|

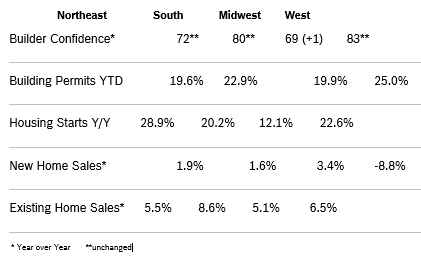

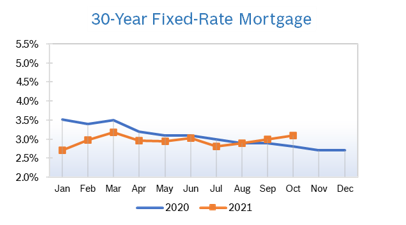

Builder Confidence Rises to 80 Builder confidence rose four points to 80 in October after rising one point to 76 in September, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The HMI hit an all-time high of 90 last November. Builders are growing increasingly concerned about affordability issues and materials price increases and supply chain bottlenecks. All three major HMI indices posted gains in October. The index gauging current sales conditions rose five points to 87, the component measuring sales expectations in the next six months rose three points to 84 and the gauge charting traffic of prospective buyers rose four points to 65. Regional scores were mixed. Any number over 50 indicates that more builders view the component as good than view it as poor. Building Permits Fall 7.7% Overall building permits fell 7.7% in September to 1.59 million units after rising to a 1.73 million units annualized pace in August. Single-family permits dropped 0.9% to 1.04 million units in September after rising to 1.05 million units in August. Multifamily permits dropped 18.3% to 548,000 units after jumping to 674,000 units in August. NAHB noted that single-family homes permitted but not yet under construction are up 50% from August 2020, a sign of persistent supply chain issues. Regional permits were up on a year-to-date basis. Housing Starts Fall 1.6% Housing starts fell 1.6% in September to a seasonally adjusted annual rate of 1.56 million starts after rising to 1.62 million units in August. Single-family starts were essentially unchanged at 1.08 million seasonally adjusted annual units, up 20.5% year-to-date. The multifamily sector, which includes apartment buildings and condos, dropped 5.0% to a 475,000 annual pace after dropping more than 20% in August. NAHB reports that demand remains strong but the housing market overall is dealing with rising affordability issues and shortages of materials and lots. Combined single-family and multifamily regional starts were up year to date compared to 2020. Single-family starts are still expected to rise this year, but at a much slower pace than they did during 2020. New Home Sales Rise 14% New home sales rose 14% in September to a seasonally adjusted 800,000 new homes after falling to a downwardly revised number in August. Sales were up 18.7% from September 2020. Inventory dropped to a 5.7-months’ supply, with 379,000 new single-family homes for sale, up from 286,000 in September 2020. The median sales price continued to climb, rising to $408,800 from $401,500 in August, and was up 18.7% year over year. At the same time, only 21% of current sales were below $300,000, compared to 35% a year ago. Year-over-year sales were up in all regions. Sales of new homes are tabulated when contracts are signed and are considered a more timely barometer of the housing market than purchases of previously owned homes, which are calculated when a contract closes. Existing Home Sales Rise 7% Existing home sales rose 7% in September to a seasonally adjusted annual rate of 6.29 million units after falling to 5.88 million units in August but were down 2.3% from September 2020, according to the National Association of Realtors. The median price of a home sold in September fell slightly to $352,800 after falling in the previous two months but was up 13.3% year over year. Year-over-year prices have risen for 115 consecutive months. Total inventories fell 0.8% to 1.27 million units after falling in August. Unsold inventory fell to a 2.4-months’ supply after holding at 2.6 months in August and was down from 2.7 months in September 2020. Properties were on the market for an average of just 17 days in September. Sales rose in all regions. Wells Fargo noted that the jump in existing home sales was reassuring, as it was an indication that the slowdown earlier in the year was being driven by supplies rather than falling demand. Regional Housing Data Mortgage Rates Rise to 3.1%

© Robert Bosch Tool Corporation. All rights reserved, no copying or reproducing is permitted without prior written approval.

Comments are closed.

|

|