|

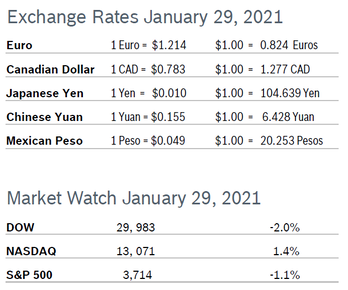

Markets ended the month with a roller-coaster performance that resulted in the worst week for the indexes since last October. Stocks had rallied to record highs on hopes that vaccines would smooth the way for the economy to recover and the country to return to a degree of normalcy by the end of the year. But the rollout is going slowly and Johnson & Johnson’s one-dose vaccine is less effective than hoped. Much of the volatility was due to a retail trading frenzy that pitted Robinhood’s small investors against big hedge funds, pushing some retail stocks to dizzying heights for no sound reason. There is some feeling that the market is overheated and there is too much leverage in the system. Consumer Spending Falls 0.2% Consumer spending fell 0.2% in December after falling a downwardly revised 0.7% in November. It was the second consecutive monthly decline in consumer spending, which had been rising since April. With new CV19 cases accelerating in much of the country, many states are adopting new restrictions and have closed or limited hours and capacity at retailers and restaurants and curtailed events and gatherings. Personal incomes rose 0.6% in December after declining the previous two months. Consumer spending accounts for 70% of US economic activity. Consumer Prices Rise 0.4% The Consumer Price Index (CPI) rose 0.4% in December after rising 0.2% in November. Core inflation, which excludes the volatile food and energy categories, rose 0.1% in December and was up 1.6% over the past 12 months. The overall increase was driven by a sharp rise in gasoline prices, which remain well below year ago prices. Wells Fargo expects inflation to firm up over 2021 as consumer spending rebounds during the second half of the year. Personal consumption expenditures (PCE), the Fed’s preferred measure of inflation, rose 0.4% in December after no change in October and November and were up 1.3% year over year, well below the Fed’s 2% target. Economists think it will be quite some time before inflation returns to a pace consistent with the Fed’s target of 2% and remains there. Consumer Confidence Rises to 89.3

Unemployment Drops to 6.3%

Job Openings Fall 1.6% U.S. job openings fell 1.6%, or 105,000 jobs, to 6.5 million at the end of November, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). It was the first drop in job openings since August. Layoffs soared 17.6% to 1.9 million, driven primarily by a big jump in job cuts at restaurants, bars and hotels. The quits rate was unchanged at 2.2% in November as 3.2 million people quit their jobs. There were 1.6 unemployed workers for every vacancy in November. While job openings declined in manufacturing, jobs in retail went unfilled. Wells Fargo notes that at one point job openings were down 31% year over year. Wells Fargo said that due to the relatively small sample-size, JOLTS may be painting a distorted picture, as response is coming from stronger businesses that have kept their doors open and are responding to the survey. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 63.8 The Chicago Purchasing Managers Index (Chicago PMI) rose to 63.8 in January after rising to 59.5 in December and remained in positive territory for the seventh consecutive month after spending a full year below 50. New Orders jumped 7.9 points and Production soared 9.9 points as business activity picked up. Prices Paid increased for the fifth consecutive month, rising 1.7 points to the highest level since 2018, with firms reporting higher prices for metals. The special question asked if the recent increase in CV19 cases was negatively impacting their business. Half of respondents reported a mild negative impact, about a third reported no impact and 16% said it had had a strong negative impact. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.3% The Producer Price Index (PPI) rose 0.3% in December after rising 0.1% in November. The increase was slightly below expectations and primarily driven by a spike in energy prices. The PPI has risen for six consecutive months, but at a very slow pace. In the 12 months through December the PPI rose 0.8% after being up 0.8% year over year in November. Excluding the volatile food, energy and trade services components, producer prices rose 0.1% in December for the third consecutive month and were up 1.2% over the past twelve months. Over the past 12 months the PPI for inputs to new residential construction has jumped 6.6%, driven by climbing prices for many of the materials used in construction. Regardless, strong demand from builders and remodelers may keep prices high, according to Data Digest from the Associated General Contractors of America (AGC). Analysts noted that while pandemic-related price distortions are reversing, the trend in inflation is expected to remain subdued for some time. Q4 GDP Rises 4% GDP grew 4.0% in the fourth quarter, slightly below expectations, according to the first reading from the Commerce Department. For the full year the economy shrank 3.5%, the sharpest annual decline in GDP since 1946. Consumer spending increased 2.5% in the fourth quarter after jumping 41% in the third quarter as restaurants promoted outdoor dining. That segment has since declined due to cold weather in much of the country. Business investment climbed 13.8% in the fourth quarter after rising 22.9% in Q3. Spending on computers is one of the things pushing up business investment as many firms buy technology so employees can work remotely and consumer upgrade their tech and add devices. Spending on factory equipment also rose as companies upgrade and expand so they can produce more goods to meet demand. Businesses are continuing to restock. Residential investment jumped, with housing construction rising 33.5% after a 63% gain in Q3. Exports and imports both increased more than 20%. Government spending dropped at all levels as states and cities dealt with pandemic- related costs and falling revenues. Analysts expect growth to slow to 2.3% in the first quarter of 2021 despite the vaccine rollout as cases remain high and restrictions remain in place. Some analysts are predicting GDP could contract in the first quarter before beginning to recover as vaccines become more widely available and consumer spending picks up. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|