|

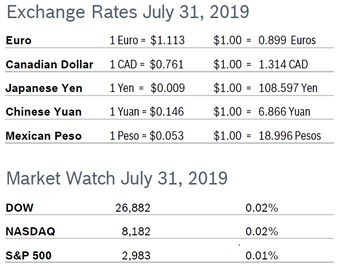

The markets eked out minuscule gains for the month of July despite falling precipitously after the Fed cut rates by 0.25% or 25 basis points on the last business day of the month. Market watchers had been hoping for a 50 point cut, and were also disappointed that the Fed did not promise another rate reduction this year. Consumer Confidence Rises to 135.7 The New York-based Conference Board’s Consumer Confidence Index rose to 135.7 in July after falling to an upwardly revised 124.3 in June, according to the Conference Board’s latest survey. It was the biggest point jump for the Index since November 2011. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, rose to 170.9 after dropping to an upwardly revised dropped to 164.3 in June. The Expectations Index, which is based on consumers’ short-term outlook for income, rose to 112.2 in July after falling to an upwardly revised 97.6 in May. The Conference Board stated that the sharp declines in June were driven by tensions over trade and tariffs, but consumers are now more optimistic about the job and labor market and the economy overall. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.3% Consumer spending rose 0.3% in June after rising an upwardly revised 0.5% in May. Core consumer spending rose 0.2% in June for the third consecutive month. Personal income rose 0.4% in June after rising 0.5% in May. Savings rose to $1.34 trillion from an upwardly revised $1.31 trillion in May. Inflation pressures remained low, with the personal consumption expenditures (PCE) price index excluding the volatile food and energy components rising 0.2% in June for the third consecutive month. In the 12 months through June, the core PCE price index increased 1.4% after increasing 1.5% in May, well below the Fed’s preferred inflation reading of 2.0%. Consumer Prices Rise 0.1% The Consumer Price Index (CPI) rose a seasonally adjusted 0.1% in June after rising 0.1% in May. The year-over-year CPI was up 1.6% in June after rising 1.8% in May and 2.0% in April. Dropping prices for gasoline, electricity and natural gas helped keep overall inflation low. Core inflation, which excludes food and energy, jumped 0.3% in June after rising 0.1% per month for eight consecutive months. Core CPI rose 0.3% in June, with rising costs for shelter, apparel and used cars and trucks exerting the most upward pressure. Fed officials worry that persistently low consumer prices could indicate slackening demand. Unemployment Steady at 3.7% The unemployment rate held steady at 3.7% in July and the economy added 164,000 new jobs, in line with economists’ expectations. Job gains for May and June were revised down by a total of 41,000 jobs, putting the three-and six-month averages of job growth around 140,000, well below last year’s average of 223,000 jobs. Employment in construction was little changed from June. Average hourly earnings rose 0.3% and were up 3.2% year over year. Unemployment remained at 3.7% because the labor participation rate edged up again. The economy needs to create about 120,000 new jobs each month to keep up with growth in the working-age population. Durable Goods Orders Rise 2.0% Durable goods orders rose 2.0% in June after falling a downwardly revised 2.3% in May. It was the first increase in durable goods orders in the past three months, and above expectations of a 0.7% increase. Orders ex transportation rose 1.2%. Core durable goods orders for non-defense capital goods excluding aircraft, widely regarded as a key indicator of business spending, rose 1.9% in June after rising a downwardly revised 0.3% in May; it was the largest increase in core orders in 18 months. Nondefense capital goods shipments, which factor into GDP, rose 0.6% in June after rising 0.5% in May. The durable goods report is very volatile and often subject to sharp revisions. Chicago PMI Falls to 44.4 The Chicago Purchasing Managers’ Index (PMI) fell to 44.4 in July after dropping to 49.7 in June, the second consecutive month the index was below 50. Four of the five components were in contraction territory, with only Supplier Deliveries above 50. The Production indicator fell 22% in July and hit a 10-year low. Demand remained soft, with New Orders dropping further into contraction and Order Backlogs remaining below 50 for the third consecutive month. Weaker demand and production led some firms to adjust their workforce, and the Employment indicator fell into contraction for the fist time since October 2017, hitting the lowest level since October 2009. July’s special question asked firms about their views on US economic growth during the second half of the year. No significant changes were seen on the horizon by 46% of firms, with 14% expecting the economy to pick up and the remaining 40% expecting the economy to weaken in the second half. Global risk, trade tensions, a slowdown in demand and weakening GDP projections all contributed to the outlook. Economists use the Chicago PMI and other regional indicators to gauge the health of the ISM manufacturing index. Wholesale Prices Rise 0.1% The Producer Price Index (PPI) rose a very slight 0.1% in June after rising 0.1% in May and was up 1.7% year over year, down from a 1.8% year-over-year increase in May. Core producer prices, which exclude food, energy and trade services, were flat, although core prices rose 0.4% in May rather than the 0.2% increase first reported. Core prices were up 2.1% year over year after increasing 2.3% year over year in May. Q2 GDP Grows 2.1% GDP grew 2.1% in the second quarter, down from the first quarter’s surprisingly strong growth of 3.1% but ahead of expectations for 1.8% growth, according to the first reading from the Commerce Department. Year-over-year growth slowed to 2.3% in the second quarter from 2.7% growth in Q1. Overall growth in the second quarter was driven by real personal consumption expenditures (PCE), which rose a robust 4.3%, in line with recent reports showing strong retail spending. Real spending on durable goods jumped nearly 13% for the quarter and spending on non-durable goods rose 6.0%. Real consumer spending on services rose 2.5%. Government spending was another area of strength, growing 5.0%. However, the housing market remained lackluster and real residential construction spending edged down 1.5%, the sixth consecutive quarterly decline for this component. Real exports fell 5.2% and real imports were essentially flat for the quarter. Job Openings Drop in May The number of job openings dropped by 49,000 to a seasonally adjusted 7.3 million in May after falling to 7.4 million in April, according to the most recent Job Openings and Labor Turnover Survey (JOLTS). The job openings rate fell to 4.6% in May after being unchanged at 4.7% in April. Vacancies in the construction sector dropped by 65,000 in May; construction and transportation are the two industries that are struggling the most with worker shortages. Hiring dropped by 266,000 to 5.7 million in May and the hiring rate fell to 3.8% from 4.0% in April. The number of workers voluntarily quitting their jobs fell to 3.4 million in May from 3.5 million in April. The quits rate was unchanged at 2.3% for the 12th consecutive month. The quits rate is viewed by policymakers and economists as a measure of job market confidence. Layoffs edged down in May, keeping the layoffs rate at 1.2% for a second consecutive month. Fed Cuts Rates 0.25% The Fed cut interest rates by 0.25% at their two-day meeting the end of July, leaving the overnight lending rate between 2.0% and 2.25%. The first rate cut in more than a decade came after months of pressure from President Donald Trump, although Fed Chairman Jerome Powell vigorously maintained that the Fed would not respond to political pressure and functioned independently. Homeowners with adjustable-rate mortgages and consumers with variable-rate credit cards may see their monthly payments drop. While widely expected, economists were divided in their analysis of whether a rate cut now will give the economy a boost and help core inflation move closer to the Fed’s target of 2%. Economic Expansion Longest on Record When the US economic expansion hit 121 months on July 1 it became the longest expansion on record. The previous record was during the 120-month expansion from March 1991 to March 2001, which ended when the dotcom boom went bust. The current expansion has been one of the slowest on record, with GDP growing 25% cumulatively since the start. Unemployment sits at 3.6%, the lowest level since 1969 and down from a peak of 10% in 2009. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.to edit.

Comments are closed.

|

|