|

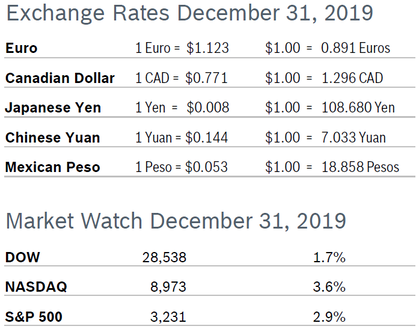

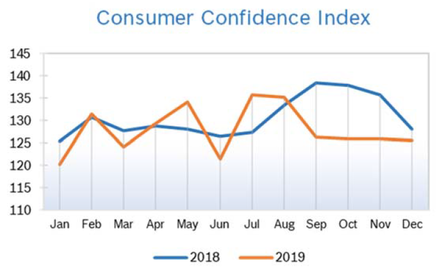

The major indexes all posted strong gains for the month of December, the fourth quarter, the fiscal year and the decade. The DOW was up 1.7% for December, 6% for the quarter, 22% for the year and 174% for the decade. The NASDAQ rose 3.6% for the month, 12% for the quarter, 35% for the year and 295% for the decade. And the S&P, the index most followed by analysts and economists, rose 2.9% in December, 8.6% for the quarter, 29% for the year and 190% for the decade. The current market is now the longest bull market run in history. Consumer Spending Rises 0.4% Consumer spending rose 0.4% in November after rising 0.3% in October, matching economists’ expectations. It was the eighth consecutive monthly increase for consumer spending. Spending rose on both goods and services, and household income rose a strong 0.5% after inching up just 0.1% in October. Wells Fargo expects consumer spending to moderate but not decline in 2020. Consumer spending accounts for more than two-thirds of US economic activity. Consumer Confidence Falls to 126.5

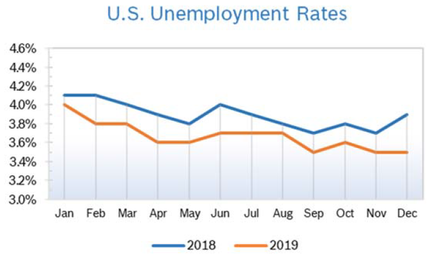

Consumer Prices Rise 0.3% The Consumer Price Index (CPI) rose 0.3% in November after rising 0.4% in October. The year-over-year CPI increase rose 2.1% in November after being up to 1.8% in October. Excluding the volatile food and energy categories, core prices rose 0.2% for the second consecutive month and were up 2.3% from a year ago. Gains were widespread, with no single category accounting for the majority of the increase. The PCE deflator shows year-over-year inflation of roughly 1.5% on both the headline and the core measure. According to Wells Fargo, the headline figure will rise this year due to the timing of the slide in oil prices, but on balance the inflation picture should remain supportive of the Federal Reserve remaining on hold. PCE is the Fed’s preferred measure of inflation. Unemployment Steady at 3.5%

Job Openings Rise The number of job openings rose to 7.27 million in October after falling to 7.0 million in September, according to the most recent Job Openings and Labor Turnover Survey (JOLTS) from the U.S. Bureau of Labor Statistics. Job openings were ahead of expectations for 7 million. Job openings reached a peak of 7.6 million in November 2018. Job openings in October were led by the retail trade sector, which saw an increase of 125,000 unfilled jobs. The job openings rate increased to 4.6% in October from 4.4% in September. Hiring decreased by 187,000 jobs to 5.76 million in October, concentrated in the private sector and the hiring rate dipped to 3.8% from 3.9% in September. The number of workers voluntarily quitting increased by 41,000 jobs to 3.51 million in October. The quits rate was unchanged at 2.3%. The quits rate is viewed by policymakers and economists as a measure of job market confidence. Chicago PMI Rises to 48.9 The Chicago Purchasing Managers Index (Chicago PMI), rose 2.6 points to 48.9 in December after rising to 46.3 in November. It was the highest level for the PMI since September. Among the major components, supplier deliveries and production led the increase, rising to 55.4 and 47.2, respectively. Production rose 4.9 points to 47.2, hitting the highest level since August. However, demand slowed, and new orders fell slightly to 49.1. After dropping to an almost four-year low in October, order backlogs picked up in November and increased further in December, leaving the index at a three-month high of 46.2. Inventories remained in contraction for the fifth consecutive month in December but strengthened by 4.4 points to 47.4. Wholesale Prices Flat The Producer Price Index (PPI) was flat in November after rising 0.4% in October and was up 1.1% year over year. Core producer prices, which exclude food and energy, were also flat in November after inching up 0.1% in October and fell to just 1.3% year over year. The wholesale cost of services dropped 0.3%, the biggest decline in the price of services since 2017, which offset a 0.3% increase in prices of goods. Analysts commented that the November PPI confirms that price pressures in the inflation pipeline are still easing and that means the Fed will most likely leave interest rates unchanged for the foreseeable future. Q3 GDP Grows 2.1% Q3 GDP grew 2.1%, according to the third and final estimate from the Commerce Department. Consumer spending was upwardly revised to a 3.2% annual rate from 2.9% first reported. Business investment dropped less than first reported, contracting 2.3% rather than 2.7%. Growth in residential investment was lowered to 4.6% from the 5.1% pace estimated in October. Inventory building was less than estimated, so inventories were neutral to GDP growth rather than adding 0.17% as previously reported. Tariffs Rolled Back in Phase One Deal President Trump suspended a planned increase in US tariffs on $156 billion of Chinese exports that was scheduled to take effect in mid-December as the US and China reached a phase one agreement. The news cheered both markets and the international community, which expects the deal to be good for the global economy. The US also agreed to halve the tariff rate, to 7.5%, on $120 billion worth of Chinese goods and China agreed to buy more farm goods from the US. US agricultural exports to China have plunged more than $10 billion since 2018. However, many manufacturers are still saddled with a 25% tariff on $250 billion in Chinese goods that remains in place. Fed Forecast for 2020 The Federal Reserve sees no interest rate cuts or hikes in 2020 after holding rates steady at their last meeting of the year in mid-December. The decision was based on a healthy job market and inflation that is solidly under control. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.to edit.

Comments are closed.

|

|