|

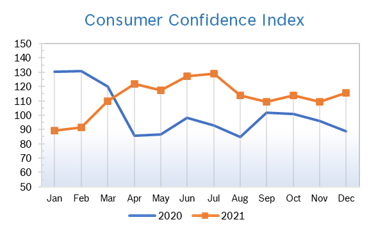

All three indexes notched gains for December and record gains for the year despite economic uncertainty created by the surging Omicron variant, persistent inflation and supply chain and labor problems. Analysts’ views of the year ahead run the gamut from a continuation of the boom to the biggest decline in years. *annual gain for 2021. Consumer Spending Rises 0.6% Consumer spending rose 0.6% in November after climbing an upwardly revised 1.4% in October. Personal incomes, which fuel consumer spending, fell 1% in September, the steepest decline in four months. Wages jumped 0.8% after rising 0.4% in August, a reflection of the tight job market and the extraordinary measures employers are taking to attract and retain workers. The economy is still being hamstrung by CV19 issues and supply chain problems. For the third quarter, consumer spending, which fuels 70% of overall economic activity, weakened to an annual growth rate of just 1.6%. Consumer Prices Rise 0.8% The Consumer Price Index (CPI) rose 0.8% in November after rising 0.9% in October and was up 6.8% year over year. Core inflation, which excludes the volatile food and energy categories, climbed 0.5% in November after rising 0.6% in October and was up 4.9% year over year, the biggest increase since 1982. Prices increased across most categories, with big jumps in groceries, gasoline, energy costs, new and used vehicles, furniture and appliances and rent. The personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, climbed 0.6% in November after rising 0.4% in October. The core PCE was up 4.7% year over year. The core PCE price index is the Fed's preferred measure for its 2% inflation target, which is now a flexible average. Supply chain constraints and disruptions are expected to keep inflation elevated into 2022. Consumer Confidence Rises to 115.8

Unemployment Falls to 3.9%

Job Openings Surge US job openings surged to 11.0 million in October after holding steady at 10.4 million at the end of September, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). Hiring dropped by 82,000 jobs to 6.5 million and layoffs fell by 35,000 to 1.36 million. Quits dropped by 205,000 to a still-elevated 4 million in October and the quits rate fell to 2.8% from 3.0% in September. Demand remains high and businesses continue to report that finding qualified workers is very challenging. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 63.1 The Chicago Purchasing Managers Index (Chicago PMI) rose to 63.1 in December after falling to 61.8 in November. It was the 18th consecutive month the index remained in positive territory. After dropping sharply in November, New Orders rose more than 8 points to 66.5. Inventories rose for the third consecutive month, reaching 62.7. Prices Paid dropped 4.2 points to a 7-month low of 85.6. Prices Paid hit a 42-year high in October. The majority of firms said their biggest problems were supply shortages, labor shortages and managing logistics. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Jump 0.8% The Producer Price Index rose 0.8% in November after rising 0.6% in October and was up 9.6% year over year, the highest increase since the federal government started tracking this data in 2010. Core inflation, which excludes the volatile food and energy categories, rose 0.8% in November and was up 9.5% from November 2020. The prices of both goods and services went up, with rising prices for gasoline, food, iron and steel contributing to much of the increase. Q3 GDP Rises 2.3% US economic growth in the third quarter was revised up to 2.3% in the third and final reading from the Commerce Department. Growth was initially reported at 2.0% and subsequently revised up to 2.1%. The relatively weak showing was due to restrictions and other issues resulting from a resurgence of CV19 cases. The revision reflected a bit more consumer spending and business inventory investment than previously estimated. That upward revision partially offset a downward revision to exports. Economists polled by Reuters had forecast third-quarter GDP growth would be unrevised at a 2.1% pace. The economy grew at a 6.7% rate in the second quarter. Last quarter's slower pace of growth reflected the strained global supply chain and the decline in pandemic relief money. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|