|

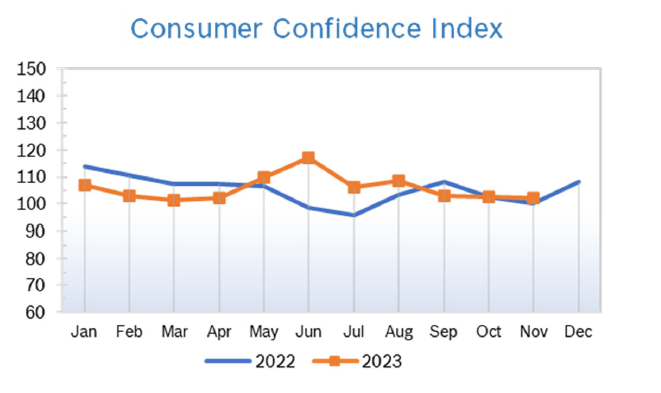

Santa came early to the markets, with the DOW closing at its highest level since January 2022 and the S&P turning in their best monthly gains since July 2022. Markets were cheered by rising confidence, falling bond yields and cooling PCE prices, which the Fed keeps a close eye on for interest rate policy. Cooling PCE makes a rate hike in December unlikely, although the Fed says it’s too early to start talking about cutting rates. Consumer Spending Rises 0.2% Consumer spending slowed in October, rising 0.2% after rising 0.7% in September. It was the slowest increase since May. The combination of ebbing income growth, high interest rates and prices, dwindling pandemic savings and the resumption of student loan payments are all eating into Americans' ability to keep spending at the pace they did over the summer, according to economists. Consumer Prices Unchanged The Consumer Price Index (CPI) was unchanged in October after rising 0.4% in September and was up 3.2% year over year after being up 3.7% year over year in both August and September. It was the first-time monthly inflation has been flat since September 2022. A big drop in volatile gasoline prices was the biggest contributor to the decline. Core inflation, which excludes the volatile food and energy categories, rose 0.2% in October after being up 0.3% in September and was up 4.0% year over year down, from 4.1% in September. The prices for core goods fell 0.1% in October after falling 0.4% in September but the prices for core services rose 0.3% after rising 0.6% in September. Price growth as measured by the personal-consumption expenditures price index (PCE), the Fed's preferred inflation gauge, remained mild in October. Core prices, which exclude volatile food and energy items, were up 3.5% from a year ago. They rose 2.5% at a six-month annualized rate, down from 4.5% in the six months through April, a dramatic improvement. The PCE still remains well above the Fed’s target of 2.0%. Inflation peaked at 9.1% in June 2022. Consumer Confidence Rises to 102.0

Unemployment Falls to 3.7%

Chicago PMI Jumps to 55.8 The Chicago PMI jumped to 55.8 in November after falling to 44.0 in October. The big increase pushed the index up over 50, the level that indicates expansion, for the first time since August 2022. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Fall 0.5% The Producer Price Index (PPI) fell 0.5% in October after rising an upwardly revised 0.4% in September and was up 1.3% year over year after being up 2.2% year over year in September. Stripping out volatile food and energy prices, core PPI rose 0.1% in October after rising 0.3% in September. Core prices were up 2.9% year over year after being up an upwardly revised 3.0% in September. It was the largest monthly decline since April 2020. The PPI peaked at a whopping 11.7% year-over-year increase in March 2022. Q3 GDP Revised Up to 5.2% GDP grew even more than first reported, increasing a strong 5.2% in the third quarter, up from 4.9% first reported, according to the second reading from the Commerce Department. Resilient consumer spending and a strong job market has helped stave off an expected downturn, despite persistently high interest rates. Nonresidential fixed investment, or business spending, was revised up to a growth rate of 1.3% from the 0.1% decline first reported. Residential investment, which generally reflects conditions in the housing market, was revised much higher, to 6.2% from 3.9%. However, consumer spending was revised down to a still-solid 3.6% from the 4% growth first reported. Economic growth is expected to slow down considerably in the final quarter. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|