|

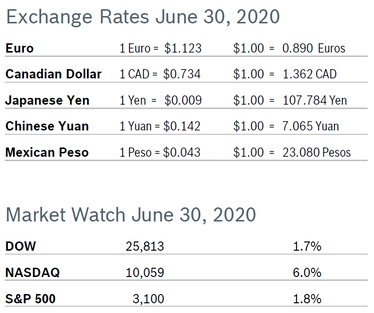

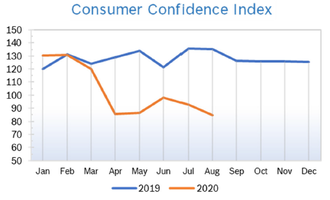

All three indexes remained in the black in June and the markets turned in the best quarter in decades, as government stimulus and low interest rates coupled with strong economic data helped markets bounce back from pandemic damage. The Dow Jones industrial average posted its strongest quarter since 1987, jumping 17.8% over the past three months. The S&P, the index most followed by economists, rose nearly 30% in the second quarter, its best quarterly gain since 1998 leaving the index only 9% off its February high. The tech-heavy Nasdaq rallied 30.6% in the second quarter, the best quarterly performance since 1999. Consumer Spending Rises 8.2% Consumer spending increased by a record 8.2% in May after plunging 12.6% in April and 6.6% in March. The sharpest increase was a 29% jump for durable goods such as autos. Spending on nondurables rose nearly 8% and spending on services rose more than 5%. Inflation edged up just 0.1% and is up a mere 0.5% over the past year, well below the Fed’s target of 2%. Personal income dropped 4.2% after increasing a stimulus-supported 10.5% in April. The federal government has pumped nearly $20 billion a week into the economy, with additional payments to the unemployed and business programs helping the economy stay afloat. The extra $600 a week in aid to the unemployed expires at the end of July, and there is no indication now that those benefits will be extended. Consumer spending accounts for 70% of US economic activity. Consumer Confidence Rises to 98.1

Consumer Prices Fall 0.1% The Consumer Price Index (CPI) fell 0.1% in May after falling 0.8% in April and was up just 0.1% year over year after being up 0.3% year over year in April. Excluding the volatile food and energy components, the CPI slipped 0.1% in May after decreasing 0.4% in April, the largest drop since the series started in 1957. The core CPI fell in March for the first time since January 2010. May marked the first time that the core CPI has dropped for three consecutive months. In the 12 months through May, the core CPI rose 1.2%, the smallest gain since March 2011. The Labor Department said in-store data collection had remained suspended since March 16 because of risks of exposure to CV19. The department added that data collection last month was also impacted by the fact that many establishments were closed or operating under restrictions that caused prices to be temporarily unavailable. Many indexes are being based on less data than usual, and a small number of indexes that are normally published were not published at all in May. Unemployment Falls to 11.1%

Job Openings Continue to Fall The number of job openings dropped again in April, falling by 965,000 jobs to 5.0 million after falling to 6.2 million in March, according to the most recent Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). Layoffs and discharges decreased by 4.8 million in April after jumping by 9.5 million in March. The layoffs and discharges rate fell to 5.9% in April after hitting a record high of 7.6% in March. Hires dropped to a series low of 3.5 million. Layoffs and discharges increased by 85,000 in construction and 338,000 in retail. The BLS warned that the pandemic is affecting their ability to collect reliable data. Chicago PMI Rises to 36.6 The Chicago Purchasing Managers Index (Chicago PMI) inched up to 36.6 in June after falling to 32.3 in May. It was the twelfth consecutive sub-50 reading for the index. Among the five indicators, Production and New Orders saw the largest monthly gains, while Supplier Deliveries and Employment fell back. New Orders rose for the month but was down 20.1 points for the quarter. Production saw the biggest jump in June, rising by 10.1 points, but remained at a series low for the quarter. Prices Paid rose 2.7% in June but fell 4.9% on a quarterly basis. Many companies noted the elevated cost of air freight from Asia. The special question asked in June regarded personnel plans for the rest of the year. The majority (55.8%) plan a hiring freeze and 23.3% expect to lay off employees. However, 18.6% plan to expand their workforce. Looking all the way back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.4% The Producer Price Index (PPI) rose 0.4% in May after falling 1.3% in April. In the 12 months through May the PPI has fallen 0.8%. Core producer prices, which exclude food, energy, and trade services, fell 0.1% in May after plunging 0.9% in April and were up 0.3% year over year. May’s gain in wholesale prices helped alleviate concerns that deflation could set in. Q1 GDP Shrinks 5.0% The first-quarter drop in Q1 GDP was unrevised at 5.0%, according to the third and final reading from the Commerce Department, which initially reported a 4.8% drop in Q1 GDP. The economy was shut down for just two weeks during the first quarter; economists believe GDP plunged about 30% during those two weeks. Analysts expect GDP to take a much bigger hit during the second quarter. While overall GDP was unchanged, the composition shifted slightly, with downward revisions to consumer spending, exports and business inventories offset by an upward revision to business investment. Fed Pledges Low Rates, Support The Fed made no major policy changes at their meeting in early June but is prepared to do whatever it takes to support the US economy, promote maximum employment and assure price stability. The FOMC sees real GDP contracting 6.5% in 2020 and expects the unemployment rate to still be above 9% in the fourth quarter. They look for GDP to rebound about 5.0% in 2021 and expect unemployment to end the year at 6.5%. The rate of PCE inflation is expected to remain well below the Fed’s target of 2% through 2022, which means there would be no need for the Fed to hike rates through 2022. US Economy in Recession The longest expansion (more than ten years) on records dating back to 1854 came to an end in February as the economy officially entered a recession, according to The National Bureau of Economic Research (NBER). The NBER, a private research group led by the nation’s top economists, has long been considered the official arbiter for determining when business cycles start and end. A recession is typically defined as two straight quarters of negative GDP, but the NBER has leeway to take into account the depth of a contraction, how quickly it occurs and how much of the economy is affected. With all states reopening again to some degree or another, analysts say the economy has probably started to recover, and technically a new expansion might already be underway, which would make it one of the shortest recessions on record. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|