|

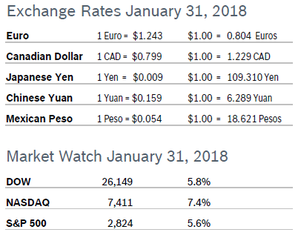

All three indexes posted strong gains for January, although the market run stalled toward the end of the month as investors grew wary that the Fed might raise rates at their March meeting. The DOW rose 5.8% for the month, closing at 26,149; the tech-heavy NASDAQ rose 7.4%, closing at 7,411 and the S&P, the index most closely followed by economists, rose 5.6%, closing at 2,824. Consumer Confidence Rises to 125.4 The New York-based Conference Board’s Consumer Confidence Index rose to 125.4 in January from an upwardly revised 123.1 in December. The Present Situation Index declined slightly, falling to 155.3 from 156.5. The Expectations Index increased to 105.5 after falling to an upwardly revised 100.8 in December. The Conference Board noted that despite the decline the level of confidence remains historically high among consumers, although there was some ambivalence about the future in the latest survey, possibly because consumers are unsure of how the new tax plan will affect them. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.4% Consumer spending rose 0.4% in December after rising an upwardly revised 0.8% in November. Core consumer spending rose 0.3% in December after rising 0.4% in November. Personal incomes rose 0.4% in December after rising 0.3% in November, and wages increased 0.5%. Savings fell to $351.6 billion, the lowest level since December 2007. The savings rate dropped to 2.4%, the lowest rate since September 2005. For all of 2017 the savings rate fell to 3.4%, the lowest level since 2007, and down from 4.9% in 2016. The Federal Reserve's preferred inflation measure, the personal consumption expenditures (PCE) price index excluding volatile food and energy prices, rose 0.1% in November after gaining 0.2% in October. The core PCE price index was up 1.5% in the 12 months through November, picking up from 1.4% in October. It has undershot the Fed's 2% target since mid-2012. Shipments of non-defense capital goods orders excluding aircraft, which is a closely watched proxy for business spending and calculates into GDP, rose 0.3% after surging 1.3% in October. Consumer spending is closely watched by economists because it accounts for 70% of U.S. economic activity. Consumer spending is closely watched by economists because it accounts for 70% of U.S. economic activity. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose 0.1% in December after rising 0.4% in November. Gains were tempered by a fallback in energy costs as gasoline prices fell 2.7%. The CPI was up 2.1% from December 2016. Core inflation, which excludes food and energy, rose 0.3% in December after rising 0.1% in November and was up 1.8% year over year. Core inflation has consistently been below the Fed’s target of 2%. The Fed’s preferred inflation measure, the personal consumption expenditures (PCE) price index excluding food and energy has undershot its target of 2% since May 2012. While core inflation is still running below the Fed’s target of 2% the recent trend has been strengthening, with core inflation up 2.5% over the fourth quarter. Unemployment Unchanged at 4.1% The unemployment rate was unchanged at a 17-year low of 4.1% in January and the economy added 200,000 new jobs, well ahead of economists’ expectations. Average hourly earnings rose nine cents, or 0.3%, in January to $26.74, building on December's solid 0.4% gain. That boosted the year-on-year increase in average hourly earnings to 2.9%, the largest rise since June 2009. Wage growth last month was likely supported by increases in the minimum wage which came into effect in 18 states in January. Further gains are expected in February when Walmart raises entry-level wages for hourly employees at its U.S. stores. Annual wage growth is now close to the 3% that economists say is needed to push inflation towards the Federal Reserve's 2% target. Employment gains were widespread in January. Construction payrolls increased by 36,000 jobs after rising 33,000 in December. Retail employment rebounded by 15,400 jobs in January after slumping 25,600 the prior month. Government employment increased by 4,000 jobs following two straight months of declines. There were also increases in payrolls for professional and business services, leisure and hospitality as well as healthcare and social assistance. Economists expect job growth to slow this year as the labor market hits full employment, which will most likely boost wage growth as employers are forced to compete for workers. Wage growth was likely supported by increases in the minimum wage which came into effect in 18 states in January. Further gains are expected in February when Walmart raises entry-level wages for hourly employees at its U.S. stores. Annual wage growth is now close to the 3% that economists say is needed to push inflation towards the Federal Reserve's 2% target. Employment gains were widespread in January. Construction payrolls increased by 36,000 jobs after rising 33,000 in December. Retail employment rebounded by 15,400 jobs in January after slumping 25,600 the prior month. Government employment increased by 4,000 jobs following two straight months of declines. There were also increases in payrolls for professional and business services, leisure and hospitality as well as healthcare and social assistance. Economists expect job growth to slow this year as the labor market hits full employment, which will most likely boost wage growth as employers are forced to compete for workers. Durable Goods Orders Rise 2.9% Durable goods orders increased 2.9% in December to $249.4 billion after increasing an upwardly revised 1.7% in November. Orders were boosted by a 15.9% surge in orders for commercial aircraft. Excluding the volatile transportation category, new orders increased 0.6% after rising an upwardly revised 0.3% in November. Excluding defense, new orders increased 2.2%. Orders for non-defense capital goods excluding aircraft, a closely watched indicator of business spending, fell 0.3% in December after falling 0.1% in November. Shipments in the same category, which factor into