inflation than overall inflation. The Fed tracks the PCE price indexes for monitoring their 2% inflation target. Consumer Confidence Rises to 109.7

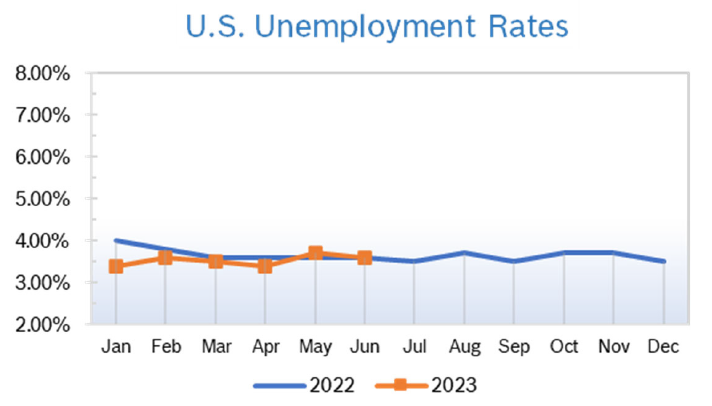

Unemployment Falls to 3.6%

Chicago PMI Rises to 41.5 The Chicago PMI rose to 41.5 in June after falling to 40.4 in May. The reading was weaker than expected. The PMI was close to 50 in April, the level that signifies expansion. The PMI has now been below 50 for ten consecutive months. A PMI number above 50 signifies expanded activity compared to the previous month. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Fall 0.3% The Producer Price Index (PPI) fell 0.3% in May after rising 0.2% in April and was up just 1.1% year over year, the smallest increase since December 2020. The PPI was up 2.3% year over year in April. It was the third decline in wholesale prices in the past five months. Stripping out volatile food and energy prices, core PPI rose 0.1% in May after rising 0.1% in April and was up 2.8% year over year after being up 3.2% year over year in April. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q1 GDP Revised Up to 2.0% Q1 GDP was revised up to 2.0% growth in the third and final reading from the Commerce Department. Growth has now been revised up twice since the initial reading of just 1.1% growth first reported. GDP grew 2.5% in the fourth quarter of 2022. Most of the growth in the first quarter came from upwardly revised consumer spending, which was revised up to 4.2% growth from the 3.7% growth first reported. Rising wages and the big bump in Social Security income also helped boost spending. Business investment in large structures jumped 16%, which could reflect new manufacturing and distribution facilities. The economy has proven surprisingly resilient and the odds of a recession are diminishing, although the Fed may still raise interest rates again to keep tamping down inflation. Fed Holds Rates Steady The Fed held rates steady at 5% to 5.25% at their meeting in mid-June after ten consecutive increases that began in March 2022 that took rates from near zero to the current level. According to meeting minutes, the Fed still wants to push inflation back down into their target range of 2% and still intends to raise rates by another half a percent by the end of the year. Fed officials more than doubled their outlook for 2023 economic growth to 1% from 0.4% projected in the March and now think unemployment will only rise to 4.1% by the end of the year compared to 4.5% in the March outlook. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|