|

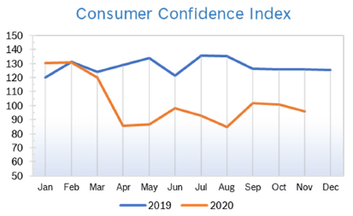

Markets soared in November despite a record surge in CV19 cases in the US and worldwide, cheered by the results of the presidential election and the news that viable vaccines are on the way. Even with a sell-off on the last business day as traders booked profits from historically strong gains, the DOW had its best month since January 1987 and the NASDAQ and S&P 500 recorded their best months since April. Analysts noted that December could be bumpy, but the mid-range outlook is encouraging. Consumer Spending Rises 0.5% Consumer spending rose 0.5% in October after rising a downwardly revised 1.2% in September. It was the smallest increase in consumer spending since April. With new CV19 cases accelerating in much of the country, many states are adopting new restrictions and analysts warn that consumer spending could slow down even more given that many government support programs have ended and Congress was unable to reach agreement on a new stimulus package. While consumers cut back spending on restaurants and travel, they spent more on automobiles, appliances and building supplies for home projects. Consumers’ incomes from all sources fell 0.7%. Consumer spending accounts for 70% of US economic activity. Consumer Prices Unchanged The Consumer Price Index (CPI) was flat in October after rising 0.2% in September and 0.4% in August. The CPI was up 1.2% year over year after being up 1.4% in September. Excluding the volatile food and energy components, core prices were also unchanged after rising in the previous two months. In the 12 months through October, the core PCE price index rose 1.6% after being up 1.4% in September. Shelter prices rose just 0.1% for the third consecutive month, with rental prices trending down. Shelter accounts for 42% of the core CPI, which should keep a lid on overall price growth. Wells Fargo expects inflation to increase but remain below the pre-pandemic trend for quite some time. Consumer Confidence Slips to 96.1

Unemployment Drops to 6.7%

Job Openings Rise in September U.S. job openings rose by 84,000 in September to 6.4 million after declining in August for the first time in four months, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). The increase was below expectations of 6.5 million. Vacancies still remain below their level of 7 million in February. Total separations, which include quits and layoffs, fell by 25,000 to 4.7 million. Separations increased in the federal government but mostly due to the temporary hiring of 2020 Census workers. The country's quits rate climbed slightly to 2.1% from 2%, while the total jumped by 179,000 to 3 million. Quits were concentrated in the construction and arts and entertainment industries. Layoffs and discharges fell to 1.3 million from roughly 1.5 million. The rate of layoffs and discharges declined to 0.9% in September from 1% in August. JOLTS is a lagging indicator, but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Falls to 58.2 The Chicago Purchasing Managers Index (Chicago PMI) fell to 58.2 in November after slipping to 61.1 in October but remained in positive territory for the fifth consecutive month after spending a full year below 50. New Orders and Production posted the only declines; Supplier Deliveries saw the biggest gain. New Orders fell for the first time since May, dropping by more than five points to its lowest level since August. Prices Paid jumped almost ten points in November to the highest level in more than two years. Two special questions were asked in November. The first was whether the pandemic had affected employee productivity. The majority, 55.4%, reported no change, while 32% saw productivity rise between 1% and 10%. The second question asked whether the results of the presidential election would impact their business forecast; 73% of respondents did not foresee any direct impact on their forecast. The remainder of responses were closely divided between a positive effect and a negative one. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 0.3% The Producer Price Index (PPI) rose 0.3% in October after rising 0.4% in September. The increase was slightly ahead of expectations, and partly due to a jump in food prices. The PPI has risen for four consecutive months. In the 12 months through October the PPI rose 0.5%. Excluding the volatile food, energy and trade services components, producer prices rose 0.1% in October after rising 0.4% in September and was up 1.6% year over year. The uptick in core prices came as prices for final demand services rose by 0.2% in October following a 0.4% increase in September. The wholesale cost of goods increased 0.4%, boosted by a 14.7% increase in the price of iron and scrap. Analysts noted that while pandemic-related price distortions are reversing, the trend in inflation is expected to remain subdued for some time. Q3 GDP Unrevised at 33.1% GDP was unrevised at a record annualized rate of 33.1%, according to the second estimate from the Commerce Department. The big increase in GDP was widely anticipated and driven by a 40.7% increase in personal consumption expenditures, which reflects the reopening of the economy. Consumer spending on goods has been much stronger than spending on services, most likely because many services involve close personal contact. Nevertheless, personal spending on services rose a solid 38.4% in Q3 after plummeting 41.8% in Q2. Other areas of strength included business spending on equipment, which jumped 70.1% and easily offset the 35.9% drop in the second quarter. Residential construction soared 59.3%, but nonresidential construction spending fell 14.6%, the fourth consecutive quarterly decline for this spending component. Growth in the fourth quarter is expected to slow sharply, with analysts predicting that GDP will grow at an annualized rate around 6%, assuming that severe CV19 restrictions are not put back in place. Analysts remain concerned that a full business recovery could take longer as the virus resurges and many business sectors remain under pressure. FOMC Stands Pat The Fed made no major policy changes when the Open Market Committee (FOMC) met in early November. They maintained the target range for the fed funds rate between 0.00% and 0.25% and kept the Fed’s monthly pace of Treasury securities and mortgage-backed securities unchanged at $80 billion and $40 billion, respectively. The decision to stand pat was unanimous. USPS Asks for Rate Increase The USPS has proposed raising Priority Mail and Priority Mail Express prices the end of January, 2021. The rate increase would impact the postal service’s popular flat rate package rates and Priority Mail Express services. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|