GDP, rose a solid 0.6% in December after rising 1.0% in November. Shipments of core capital goods have now risen for eleven consecutive months. Orders for durable goods were up 5.8% for the full year of 2017, the best showing in six years. The durable goods report is volatile and often subject to sharp revisions Chicago PMI Falls to 65.7 The Chicago Purchasing Managers’ Index (PMI) fell to 65.7 in January after rising to 67.6 in December. The PMI was up 28.3% compared to January 2017. Three of the five components fell for the month, with New Orders falling to a five-month low and accounting for most of the PMI’s decline. Production and Order Backlogs also fell. Prices Paid accelerated, rising to the highest level since September. Steel, wood and resin were all cited as having increased in price. In January, firms were asked how the expected interest rate increase would affect their business. Most thought it would have no effect, with just 3.8% feeling they would be hindered by higher rates. Firms were also asked how they thought the tax reform bill, which was still pending at the time of the survey, would affect them. A majority, 63.5%, thought that everyone would benefit from less red tape; just under 6% felt it would be bad for both their business and the US economy. Wholesale Prices Fall 0.1% The producer price index (PPI) fell 0.1% in December, the first drop in headline prices since August 2016. The PPI for final demand slipped 0.1%. The decline followed two consecutive monthly increases of 0.4%. In the 12 months through December, the PPI rose 2.6% after accelerating 3.1% year over year in November. It was the fastest pace of annual increase in six years. Economists had expected the PPI to increase 0.2%. Core producer prices, which exclude food, energy and trade services, edged up 0.1% in December after rising 0.4% in November. Core PPI was up 2.3% from December 2016. Q4 GDP Rises 2.6% GDP grew 2.6% in the fourth quarter, below economists’ expectations, after growing 3.2% in the third quarter. The economy grew 2.3% in 2017, up from 1.5% in 2016 but below President Trump’s targeted growth of 3%. Consumer spending rose a robust 3.8% in the fourth quarter, the fastest pace since fourth quarter 2014 and up from 2.2% growth in the third quarter. The savings rate fell to 2.6% from 3.3% in the third quarter. Imports grew 13.9%, the fastest pace since the third quarter of 2010. International trade trimmed 1.13% from GDP after adding 0.36% in the third quarter. Robust consumer spending limited the accumulation of inventories, which subtracted 0.67% from GDP growth. Business spending on equipment rose 11.4% and investment in new housing jumped 11.6%. Accelerating consumer spending also raised inflation, with the personal consumption expenditures (PCE) excluding food and energy, rising 1.9%, the fastest pace in more than a year. Signs of rising inflation coupled with a tightening labor market could cause the Fed to raise interest rates more aggressively than expected. The Fed has forecast three interest rate hikes this year, the same number as in 2017. Despite failing to hit 3% growth for the year, economists generally agreed that 2017 was one of the best years for the economy in recent years. Job Openings Fall Job openings fell by 46,000 to a seasonally adjusted 5.88 million in November, the lowest level since May. The job opening rate was 3.8%, a drop from October’s rate of 3.9%. It was the second consecutive month job openings declined. Hiring dropped by 104,000 to 5.49 million in November and the hiring rate fell to 3.7% from 3.8%. Economists expect job growth this year to slow well below the 2017 average of 170,000 jobs per month as the labor market hits full employment. The unemployment rate is at a 17-year low of 4.1% and economists expect it to drop to 3.5% by the end of 2018. Job openings in what has been the troubled retail sector rose by 88,000 in November. Retail lost 67,000 jobs in 2017 as many retailers closed stores and cut staff. Layoffs fell by 7,000 to 1.67 million in November, the lowest level since May. The number of people quitting their jobs dropped slightly, but the quits rate was unchanged at 2.2%. The JOLTS report is expected to remain one of the Fed’s preferred economic indicators even though Fed Chair Janet Yellen’s term expires in February. Economic Growth Forecast S&P Global Ratings raised its short-term economic growth forecasts for the US, citing a modest boost from the tax reform law. According to S&P, the new tax package will increase real annual US GDP growth in 2018 and 2019 by close to 0.35 points. S&P expects the economy to expand by 2.8% this year and 2.2% next year, up from previous forecasts of 2.6% growth this year and 1.9% next year. S&P said that less-generous deductions partially offset the lower tax rates, which are considered to be skewed toward businesses and high-income earners. S&P also forecast that the budget deficit will grow to 4.4% of GDP by 2020, up from 3.5% in 2017 and previous estimates of 3.8%. NAFTA and the Economy Pulling out of the North Atlantic Free Trade Agreement (NAFTA) would have a sharp short-term impact on the economy, cutting real GDP growth by 25% to 1.5% compared to the 2.0% forecast and leaving the US with 300,000 fewer jobs by the end of 2019, according to Oxford Economics. However, trade accounts for less than one-third of US GDP, so the researchers report it would not weigh heavily on the economy over the long term. The report also predicts that a NAFTA withdrawal would not significantly reduce the US trade deficit, one of President Trump’s goals, but would cause the stock market to fall about 5% by 2019. However, a vast majority of economists surveyed by Reuters believe that NAFTA will probably be renegotiated successfully with only marginal changes, despite the Trump administration’s saber-rattling. Only four of 45 economists polled said they thought the deal would be terminated, with the rest expecting an updated trilateral agreement that would not differ radically from the current one. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|