|

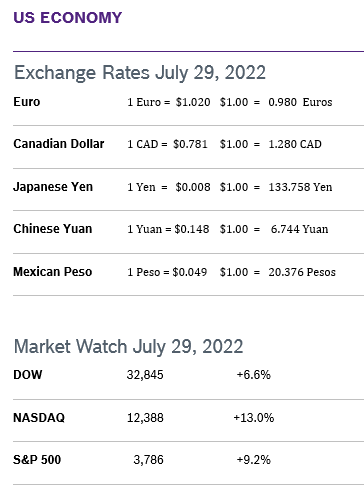

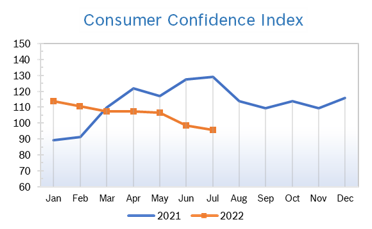

Markets turned in a winning month despite another quarter of negative GDP, high inflation and worries about the ongoing war with Ukraine. Strong corporate earnings and signals that inflation may have peaked and the Fed may take it’s foot off the gas cheered markets. Consumer Spending Rises 1.1% Consumer spending rose a robust 1.0% in June after rising an upwardly revised 0.3% in May. Incomes rose 0.6% for the month and are up sharply over the past year, but not enough to keep up with inflation. Gas prices fell sharply in July, but overall prices are still much higher than a year ago. The savings rate fell to a 13-year low of 5.1% in June from 5.5% in May. Families seem to be slowly drawing down their savings to cope with higher prices. Spending on goods dropped again and spending on services rose modestly. Consumer Prices Rise 1.1% The Consumer Price Index (CPI) rose 1.1% in June to a new 40-year high of 9.1% year over year. Core inflation, which excludes the volatile food and energy categories, rose 0.7% after rising 0.6% in both April and May, but fell to 5.9% year over year after rising to 6.2% in May. There were big increases in food, shelter and gasoline. Excluding the volatile food and energy components, the PCE price index shot up 0.6% after climbing 0.3% in May and was up 4.8% year over year in June up from 4.7% in May. The PCE price indexes are the Fed's favored measures for their 2% inflation target. Consumer Confidence Falls to 95.7

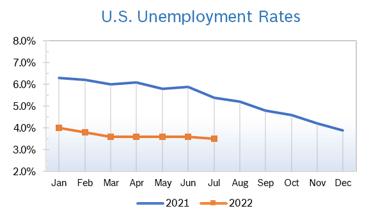

Unemployment Falls to 3.5%

Chicago PMI Falls to 52.1 The Chicago PMI fell to 52.1 in July from 56 in June. It was the lowest reading since August 2020, and well below expectations. The index has tumbled almost 20 points from last year’s June reading. Nevertheless, it was the 25th consecutive month the index has remained in positive territory. A PMI number above 50 signifies expanded activity over the previous month. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 1.1% The Producer Price Index rose 1.1% in June after rising 0.8% in May and was up a record-setting 11.3% year over year after being up 10.8% year over year in May. The increase was broad-based, with the indexes for gasoline, shelter, and food being the largest contributors. The energy index rose 7.5% over the month and contributed nearly half of the increase, with the gasoline index rising 11.2% and the other major component indexes also rising. The index for all items less food and energy rose 0.7% in June after increasing 0.6% in the preceding two months. Core inflation, which excludes the volatile food and energy categories, climbed 0.5% in May after rising 0.6% in April and was up 8.3% from May 2021. Producer prices surged nearly 18% for goods and nearly 8% for services compared with June 2021. Q2 GDP Shrinks 0.9% GDP shrank 0.9% in the second quarter after dropping 1.6% in the first quarter, according to the Commerce Department. While back-to-back quarters of negative GDP growth is typically considered a recession, many economists say that while the economy is slowing, strong job growth and consumer spending don’t indicate a wide-spread recession. Consumer spending was a bright spot, rising at a 1.0% annualized pace. Spending was driven by services as consumers transition away from goods. Trade provided another bright spot in the report. Exports rose at a robust 18% annual rate, as demand picked up for American-made goods and more international travelers returned to the US after pandemic disruptions. Americans still have relatively healthy balance sheets thanks to all that stimulus money. According to Moody's Analytics, excess savings totaled $2.5 trillion in May. Fed Raises Rates by 0.75% The Fed raised rates by 0.75% to a range of 2.25% to 2.5% at their meeting in mid-July. The second consecutive monthly increase of three-quarters of a point was supported unanimously by the 12-member board and was widely expected. The Fed board is using the only tool it has now to try and tamp down inflation and demonstrate their conviction that the economy is strong enough to continue to recover without further support from the Fed. Traders generally see the benchmark rate ranging between 3.25% and 3.50% by the end of the year, rates that are still quite low by historical standards. The Fed sees inflation topping 5% by the end of the year before rapidly falling back in the wake of aggressive rate hikes. However, they also indicated the pace of current increases will be based in part on data coming in about the economy, which they characterized as “softening.” The committee's median forecast for the unemployment rate in 2022 rose to 3.7% from 3.5%. The rate is then seen rising to 3.9% in 2023 and 4.1% the following year. The outlook suggests the Fed's efforts to cool inflation will have some adverse effects on the labor market. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|