|

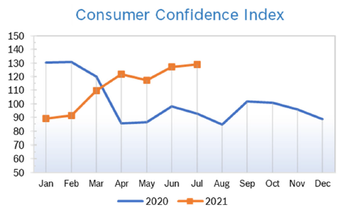

It was a choppy and volatile month for the markets, with some big one-day declines as well as quick recoveries as markets dealt with rising cases of the Delta variant, balanced by weaker than expected GDP and strong consumer spending. Consumer Spending Rises 1.0% Consumer spending rose 1.0% in June after falling a downwardly revised 0.1% in May. Consumer spending grew at a robust annualized rate of 11.8% in the second quarter, accounting for much of the 6.5% growth in GDP. Personal incomes rose 0.1% in June after falling 2.0% in May and tumbling 13.1% in April. Spending increased in both goods and services in June. Going forward, analysts expect consumer spending growth to remain strong as the services sector continues to normalize. Consumer Prices Rise 0.9% The Consumer Price Index (CPI) rose 0.9% in June after rising 0.6% in May and was up 5.4% year over year. It was the biggest monthly increase in inflation since 2008, and far exceeded analysts’ estimates. Core inflation, which excludes the volatile food and energy categories, rose 0.5% in June after rising 0.7% in May and was up 4.5% from June 2020. Consumers are seeing higher prices in many categories, particularly in categories that were depressed during the pandemic, including vehicles, rental cars, airline tickets and hotels. Shortages of supplies and labor are also driving up leisure, entertainment and restaurant prices. Personal consumption expenditures (PCE) price index excluding the volatile food and energy component rose 0.4% in June after rising 0.5% in May and was up 3.5% year over year, the largest gain since April 1992. The core PCE price index is the Fed's preferred inflation measure for its 2% target, which is now a flexible average. The Fed remains convinced inflation is transitory and is more focused on the employment situation. Consumer Confidence Rises to 129.1

Unemployment Falls to 5.4%

Job Openings Inch Up US job openings inched up to a new record high of 9.2 million in May and hiring fell slightly, according to the latest Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics (BLS). It was the highest number of job openings on record and up substantially from the pandemic low of under 5 million jobs. Hiring dipped to 5.9 million after holding steady at 6.0 million in April. Quits fell to 3.6 million after rising to a record high of 4 million in April. The quits rate is normally viewed by policymakers and economists as a measure of job market confidence. The quits rate now accounts for more than two-thirds of all job separations and remains well above pre-pandemic levels. JOLTS is a lagging indicator but is closely watched by the Federal Reserve and factors into decisions about interest rates and other measures. Chicago PMI Rises to 73.4 The Chicago Purchasing Managers Index (Chicago PMI) jumped to 73.4 in July after falling to 66.1 in June. It was the 13th consecutive month the index remained in positive territory. Production jumped 8.8 points and New Orders rose 5.4 points, signaling strong demand. Prices Paid eased 0.3 points but high prices remained an area of great concern to survey respondents. Looking back to when the series began in 1967, the PMI has ranged from 20.7 in June 1980 to 81.0 in November 1973. Wholesale Prices Rise 1.0% The Producer Price Index rose 1.0% in June after rising 0.8% in May. The increase was above expectations and marked the sixth consecutive monthly increase in wholesale prices. Prices were up 7.3% from June 2020 after being up 6.6% year over year in May. Core inflation, which excludes the volatile food and energy categories, rose 0.5% in June after rising 0.7% for the previous three months and was up 5.5% year over year, the largest year-over-year gain since reporting began in 2014. Prices are being driven up by substantial increases in wholesale food prices and energy, both of which are stripped out of core prices. Analysts noted that year-over-year inflation numbers will consistently be higher going forward because of the year-over-year comparison to very low numbers caused by the pandemic as well as near-term pressures from supply chain bottlenecks. Q2 GDP Grows 6.5% GDP grew 6.5% in the second quarter, up slightly from a downwardly revised 6.3% in the second quarter, according to the first reading from the Commerce Department. While robust, the increase was well below economists’ expectations of 9.1% growth. In the second quarter of 2020 GDP contracted more than 30%. Despite the lower-than-expected growth, real GDP is now 0.8% above pre-pandemic levels. However, GDP is still below where it would have been if the pandemic had not sent the economy into a downward spiral. Growth in real GDP in the second quarter was driven largely by consumer spending. Real personal consumption expenditures (PCE) shot up 11.8%, which was stronger than most analysts had expected, and every major category of spending posted solid gains. Spending on durable goods rose 9.9%, non-durable goods jumped 12.6% and services surged 12.0%. This robust growth in real PCE reflects the reopening of the economy that occurred in the second quarter and the fiscal relief measures that put money in consumers' pockets. Growth in business fixed investment spending was also generally robust with equipment spending shooting up 13.0% as businesses continue to invest in tech equipment to facilitate employees working from home. Many forecasts call for GDP to grow between 6% and 7% this year, which would be the strongest performance since a 7.2% gain in 1984 when the economy was emerging from a deep recession. The Fed’s GDP forecast for this year was revised to growth between 6.5% to 7.0% in mid-June. Fed Leaves Rates Unchanged The Fed maintained their target fed funds rate range of between zero and 0.25% at their meeting in late July, and reassured investors they will continue to support the economy via asset purchases while the US continues to recover from the pandemic. The decision by the Fed Open Market Committee (FOMC) was unanimous. They acknowledged that while progress has been made, it has not yet been enough to warrant raising rates or tapering asset purchases. Wells Fargo expects the Fed to keep the target rate unchanged through at least the end of next year. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|