|

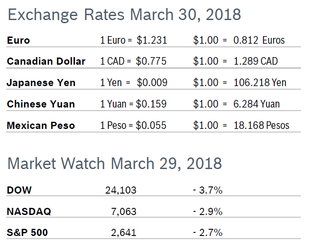

All three indexes finished the month of March with losses as market volatility continued, fueled by worries of a trade war with China. Both the DOW and the S&P also finished the first quarter in the red, ending a 9-quarter winning streak. For the first quarter, the DOW fell 2.5%, the NASDAQ rose 2.3% and the S&P, the index most closely followed by economists, fell 1.2%. Consumer Confidence Falls to 127.7 The New York-based Conference Board’s Consumer Confidence Index fell to 127.7 in March after rising to a slightly downwardly revised 130.0 in February. The Present Situation Index dropped to 159.9 from a downwardly revised 161.2 in February. The Expectations Index also fell, dropping to 106.2 from a slightly downwardly revised 109.2. Consumer confidence reached an 18-year high in February, but declined modestly in March, partially due to the extreme volatility that continued in the stock market. Consumers remain generally confident that the economy will continue to expand over the coming months. Economists note that a level of 90 indicates that the economy is on solid footing and a level of 100 or more indicates growth. Analysts caution that the real driver behind consumer spending is income growth and that labor market trends are a more accurate predictor of consumer behavior. Consumer Spending Rises 0.2% Consumer spending grew 0.2% in February after rising by the same amount in January and was up 1.8% year over year. Personal incomes rose 0.4% for the third consecutive month. The savings rate increased to 3.4% from 3.2% in February. The core PCE price index rose 0.2% in February after rising 0.3% in January and was up 1.5% from January 2017. The Fed’s preferred inflation measure has undershot its target of 2% since May 2012. Consumer Prices Rise 0.2% The Consumer Price Index (CPI) jumped rose 0.2% in February after jumping 0.5% in January. The CPI was up 2.2% over the past twelve months. Core inflation, which excludes food and energy, rose 0.2% in February after rising 0.3% in January and was up 1.8% from February 2017. Core inflation has consistently been below the Fed’s target of 2%. Gains in the CPI were tempered by a fallback in energy costs as gasoline prices fell 2.7%. However, recent job reports and increases in producer prices in the pipeline suggest that inflation could be inching closer to the Fed’s target. Unemployment Remains at 4.1% The unemployment rate remained at a 17-year low of 4.1% for the third consecutive month, but the economy added just 103,000 new jobs, the smallest increase since last fall and well below forecasts of 170,000 new jobs. The pace of hiring was expected to slow in March after the economy gained more than 300,000 new jobs in February. The tight labor market is slowly pushing up wages. Hourly wages rose 8 cents, or 0.3%, to $26.82 and the 12-month increase in pay rose to 2.7% from 2.6%. The largest job gains took place in manufacturing, health care and white-collar businesses. Retailers lost 4,000 jobs in March after adding 47,000 in February, but retail employment has shown little net change over the year. Construction lost 15,000 jobs in March after adding more than 65,000 in February. Durable Goods Orders Rise 3.1% Durable goods orders rose 3.1% in February after dropping an upwardly revised 3.5% in January. It was the biggest gain in durable goods orders since last summer, and well ahead of economists’ expectations. Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, rose 1.8% in February after dropping a downwardly revised 0.4% in January and were up 7.4% year over year. It was the biggest gain in five months. Shipments of core capital goods, which factor into GDP, increased 1.4% in February after rising an upwardly revised 0.1% in January. Economists expressed fears that a trade war could negatively impact future orders. The durable goods report is volatile and often subject to sharp revisions. Chicago PMI Falls to 57.4 The Chicago Purchasing Managers’ Index (PMI) fell to 57.4 in March after falling to 61.9 in February. It was the third consecutive monthly decline for the index and the lowest reading for the PMI in the past year. The PMI was up just 0.5% from March 2017. Three of the five components fell for the month, with only Employment and Supplier Deliveries expanding. The Production indicator sank to the lowest level since October 2016 and the New Orders indicator dropped to a level not seen in more than a year. The two indicators, which account for about two-thirds of the overall reading, have fallen 28% and 19% since their respective December highs. The Prices Paid indicator picked up enough in March to be at the highest level since the third quarter of 2011. Most firms expect orders to grow in the second quarter. Wholesale Prices Rise 0.2% The Producer Price Index (PPI) rose 0.2% in February after rising 0.4% in January, continuing the upward climb in producer prices that has been going on since August 2016. Core producer prices, which exclude food, energy and trade services, rose 0.4% in February after rising by the same percentage in January. Core prices were up 2.7% compared to February 2017. That’s the biggest year-over-year gain in core prices since 2014. The PPI for inputs to construction was up 5.2% year over year. Lumber and plywood was up 4.4% for the month and 13% for the year. While inflation has definitely picked up, analysts say it is doing so at a manageable pace that is not likely to alter the Fed’s methodical plan for small increases in interest rates. Q4 GDP Revised Up to 2.9% Growth GDP grew an upwardly revised 2.9% in the fourth quarter, up from the second estimate of 2.5% growth. The latest reading also contained the government’s first broad estimate of profits at US companies in the fourth quarter. After-tax profits, without inventory valuation and capital consumption adjustments, dropped 9.6% from the third quarter and were down 6.0% from Q4 last year. The Commerce Department said that the weak reading may have reflected one-time provisions that took effect in the fourth quarter. Consumer spending rose at a 4.0% annual rate in the fourth quarter, revised up from a previous estimate of 3.8% growth and the strongest quarterly reading in three years. Business investment remained solid, with fixed nonresidential investment rising 6.8% and spending on equipment up 11.6%. Both net exports and inventories subtracted from overall GDP growth. Job Openings Rise There were 645,000 new job openings in January, for a total of 6.3 million openings, a new high. Job openings had fallen to 5.8 million in December, bringing the openings rate to 4.1%. Construction had 101,000 new job openings. The number of openings increased in all regions except the Northeast. Hires and separations were little changed at 5.6 million and 5.4 million, respectively. Within separations, the quits rate and the layoffs and discharges rate remained at 2.2% and 1.2%, respectively. There were 1.8 million layoffs and discharges in January, also little changed from December. Separations increased in retail trade. The quits rate is considered a measure of confidence in the job market, and has been steadily rising since hitting a low of 1.3% in late 2009. Rising job turnover should eventually lead to accelerated wage growth, which economists say will help push inflation towards the Fed’s target of 2%.The JOLTS report is one of the Fed’s preferred economic indicators. Fed Raises Rates The Federal Reserve raised rates in March by a quarter of a percentage point to between 1.5% to 1.75%. The increase, which was the sixth since 2015, was widely expected. The Fed is still forecasting two more rate increases this year, but increased the number of hikes it expects in 2019 and 2020, and now sees a total of eight quarter-point hikes through the end of 2020, including the three increases expected this year. That means by the end of 2020 rates would be around 3.5%. The Fed based its optimistic projections on a strengthening economic outlook and greater confidence that lower unemployment won’t trigger inflation. The Fed estimates that the increase in core prices will rise above the target of 2% in 2019 and 2020, although it will only rise to 2.1%. © Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|